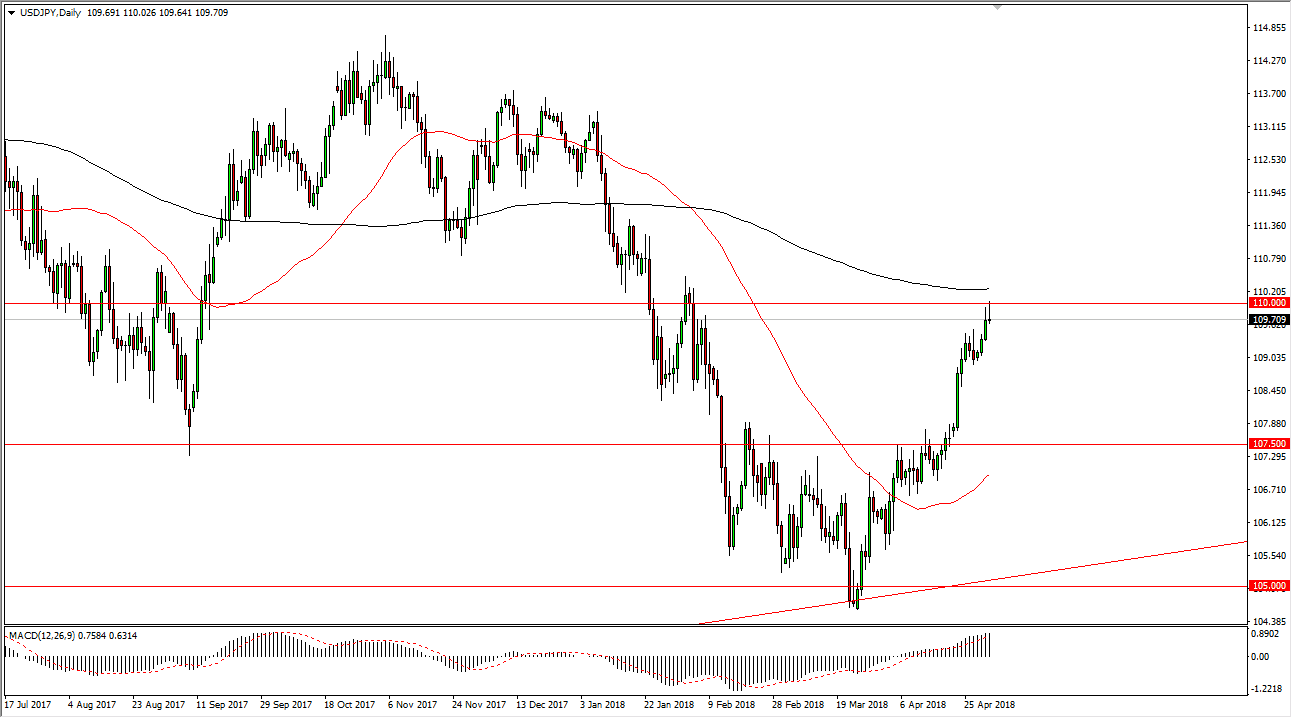

USD/JPY

The US dollar tried to rally initially on Wednesday but after the FOMC statement came out, traders pared their bullish positions in anticipation of the nonfarm payroll announcement on Friday. The psychologically important 110 level and the 200-day SMA just above could cause a bit of trouble as well, so I anticipate that we will probably pull back a bit from here, as it would take a significant amount of momentum to break out to the upside and above the large number. I anticipate that the 109-level underneath is supportive, just as the 108 level and the 107.50 level would be. I like buying pullbacks, and I think were about to get one here over the next 24 hours. I don’t look to sell this market, I don’t think that is the prudent thing to do until we get some type of reaction to the jobs figure tomorrow.

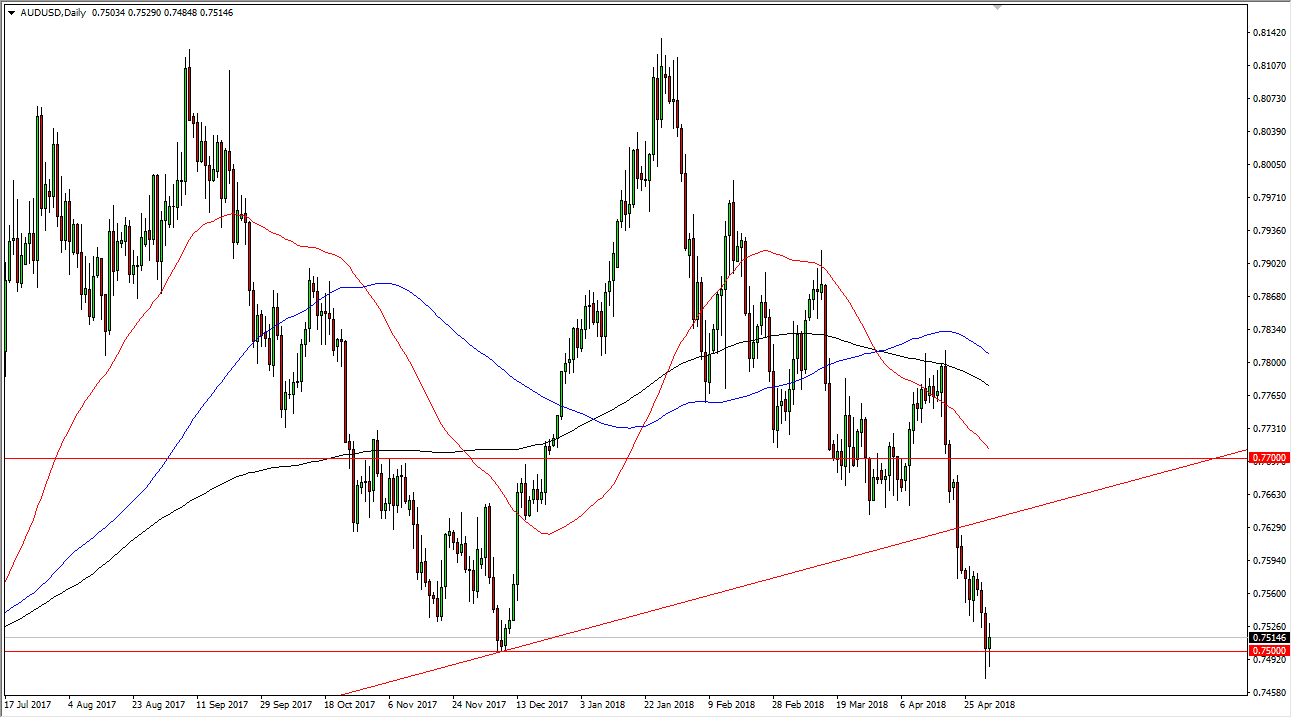

AUD/USD

The Australian dollar initially fell during the trading on Wednesday, breaking below the 0.75 handle before turning around and rally. However, we are still significantly depressed, and I think that eventually the sellers could return. The uptrend line above that had been broken through several days ago continues to be massive resistance, so I think that any bounce from here is probably going to be position squaring ahead of the jobs number more than anything else. I anticipate that we should get an opportunity to sell this market at higher levels and will need to be patient in waiting for that opportunity. Granted, we very well could bounce here but I think that would be a very dangerous trade to take considering how bearish it has been recently. Alternately, if we break down below the lows, the market continues to unwind to the 0.7350 level.