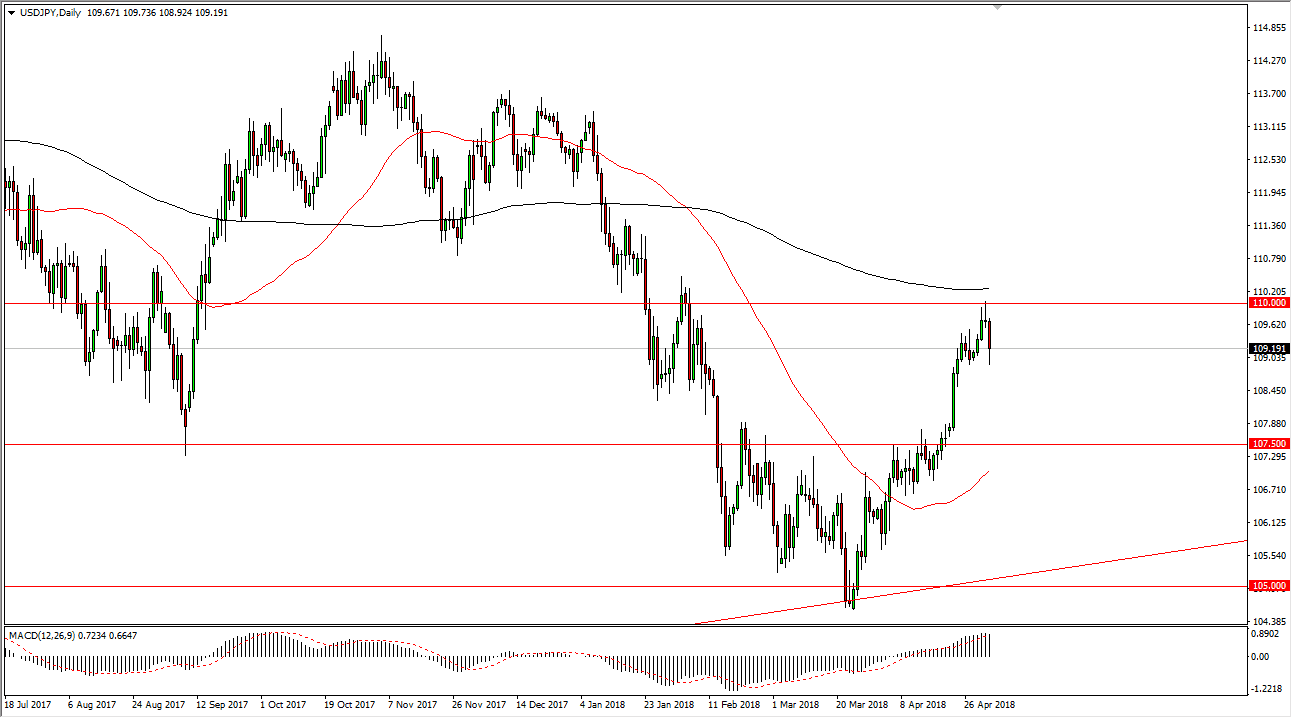

USD/JPY

The US dollar fell against the Japanese yen during training on Thursday but did see a bit of a rally and support near the 109 handle. This pair tends to be very sensitive to the jobs number, which of course comes out later today. Because of that, I think this might be a very interesting currency pair to watch, but I think that we have enough support at the 109, 108, and 107.50 levels to find buyers sooner rather than later. I think that the markets continue to be very choppy obviously, and between now and 8:30 AM Eastern standard Time, there’s very little that will happen. If we can break above the 110.25 level, the market should then continue to go much higher, with 112.50 being my target. As far as selling is concerned, I’m not interested in doing so until we break below the 107.50 level.

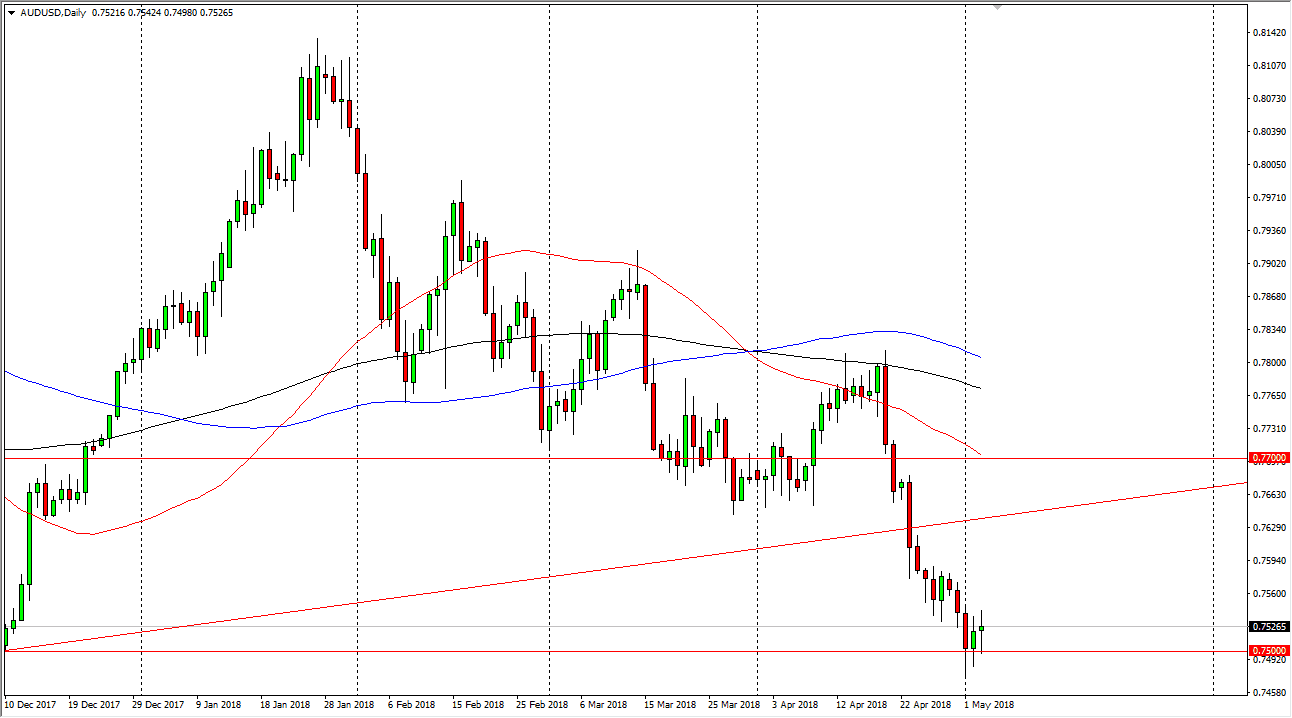

AUD/USD

The Australian dollar initially fell during Thursday, reaching towards the 0.75 level again. This is an area that has offered support, so the fact that we have bounce from there is not a huge surprise. It is also a large, round, psychologically significant figure, so it makes a bit of sense that we would see buyers coming in to support this market. I think part of this might be position covering ahead of the jobs number, which of course will have a massive influence on what happens with the US dollar next. Obviously, that’s half the equation here, so what happens with the US dollar matters overall.

If we did breakdown to a fresh, new low, then I think that the Aussie dollar will probably go looking towards the 0.7350 level next, as it is a structural area of interest that we have seen for quite some time. I like the idea of waiting for the daily close before putting money to work, but I would be the first to recognize and point out that there’s an uptrend line above that could cause resistance, so I suspect there’s probably more room to run to the downside.