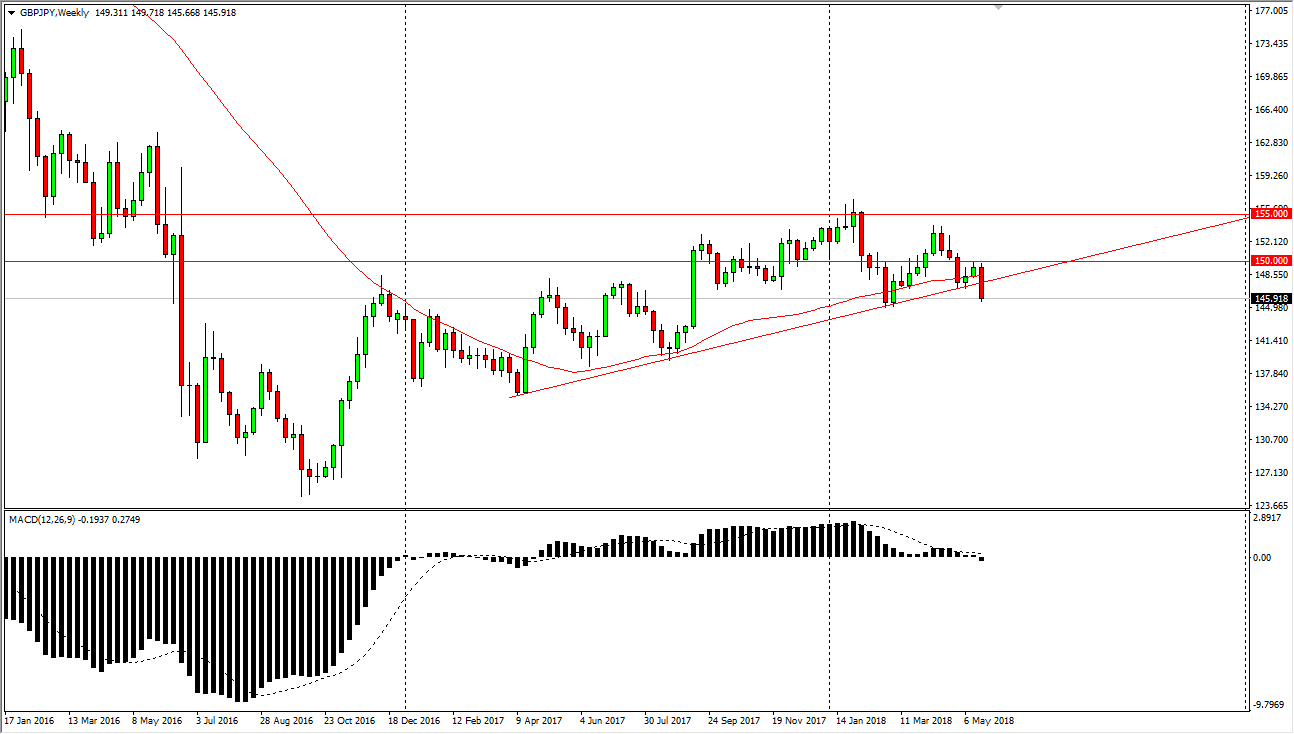

GBP/JPY

The British pound has broken down significantly against the Japanese yen during the week, slicing through a major uptrend line going back roughly one year. Because of this, I think that short-term rallies will continue to be sold, and I think we will test the ¥145 level. A breakdown below that level unwinds this market several handles below.

