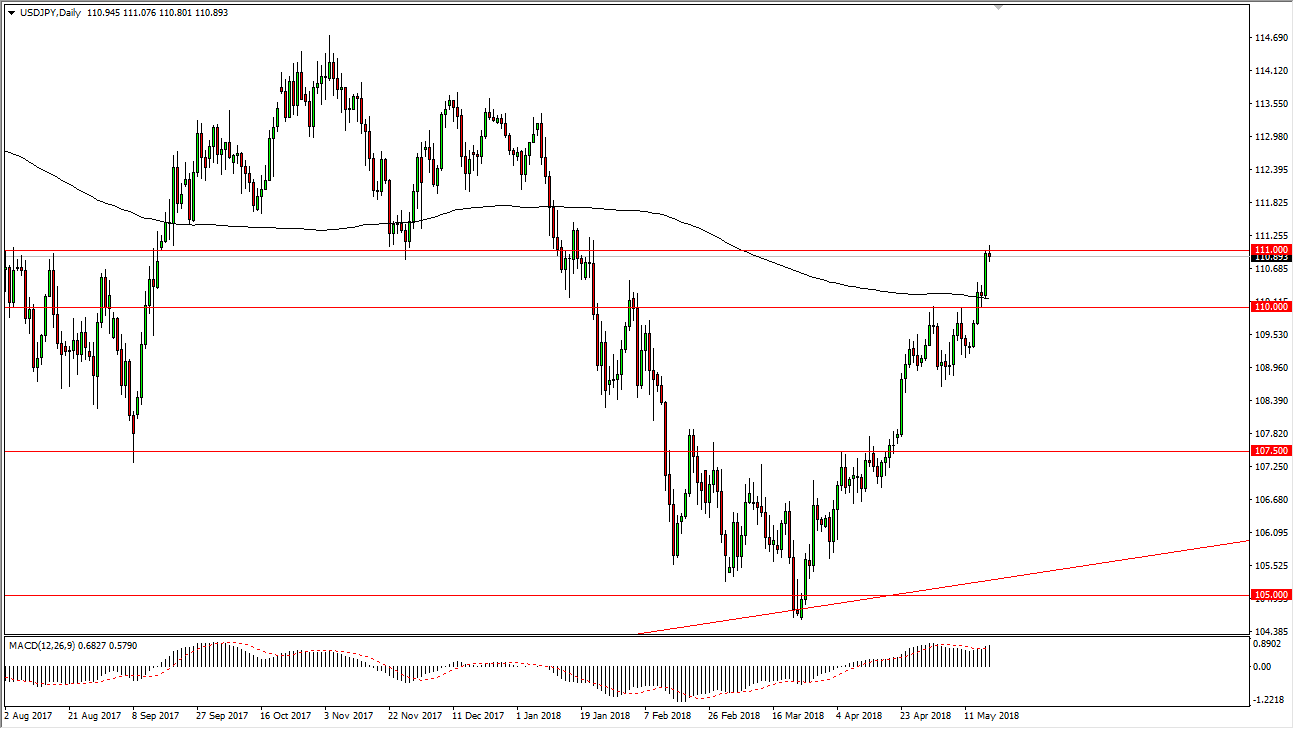

USD/JPY

The US dollar tried to break above the ¥111 level during the day on Friday but turned around as it was a bit too much. That’s an area that’s been support and resistance in the past, so it’s not a huge surprise that we failed, especially considering that we have seen such a huge move to the upside in the short term. However, I don’t have any interest in shorting this market, rather I think that the ¥110 level below should be a nice buying opportunity, not only because of the round number and the structural resistance that we had seen previously, but also the fact that the 200-day moving average is sitting right there. Either way, I think it’s only a matter of time before the market participants try to pick up the US dollar “on the cheap.”

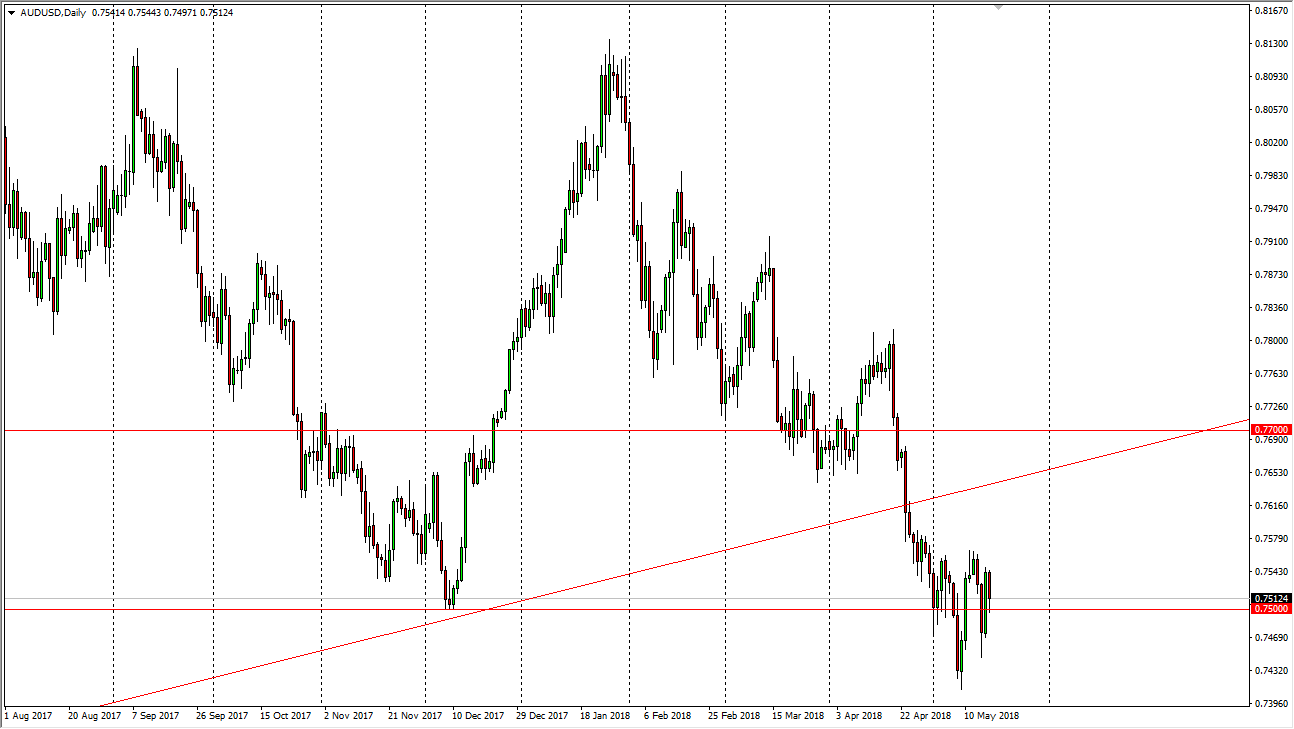

AUD/USD

The Australian dollar was very choppy during the day on Friday as we continue to dance around the 0.75 level, which for my money is a fulcrum for price. I believe that the market continues the bounce around this area, and it’s likely that we will need to make some type of decision rather soon. The last three weeks have formed hammers on the weekly chart, so we could get a short-term bounce. That bounce will face significant resistance above at the previous uptrend line, and of course the 0.77 level after that. Ultimately, this is a market that I think does attract selling pressure on signs of exhaustion, and I believe that we will continue to see a lot of volatility. Pay attention to gold, it moves this market quite a bit, which is by extension moved by the interest rate markets in the United States.