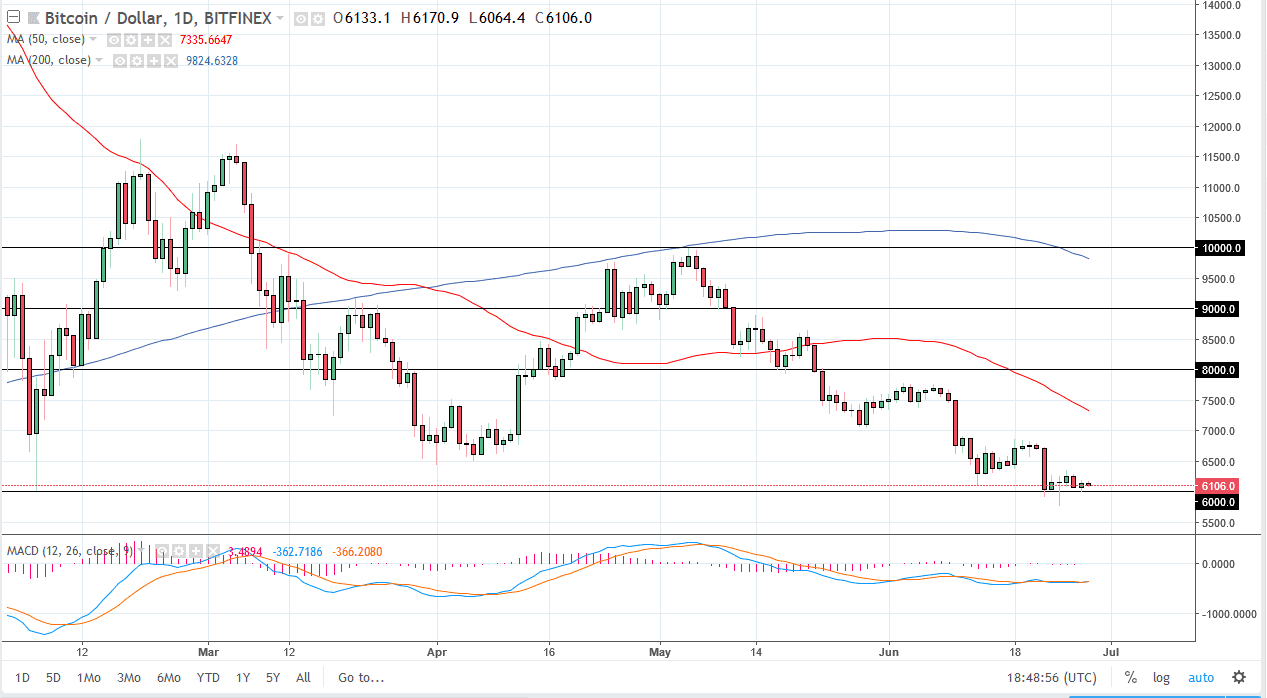

BTC/USD

Bitcoin markets did very little during the trading session on Thursday, as we continue to look at the $6000 level is a major support level. I think at this point though, it’s obvious that there is no significant desire to put a lot of money to work, so I think rallies will continue to be sold. The $7000 level above should continue to offer resistance, and I think that any signs of exhaustion between here and there after a short-term rally should be thought of as an opportunity to go short yet again. Otherwise, if we break down below the Sunday hammer, that would be a reason to start selling as well. The Bitcoin markets continue to suffer, as there is a lack of interest lately. Unfortunately, the one thing that Bitcoin needs is a couple of months of stability before larger money comes back in.

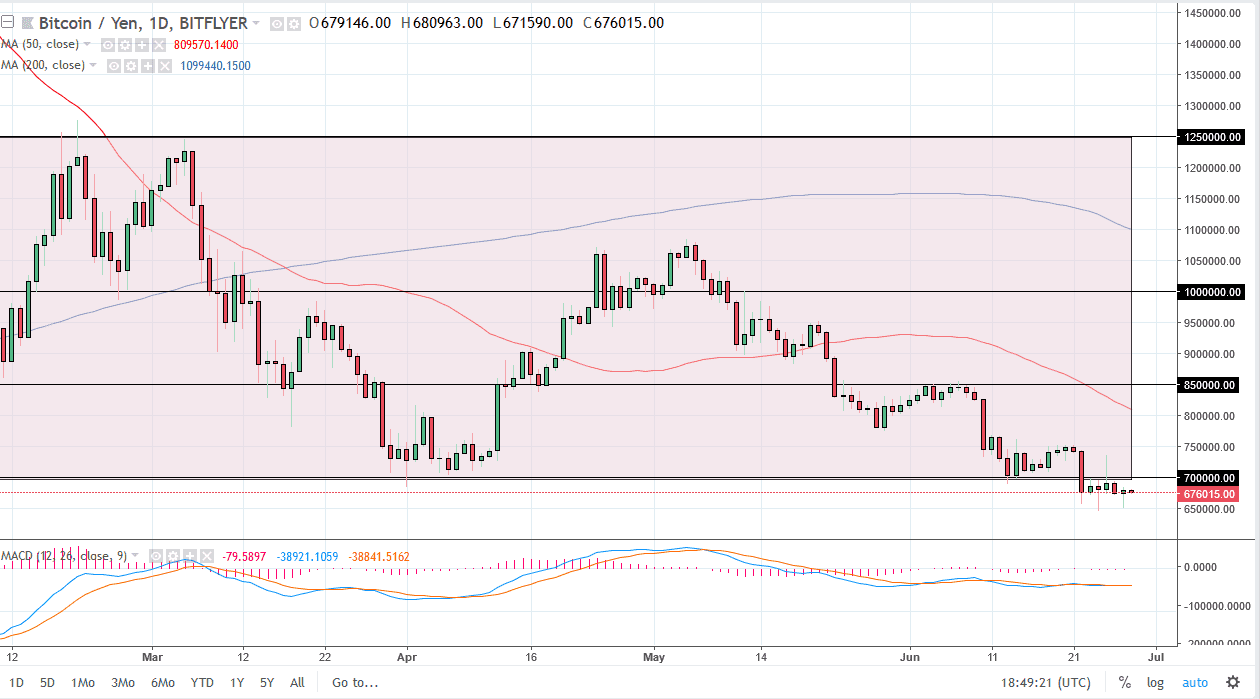

BTC/JPY

Just as it did against the US dollar, Bitcoin struggled against the Japanese yen. The ¥700,000 level has been supportive several times over, as it was the bottom of the overall consolidation. I think that the market is likely to continue to see a lot of noise, but in the end I believe that the sellers are probably in control more than anything else. The market participants haven’t bought this market, even though the Japanese yen has been very active. That tells me there is a certain amount of apathy in this market, and therefore the best thing that buyers can hope for is several weeks of calm trading as it could give us an opportunity to build up a little bit of confidence. If we break down below the ¥650,000 level, the market should then go down to the ¥600,000 level after that. Rallies should have plenty of sellers above, with the ¥750,000 level being the short-term “ceiling”.