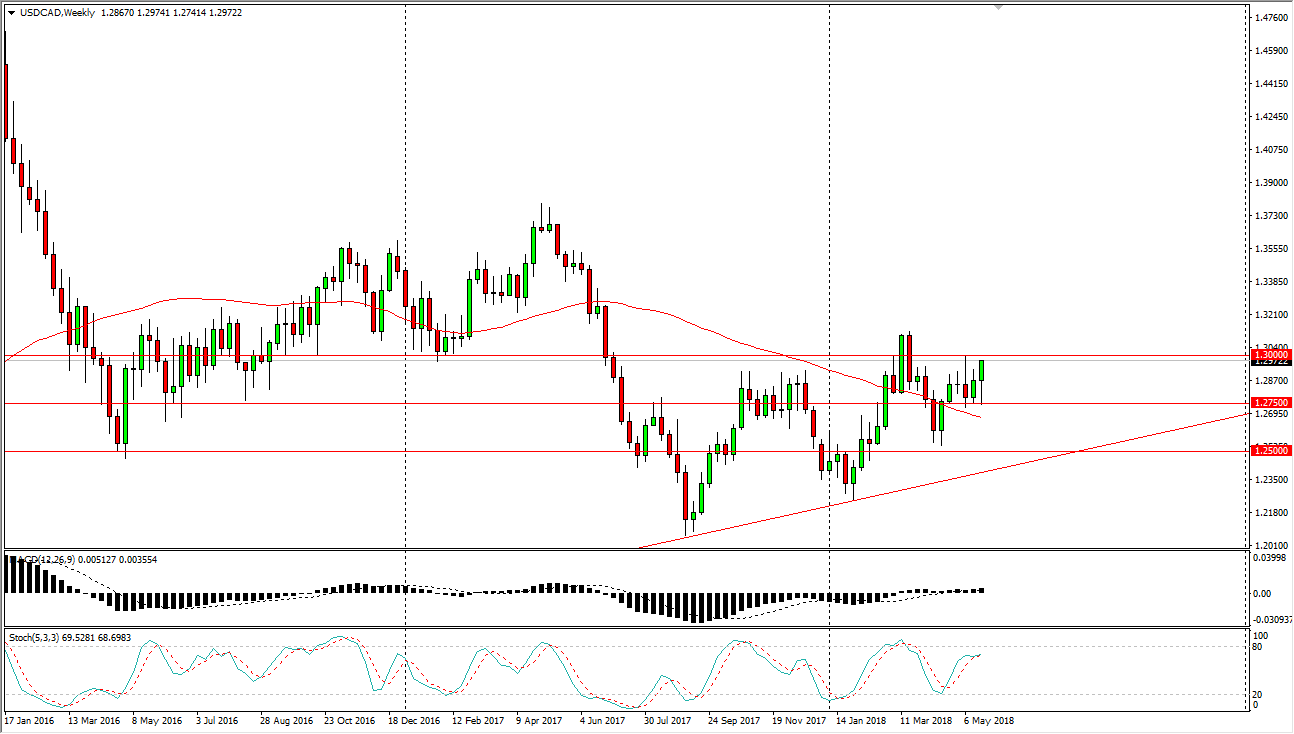

USD/CAD

The US dollar initially fell during the week against the Canadian dollar but found support at the 1.2750 level again. We bounce from there to reach towards 1.30 level, and I think that there is a significant barrier above at the 1.30 level that extends about 100 pips. I think we are simply trying to build up enough momentum to break out to the upside, so I continue to think that buying the dips works out.

