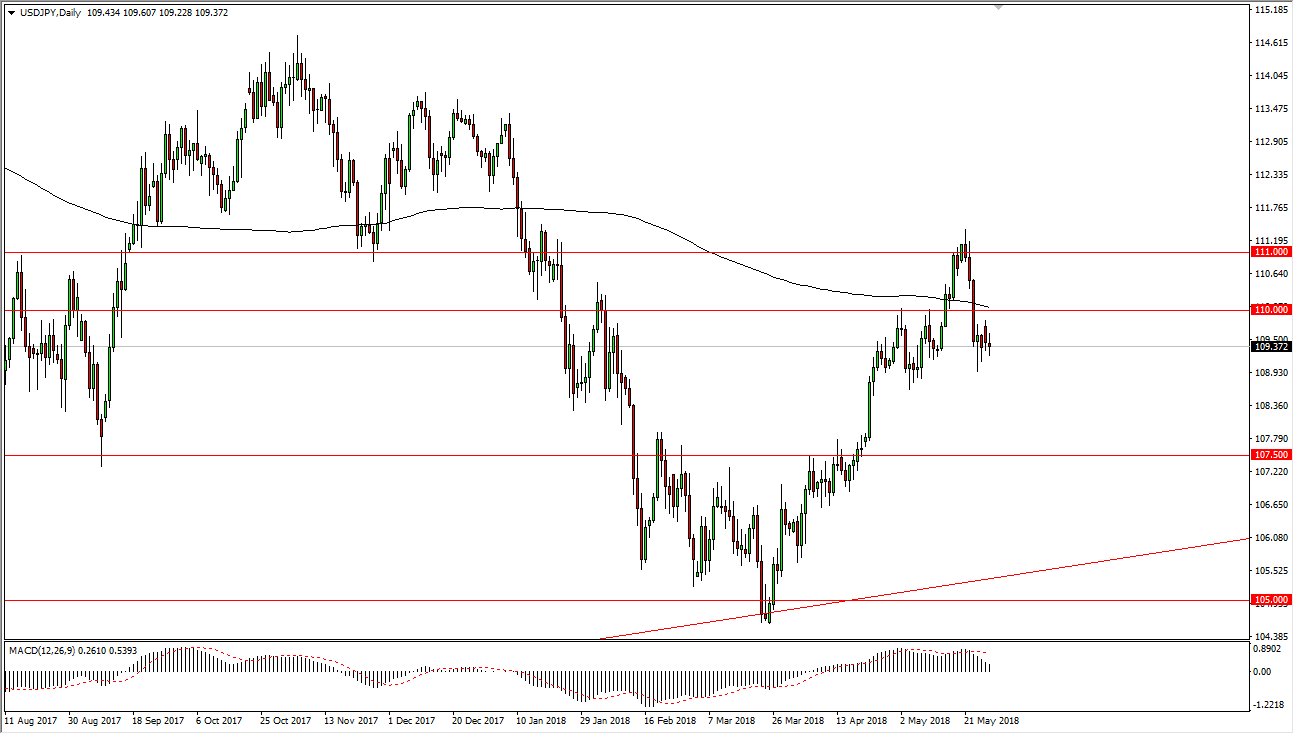

USD/JPY

The US dollar has gone back and forth during the trading session on Monday, as traders came back from the weekend. We are just below the 200-day simple moving average, which of course is a longer-term moving average that a lot of traders will put on their charts to determine the overall trend. We are treading water just below the ¥110 level, but the most important thing we should be paying attention to for the past 24 hours is that the Americans were away for Memorial Day celebrations. I suspect that we will continue to see a lot of volatility around this area, as the 200 moving average of course attracts both buying and selling. I think that if we do break down below the ¥109 level, we will probably go looking towards the ¥107.50 level underneath. Otherwise, we could see the market break above the ¥110 level and go looking towards ¥111 level in the short term.

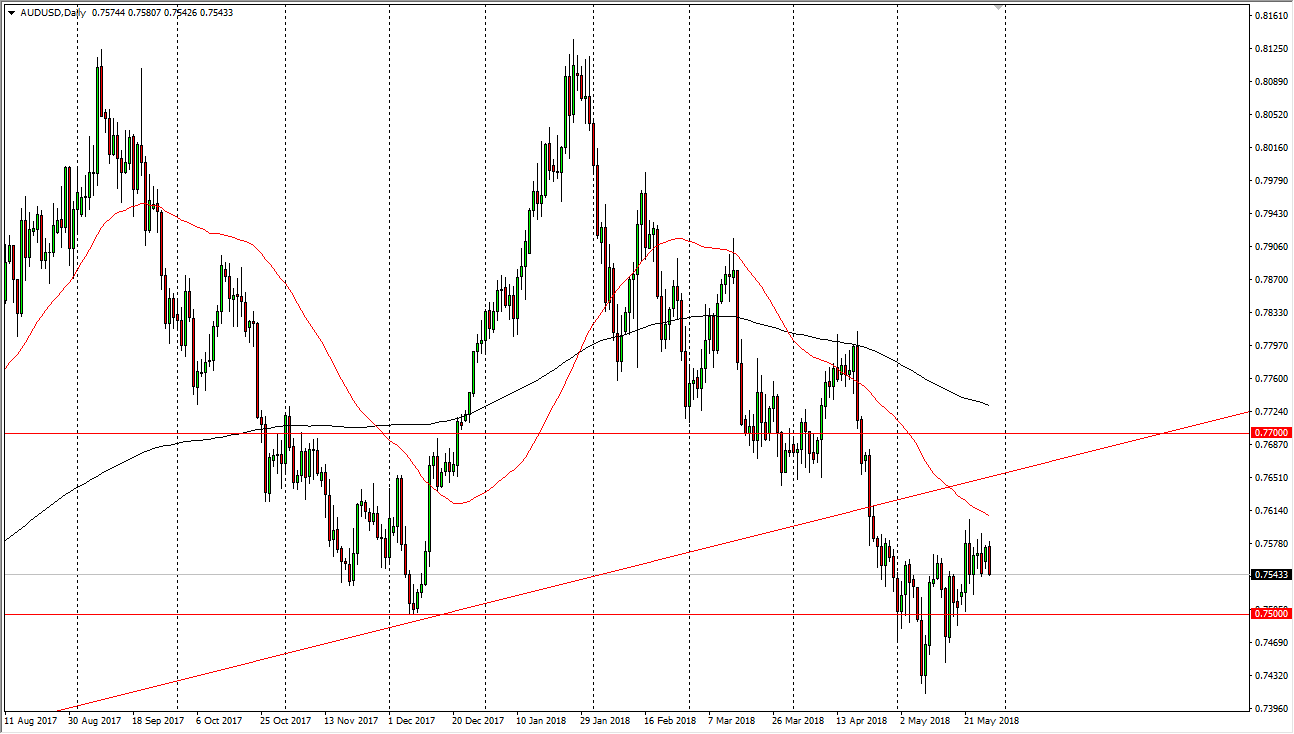

AUD/USD

The Australian dollar fell during the day on Monday, but it would have been a relatively thin trading. Over the last couple of weeks, on the weekly chart that is, we have ended up forming a couple of hammers. Ultimately, this shows just how much support there is near the 0.75 handle, and I think that if we were to make a fresh, new low, the market could break down significantly. The previous uptrend line should now offer resistance, so I think that although there is a proclivity for short-term trading to go to the upside, a nice selling opportunity should present itself above, especially near the 0.77 handle. Overall, I believe that we are going to see some consolidation more than anything else.