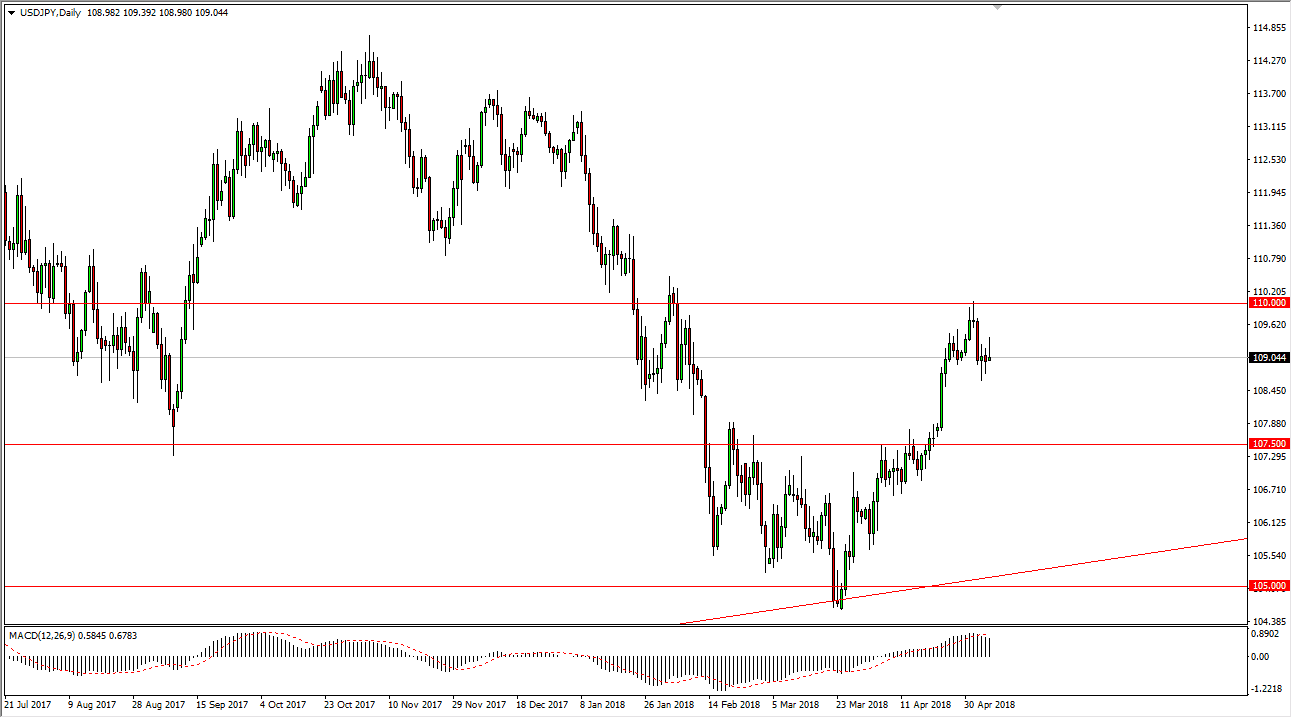

USD/JPY

The US dollar initially spent Monday rallying against the Japanese yen, as we had formed a nice hammer on Friday. However, by the end of the day we get back all of the gains, Lindy more credence to the shooting star that formed on the weekly time frame. I suspect that the US dollar is probably going to give up some of its gains in the short term, but ultimately we should find buyers. It would make sense for the market to go back and forth in the meantime, trying to build the necessary momentum to break above the vital 110 level. I see support at the 107.50 level underneath, so I think pullbacks are buying opportunities down to at least that level. If and when we can finally break above the 110 handle, I think the market goes looking towards the 112.50 level next.

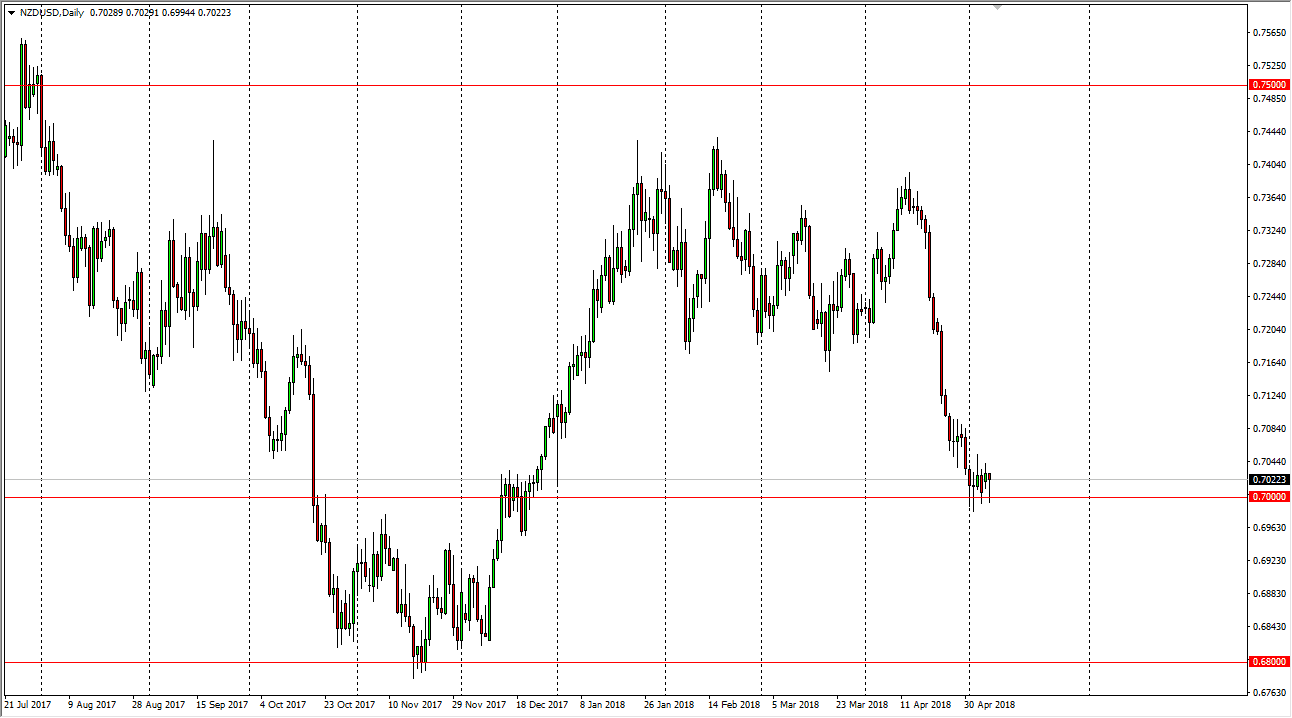

NZD/USD

The New Zealand dollar initially fell during trading on Monday but found the 0.70 level to be supportive again. The level of course has a certain amount of psychological significance, but in the end I think the real support overall is closer to the 0.68 level, as it is support from the last several years. We have just started to make a ‘round trip’, and the bottom of it has been hit quite yet. Because of this, I think that we will eventually break down and reach towards the bottom of the overall consolidation area, but I don’t think that we will be a way to break down below there. Ultimately, I think that the usual correlations will hold for the New Zealand dollar, as the commodity markets are course are highly influential with the Kiwi. In general, I think this is more about higher interest rates in America, and I think that rallies will offer selling opportunities.