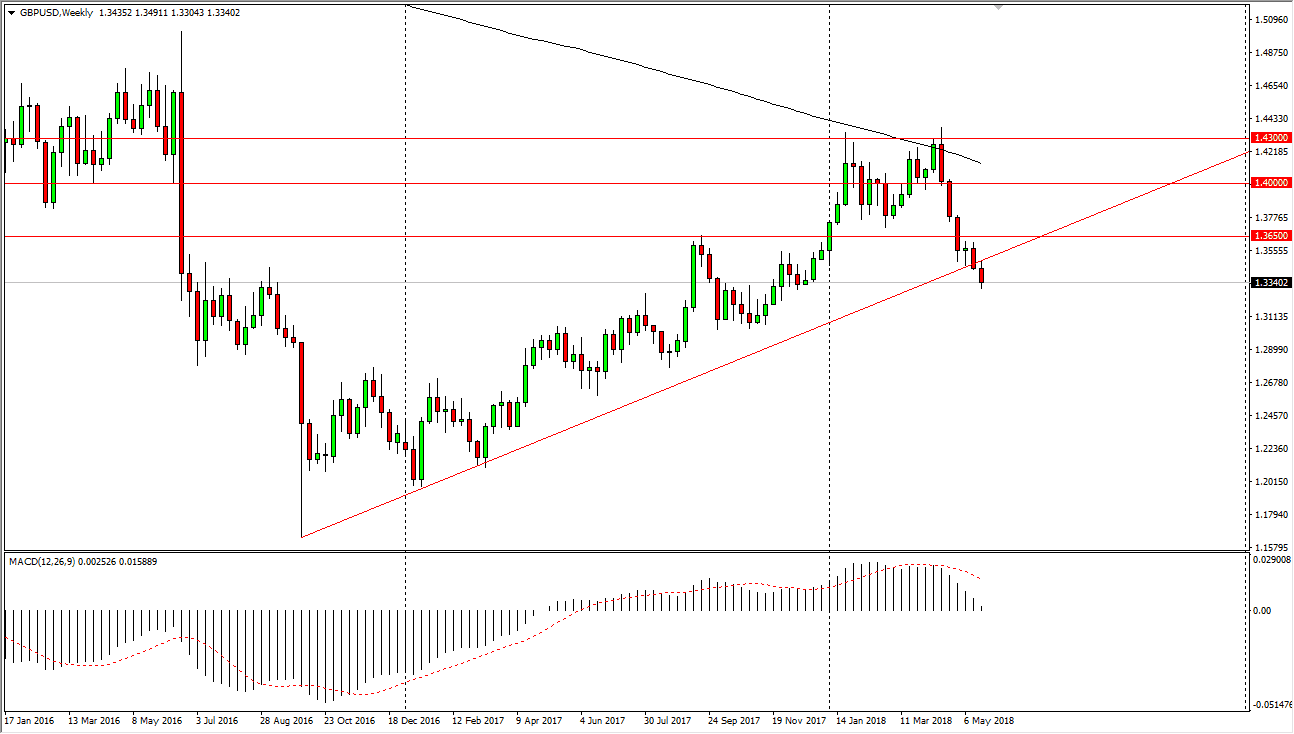

GBP/USD

The British pound has broken down significantly during the week, after initially trying to rally and retest the previous uptrend line. The fact that it has failed at that uptrend line to break above again tells me that we will more than likely continue to see a lot of downward pressure in this market. Higher interest rates in the United States course help set situation as well, it looks as if we are trying to break down below the 1.33 level. Once we cleared that level, the next target would be the 1.30 level.

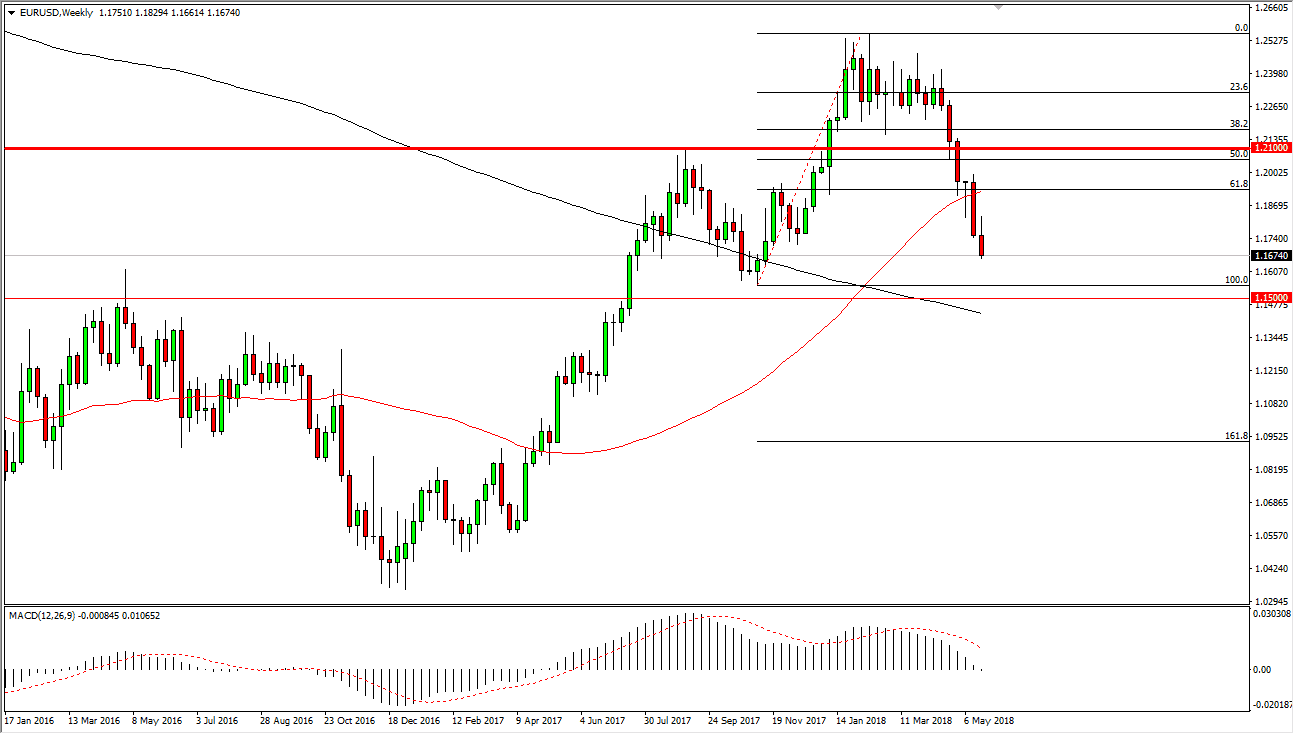

EUR/USD

The Euro initially tried to rally against the US dollar as well but found trouble with the 1.1850 level. We ended up turning around and forming a very ugly candle, we suggest that we are in fact getting ready to take out the entirety of the move higher. The 100% Fibonacci retracement level will be targeted which is the 1.1550 level. At this point, I think rallies continued offer selling opportunities in a market that quite frankly looks broken.