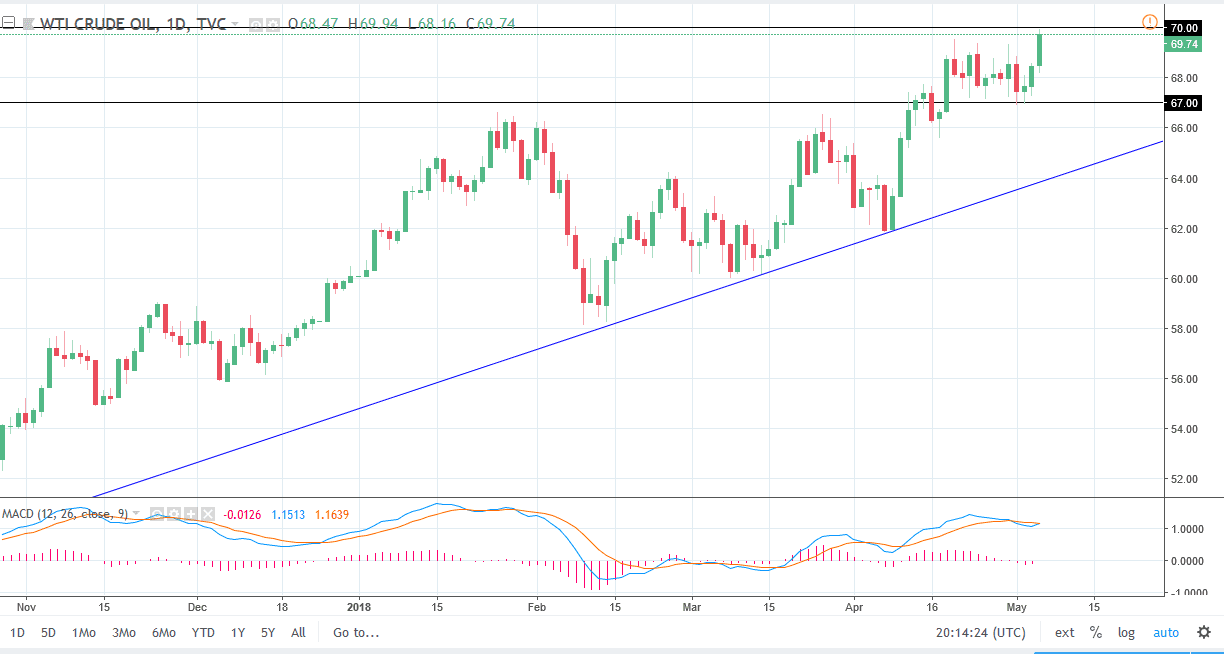

WTI Crude Oil

The WTI Crude Oil market initially fell during the session on Friday, but then exploded to the upside, slamming into the $70 level. This is an area that should be resistive due to the large, round, psychological significance of the number, but also the previous resistance that we had seen for a while. I think that the market has been consolidating between the $67 level on the bottom, and the $70 level on the top. If we can clear the $60 level, then the market should continue to go much higher, and I do expect that to happen. I think short-term pullbacks should be buying opportunities, as we have seen so much in the way of bullish pressure. The crude oil markets continue to be influenced by OPEC quotas, and of course geopolitical issues in the Middle East, which always tend to push oil prices higher.

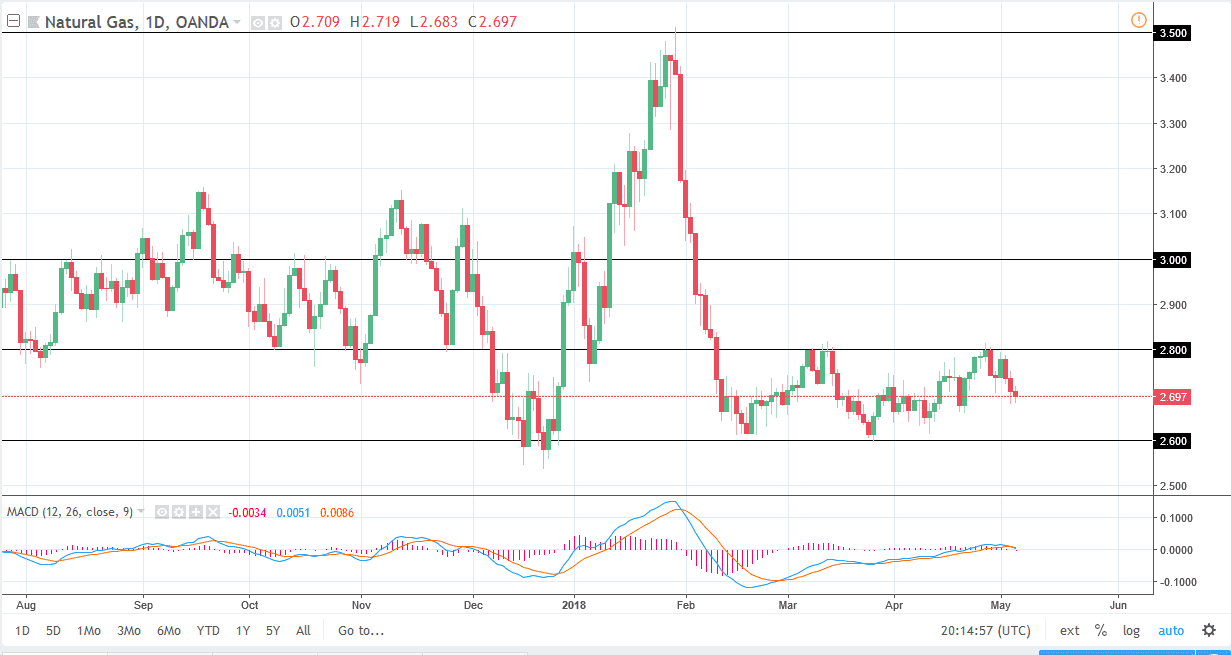

Natural Gas

Natural gas markets fell during the day on Friday, breaking below the $2.70 level. I think that the market should continue to go down to the $2.60 level after that. There is a certain amount of consolidation that we have been dealing with between the $2.66 level on the bottom, and the $2.80 level on the top. I think that we are essentially near the “fair value” region, and therefore it will be very choppy in this region. However, the longer-term attitude of this market will continue to be bearish, mainly because there is so much oversupply of natural gas to be found in America and Canada. I think that if we break down below the $2.60 level, then we would go to the $2.50 level. I prefer to sell rallies every time they occur and show signs of exhaustion.