USD/JPY

The US dollar has bounced around quite a bit during the trading session on Monday, but ultimately ended up forming a bit of the shooting star. It looks as if maybe the market is starting to run into a reasonable amount of resistance. However, if we can break above the top of the shooting star, the market continues to go much higher. If we do pull back, I anticipate that we will see more than enough support below at the ¥110 level, an area that of course has a lot of psychological significance attached to it, and of course the 200-day moving average. So at this point I am a buyer of a dip or breaking above the top of the shooting star for the day. If the US treasury markets continue to show higher interest rates, that should push this market to the upside.

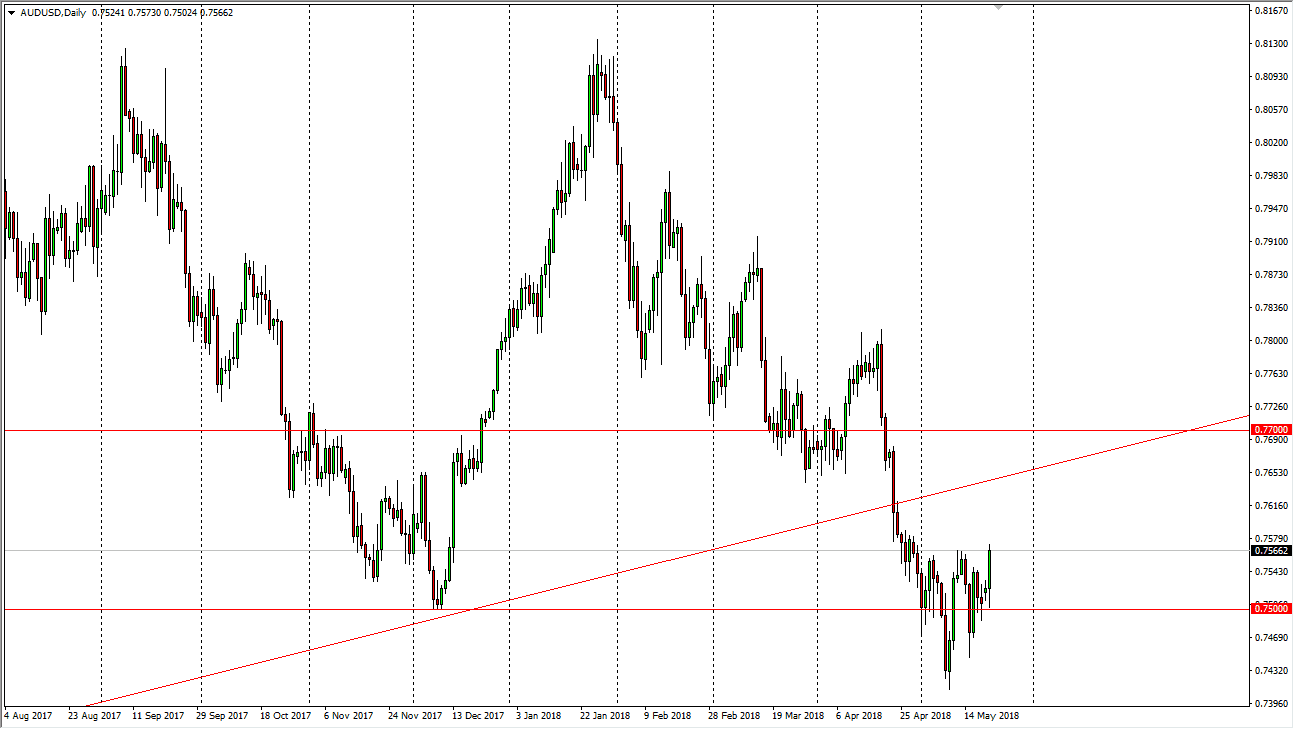

AUD/USD

The Australian dollar initially fell on Monday but found enough support at the 0.75 level to bounce significantly and form a bullish candle. By doing so, it looks as if we may try to go a bit higher, but we have the previous uptrend line that should cause significant resistance. Beyond that, the 0.77 level will also cause a significant amount of resistance as well. Any signs of exhaustion should be a nice selling opportunity, and I believe that we will continue to go lower, but it does make sense that the 0.75 level cause a bit of a bounce from a psychological standpoint. Longer-term, I anticipate that this market will probably go to the 0.7350 level, possibly even lower than that. If we did get a daily close above the 0.77 handle, then I believe that the market could go much higher. However, we most certainly have more bearish pressure than bullish.