Gold ended the week down $8.12 at $1314.59 an ounce, recoding a third consecutive weekly loss, as the recent solid rally in the U.S. dollar index continued to curtail buying interest in the market. Also working against the safe-haven metal are the risk-on trading/investing attitudes in the world marketplace. The latest data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 106779 contracts, from 136646 a week earlier. XAU/USD initially drifted lower towards the strategic support at $1300, but was able to recover some of its losses after Federal Reserve officials gave no signal they were planning to pick up the pace of rate hikes. The key U.S. economic highlights of the week will be producer price index, consumer price index and consumer confidence index.

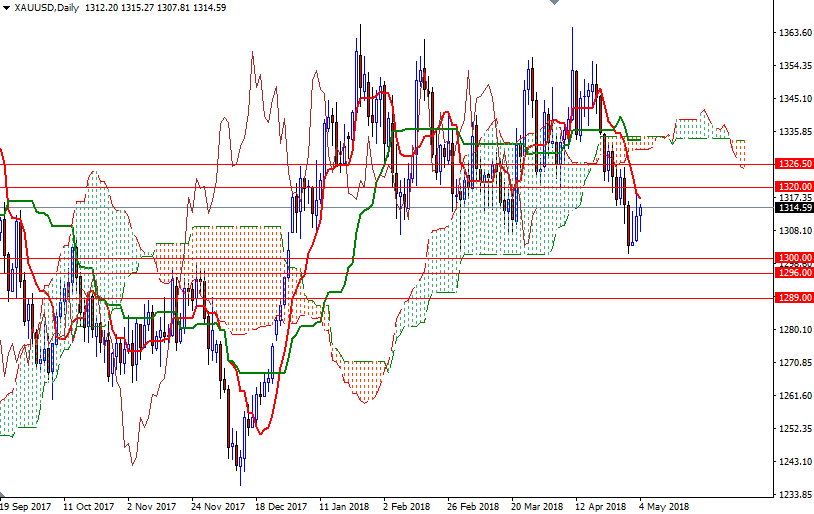

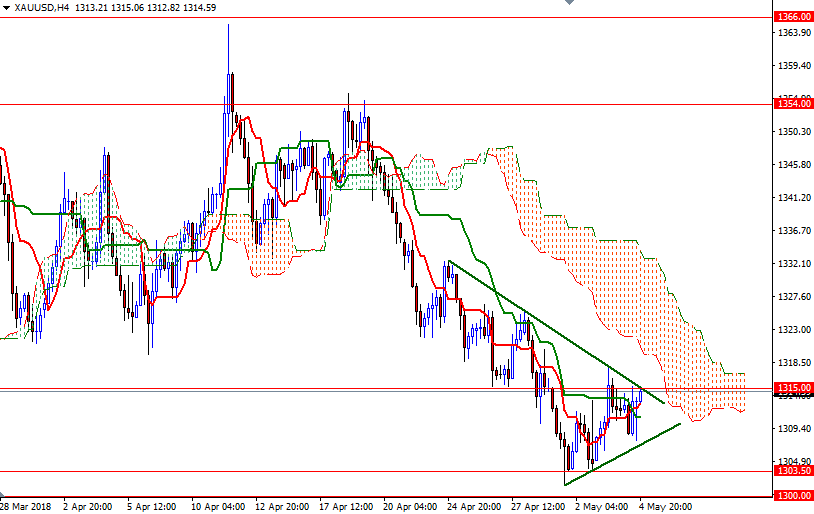

From a technical perspective, there are two things to pay close attention. Prices are below the Ichimoku clouds on the daily and the 4-hourly charts, indicating that the key support in the 1300-1296 zone is still in danger. However, XAU/USD is still above the weekly cloud, and the positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) on the H4 time frame suggest that the bearish momentum is fading. If the market penetrates the 4-hourly cloud, then the bulls will have a chance to make an assault on the critical resistance in the 1336/4 zone. Closing above 1336 on daily basis implies that the bulls are on their way to tackle 1341. A break through there brings in 1345.

A close below the 1300-1296 area, on the other hand, could put significant downside price pressure on gold. In that case, 1292-1289 and 1285/2 will be the next targets. The bears have to drag prices below 1282 to challenge the bulls waiting in the 1276/4 zone. Once below there, the market will be aiming for 1270 and 1261.