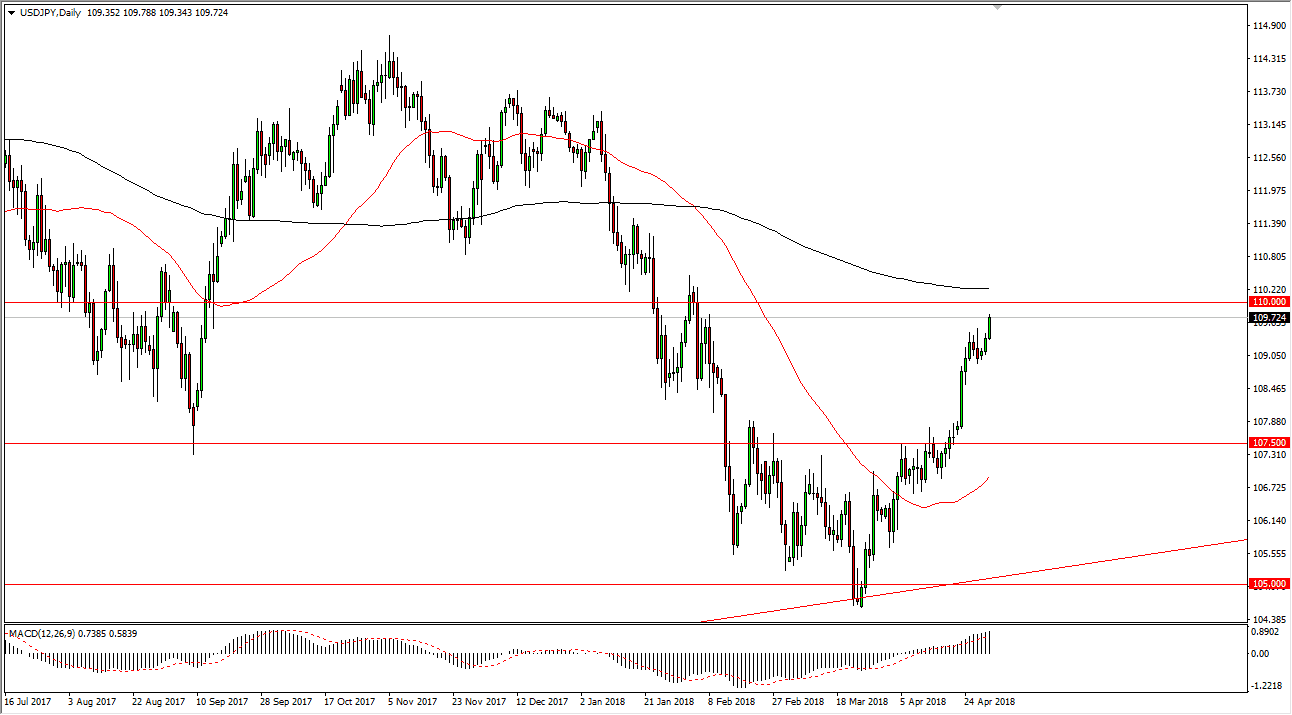

USD/JPY

The US dollar has rallied again during the trading session on Tuesday, reaching towards the 110 handle. The 110 handle is very important from a certain psychological standpoint, and it looks as if the 200 SMA is just above. If we have a break above the 200 SMA, the market will continue to go much higher. In the short term, I anticipate that we could pull back from here, as we are bit overextended, and especially as we are coming close to the jobs number now. A lot of traders will be cautious about putting on too much leverage and money into the market ahead of such an important announcement. However, I think there is more than enough support underneath, with the “floor” being at the 107.50 level. Short-term pullback to show signs of support will be buying opportunities longer-term, a move above the 110 level should send this market towards the 112.50 level.

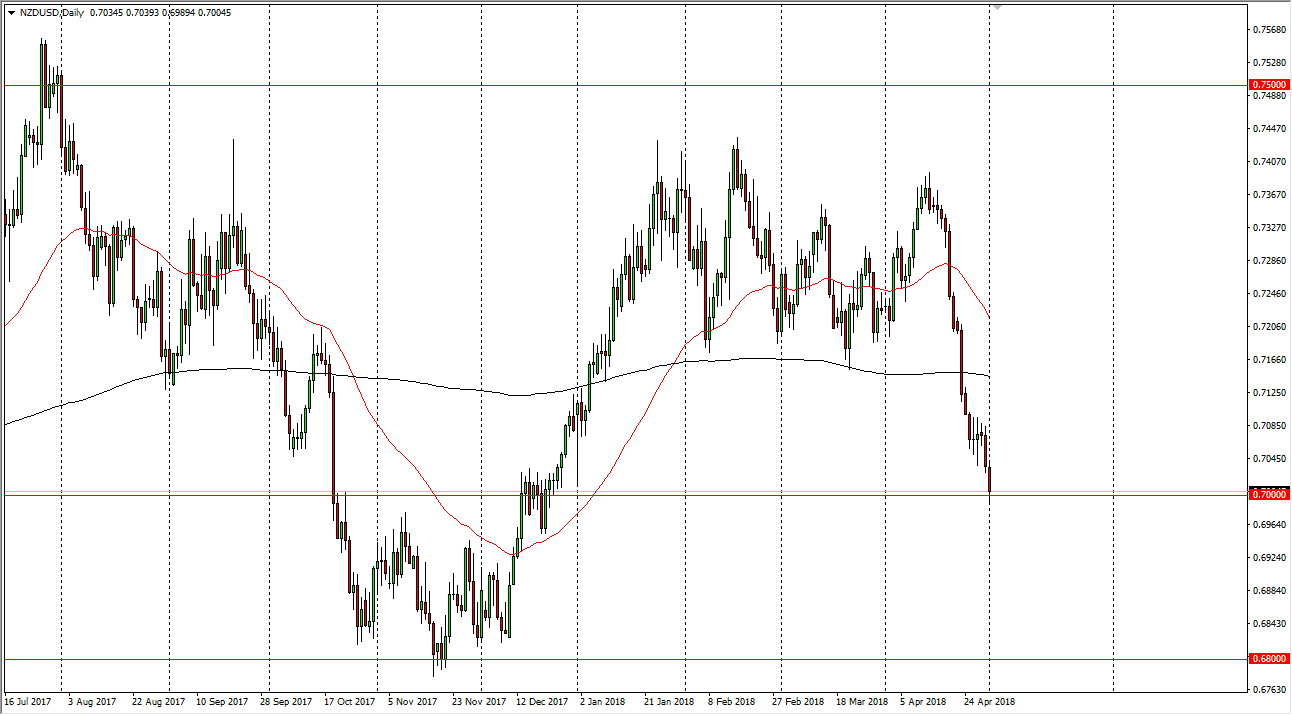

NZD/USD

The New Zealand dollar breakdown rather significantly during the day, slicing through the 0.70 level at one point. However, we are bit oversold, so I would anticipate that we could get a bit of a rally. If we break down below the lows of the day, then we could continue to go much lower, down to the 0.68 handle underneath which is the bottom of the larger consolidation area from months back. I think that the US dollar will continue to strengthen based upon higher interest rates, and of course the New Zealand dollar has suffered as many of the central banks around the world are starting to soften their stance, including other commodity currency central banks. Rallies will struggle to get above the 0.71 handle. If they do, then perhaps we could go to the 0.7250 level, but ultimately I think we have certainly seen the attitude of this market show itself.