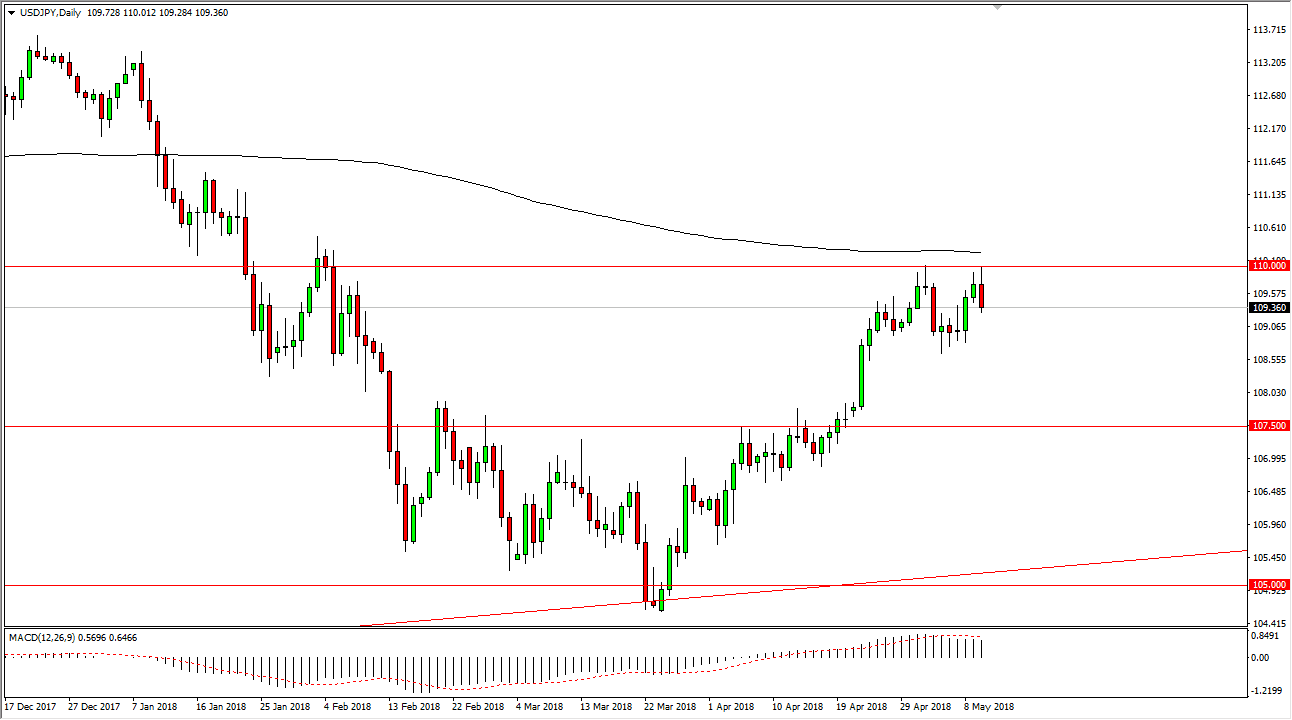

USD/JPY

The US dollar has initially tried to rally during the day on Thursday but found the 110 level to be massive resistance. If we can break above the yen level, and more importantly the 200-day simple moving average, the market could go much higher, with my initial target being the ¥112.50 level. In the meantime, I think we will pull back occasionally to try to build up the necessary momentum, and I see the ¥107.50 level underneath being a massive support level as it was previous resistance. I believe that the market is simply trying to build up enough momentum to finally break this area above, which of course has attracted a lot of attention. If we do breakout from here, that is a major turn of events and sends this market into a longer-term uptrend. The uptrend line underneath at the ¥105 level will course continue to be the “floor.”

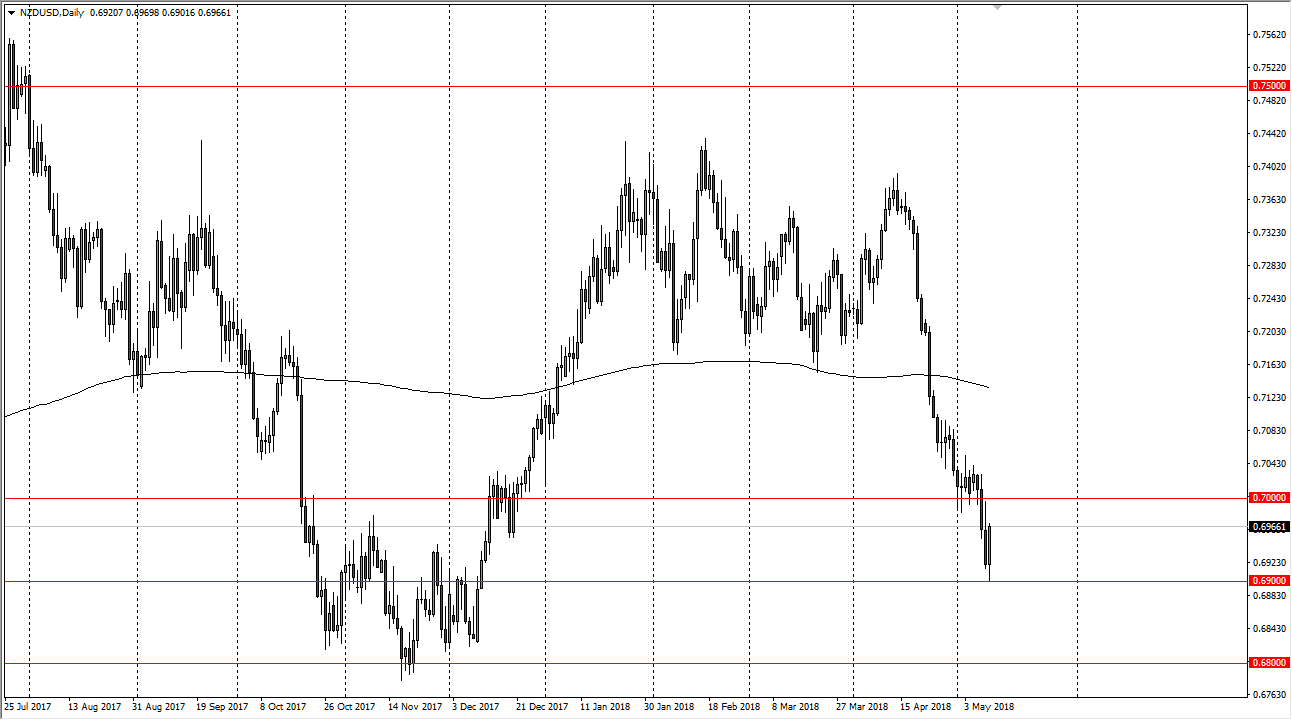

NZD/USD

The New Zealand dollar fell initially during the day on Thursday, reaching down to the psychologically important 0.69 level. If we can break down below there, the market will probably go looking towards the 0.68 level, an area that matters quite a bit on the longer-term charts. I think that the 0.70 level should offer a bit of resistance, and I think that resistance extends to at least the 0.71 level. Short-term rallies could continue to be selling opportunities, as we have seen continued bearish pressure, and of course with the US dollar strengthening over the course of the summer, I think we will continue to see sellers jump in. If we broke above the 0.71 handle, then the market probably goes to the 0.74 handle next. Ultimately though, I prefer shorting this market as we get opportunities.