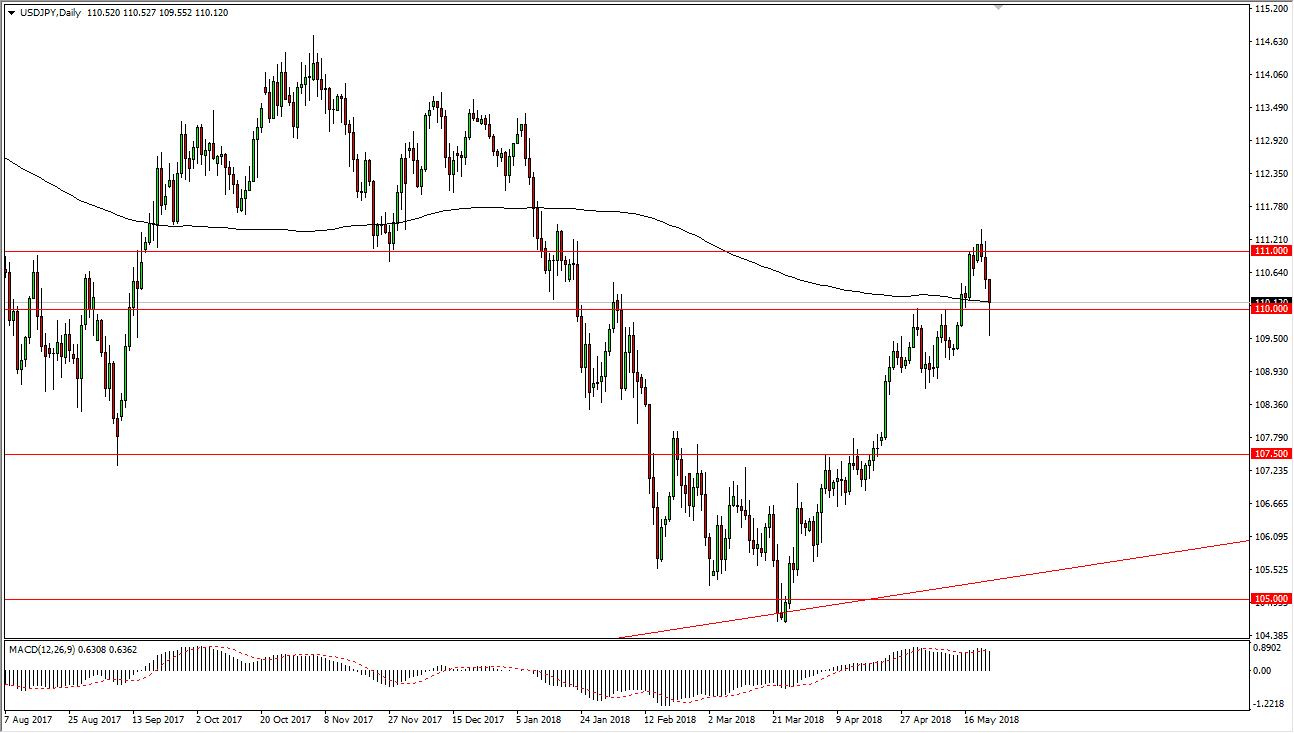

USD/JPY

The US dollar fell significantly against the Japanese yen during trading on Wednesday but bounced back above the ¥110 level to use the 200-day moving average as support, as well as the large come around, psychologically significant figure. Because of this, I think that the algorithms kicked in during the session as buyers came to the rescue. I believe higher interest rates in the United States will continue to drive this pair higher, and that it’s only a matter of time before we reach towards the ¥111 level. Even if we did break down from here, I anticipate that there is even more support at the ¥109 level. I don’t have any interest in shorting, at least not right now and I think that during the next few months we should see a move towards the ¥112.50 level as the US dollar should strengthened during the summer.

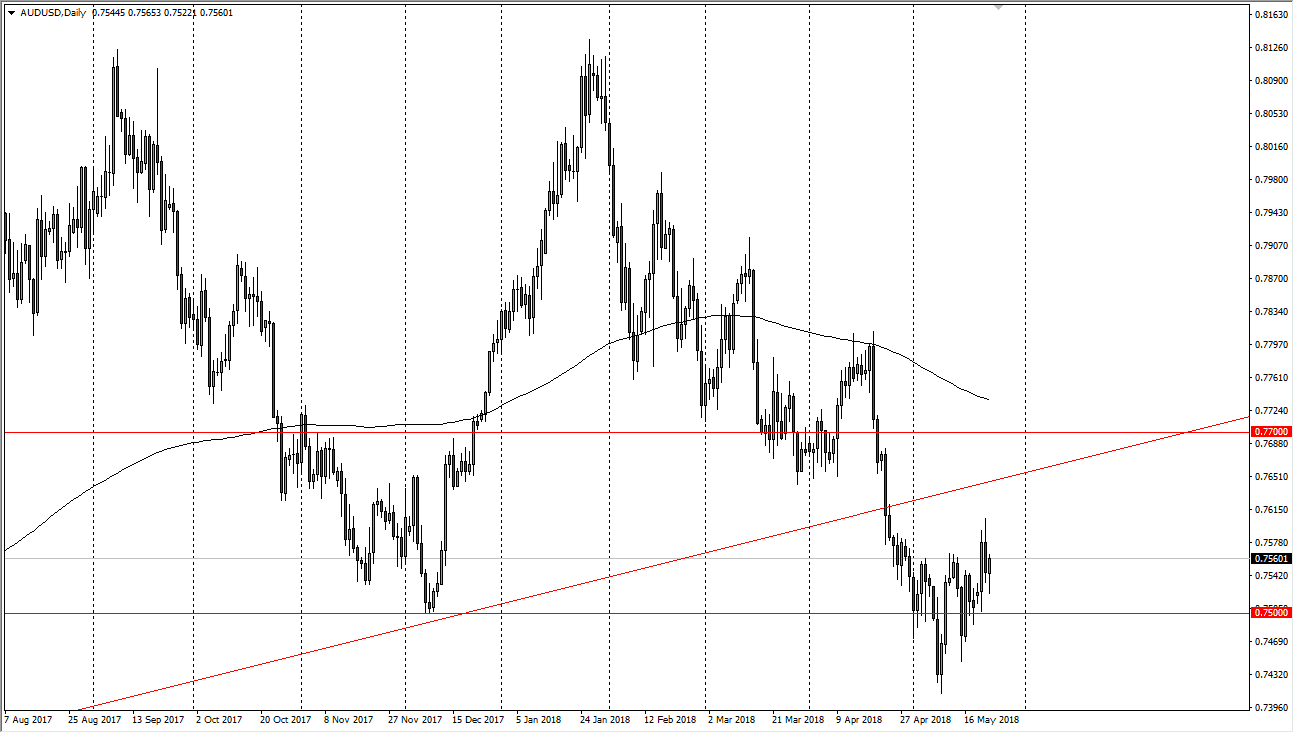

AUD/USD

The Australian dollar fell initially during trading on Wednesday but found enough support at the 0.75 region to turn around of form a little bit of a hammer. This is encouraging for Aussie bulls, as this shows that the large number is trying to keep the market afloat, but I see the area above as being very resistive, and quite frankly I think that it is going to be a tall order for this market to not only break above the previous uptrend line, but also the 0.77 handle. I think signs of exhaustion will be selling opportunities, and I will use them as such. I also think that we will more than likely go down to the 0.7350 level during the summer. However, I am the first to admit that I would be a buyer on a break above the 200-day moving average as plotted on the chart.