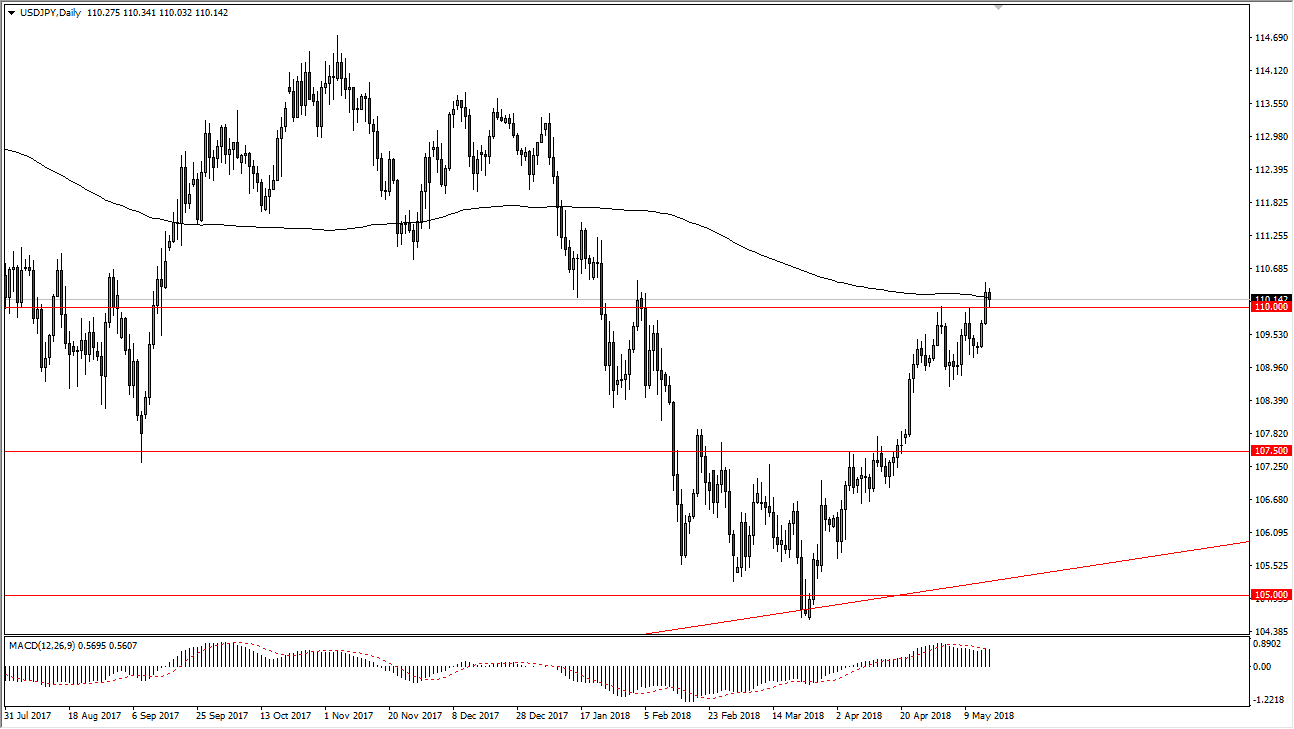

USD/JPY

The US dollar has rallied over the last several sessions, but Wednesday was a little bit soft as we continue to bounce around the 200-day simple moving average. This is an average that a lot of traders will pay attention to, and I think it’s very interesting to see how this market will move next. Is very interesting to pay attention to this market right now with the participants pain attention to the 10-year bonds in America. We are at a major crossroads and breaking above the ¥110 level is of course a very bullish sign. I think if we can break above the highs from the Tuesday session, then I think the market could continue to go higher. I think there is plenty of support underneath based upon the choppiness, which should have a lot of order flow attached to it. At this point, I look at short-term pullbacks as a buying opportunity.

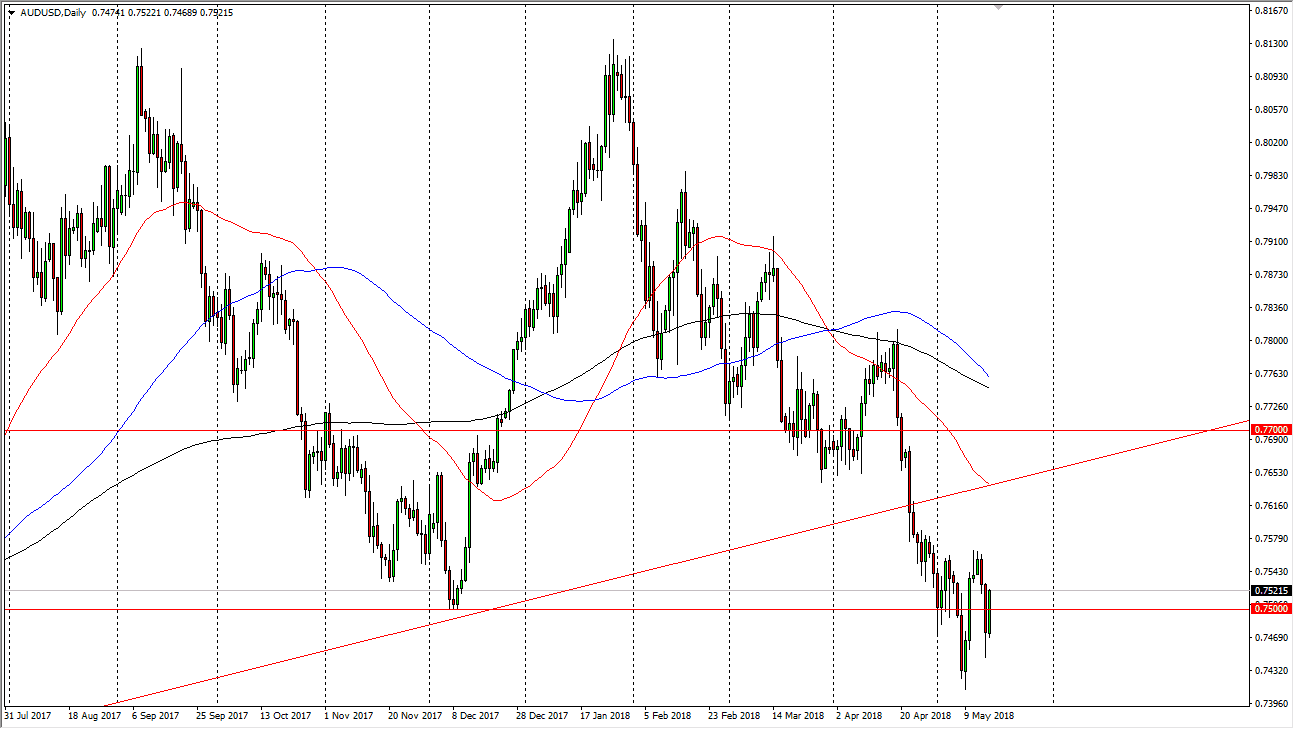

AUD/USD

The Australian dollar has rallied a bit during the trading session on Wednesday, as we continue to bounce around in a consolidation area. The 0.75 level of course is a significant round number, as it is a level that will attract a lot of attention. We have gone back and forth, and I think that we will continue to consolidate in general. I think if we make a fresh, new low, the market then reaches down to the 0.7350 level, and possibly even the 0.73 handle after that. I anticipate that market move could happen rather quickly, but I also recognize that the move higher breaking above the uptrend line could send buyers into this market in an attempt to break above the 0.77 handle. While I don’t think that happens in the short term, it is something that you should pay attention to.