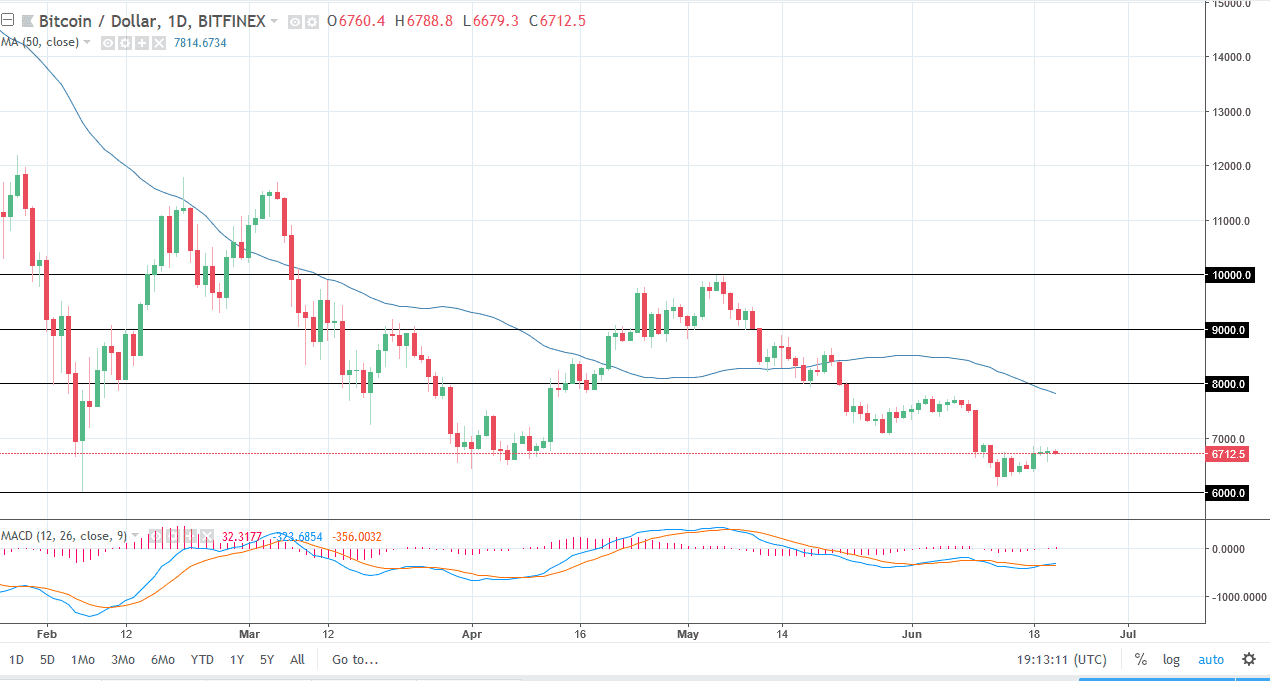

BTC/USD

Bitcoin did very little during the trading session on Thursday, losing 0.75% as I record this. The market continues to hover around the $6700 level, an area that has been supported in the past. It’s very interesting turn of events, because it was very important back in April, and now that we have broken below that level, it’s likely that the resistance would be an issue. Ultimately, the real “floor” of the larger consolidation area is the $6000 handle, and if we can break down below there the market should unwind quite nicely. However, we could rally from here, and a move above the $7000 level probably opens the door to the $7750 level above. I expect volatility, but I also believe that it’s only a matter of time before the sellers come back as Bitcoin continues to struggle.

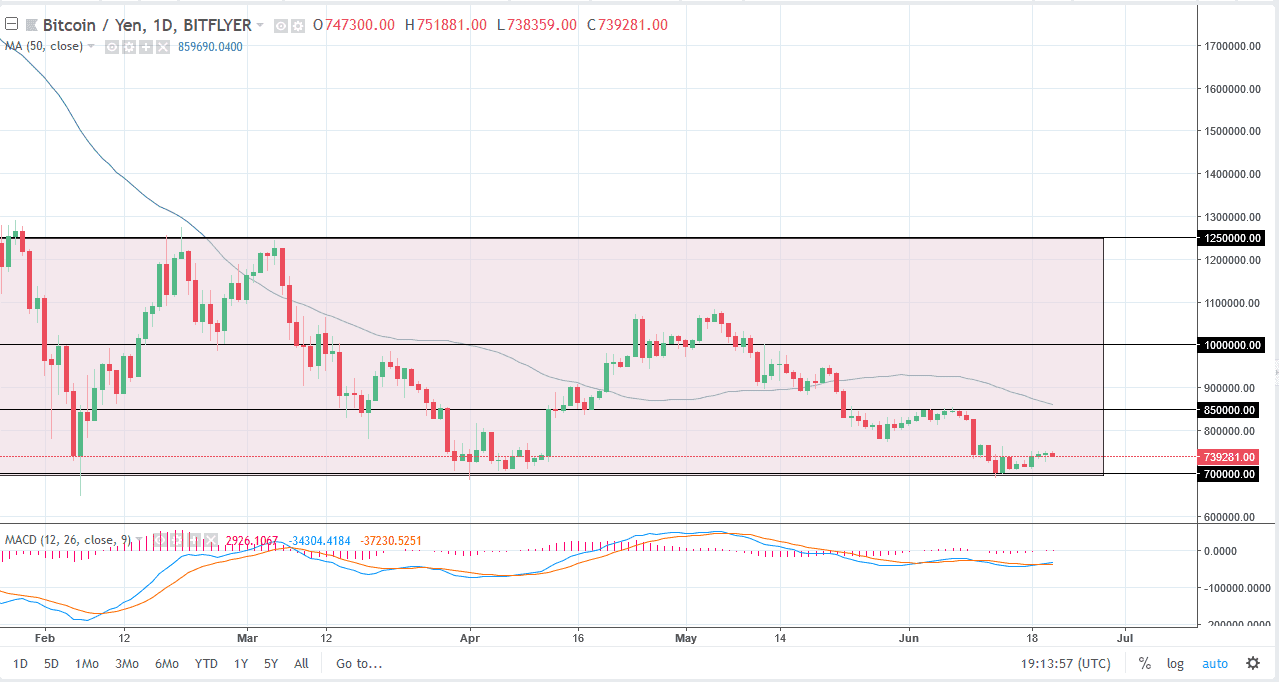

BTC/JPY

Bitcoin dropped slightly against the Japanese yen as well during the day, as we continue to look towards the ¥700,000 level. That’s an area that has been massive support over the last several months, and I think that buyers should continue to be interested in Bitcoin at that level. However, if we break down below that level I think the market probably goes down to the ¥600,000 level. The ¥850,000 level above there should be a bit of a “ceiling”, and I think it’s good to be very difficult to break out above that level not only do we have structural resistance, but we have the 50 day SMA just above there. That is a situation that quite often will attract longer-term traders, so keep in mind that any rally at this point it’s probably good to be a nice selling opportunity yet again.