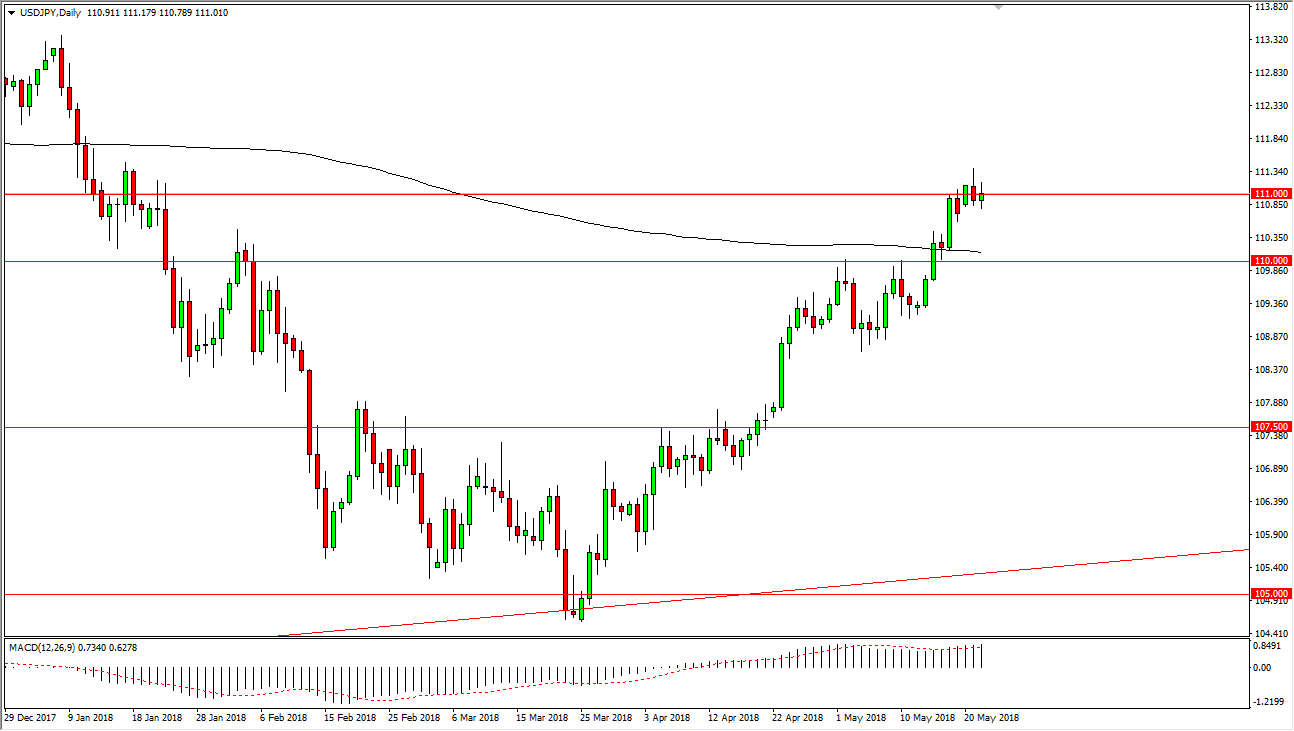

USD/JPY

The US dollar rallied a bit against the Japanese yen during trading on Tuesday but continues to struggle above the ¥111 level. While in and of itself and the shooting star suggest weakness, I think it should be pointed out that it’s not so much weakness as it is a proclivity to pullback to find momentum. I think we will eventually go higher, as we continue to see the US dollar strengthened against many other currencies around the world, but the USD/JPY pair is a little bit different in the sense that it tends the fall in a “risk off” move. Nonetheless, we are above the 200-day moving average and comfortably so, so I think we will continue to see buyers being interested in this market on dips. I look at the ¥110 level as an area that is extraordinarily important, extending down to the 190 and level.

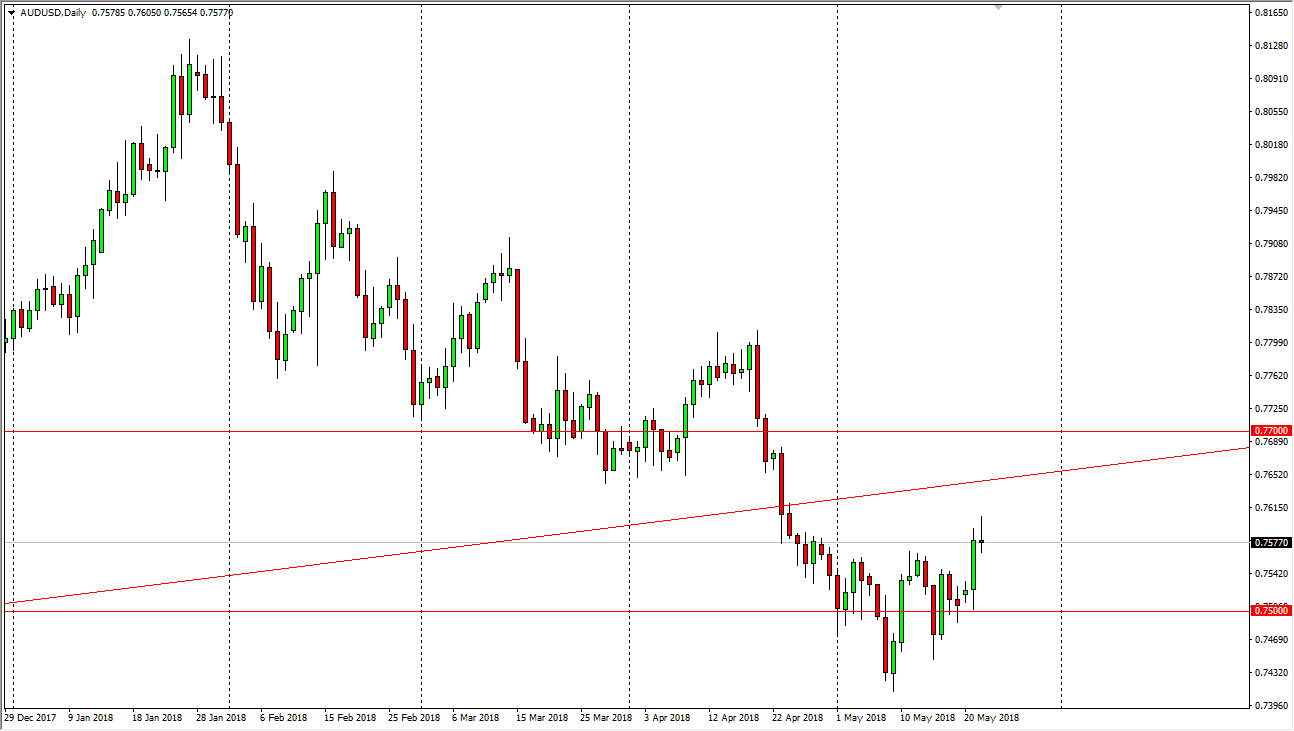

AUD/USD

The Australian dollar initially rallied during the day but rolled over to form a shooting star. The shooting star signifies that we will probably see sellers again, as we could not break above the previous uptrend line, an area that should be massive in its resistance. If we can break above that uptrend line, and more importantly the 0.77 handle, then the market could go much higher. Otherwise, it’s likely that the market will continue to struggle, as the US dollar is boosted by higher interest rates coming out of the United States. This puts a weight around the neck of gold, which puts a weight around the neck of the Aussie. I believe ultimately, we are going to go lower given enough time and I think that rallies are to be sold. The 2C candle only confirms that overall bias.