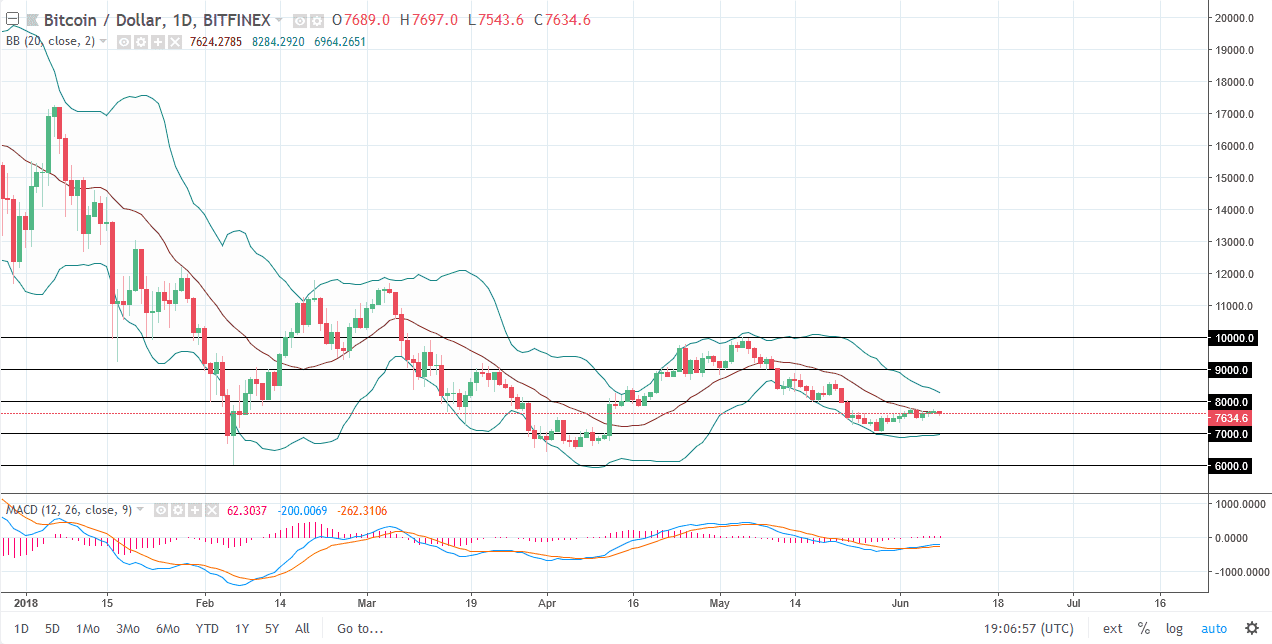

BTC/USD

Bitcoin did very little during the trading session on Friday, losing about 0.7% by the time most American traders went home. This is a market that has been very sluggish as of late and seems destined to test the lows again near the $6000 level. However, it’s going to take it’s time getting there. We simply have no volatility, and it looks very likely that a lot of flat trading sessions will be one of the mainstays of bitcoin. I believe that the $8000 level above is resistance, just as the $7000 level underneath is support. Longer-term though, it’s easy to see that each successive swing high as lower than the one before it, the very essence of a downtrend. The market has been very soft most of the year, and I don’t see this changing anytime soon as there is no catalyst to turn things around.

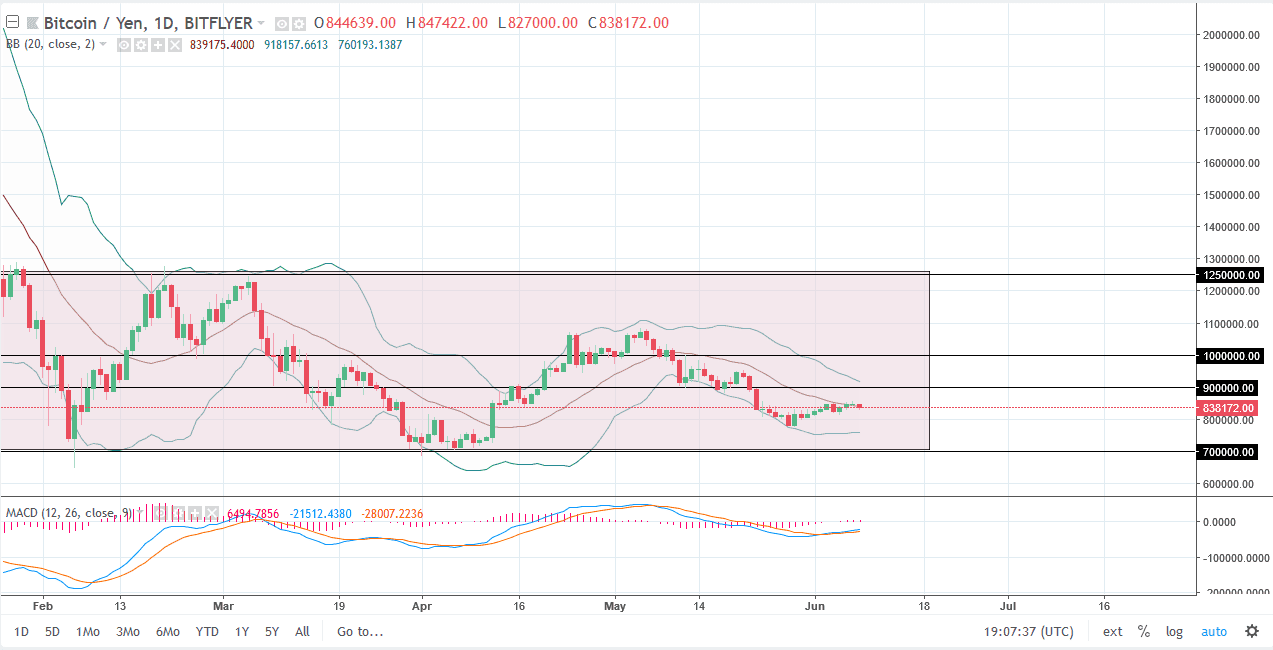

BTC/JPY

Bitcoin also fell against the Japanese yen, albeit very slightly. The market looks as if it is struggling with the ¥850,000 level, and I think we will probably roll over from here. Even if we don’t, the ¥900,000 level will most certainly be resistive as well. The ¥700,000 level underneath continues to be a target for the sellers, as it has been such support in the past. We bounced from there in April but could not reach the top of the overall consolidation, which is normally assigned that we are going to turn around and fall through the floor. Once we do, this market could very well find itself going down to the ¥600,000 level and beyond. I believe selling rallies continues to be the way that most profits will be made in this market.