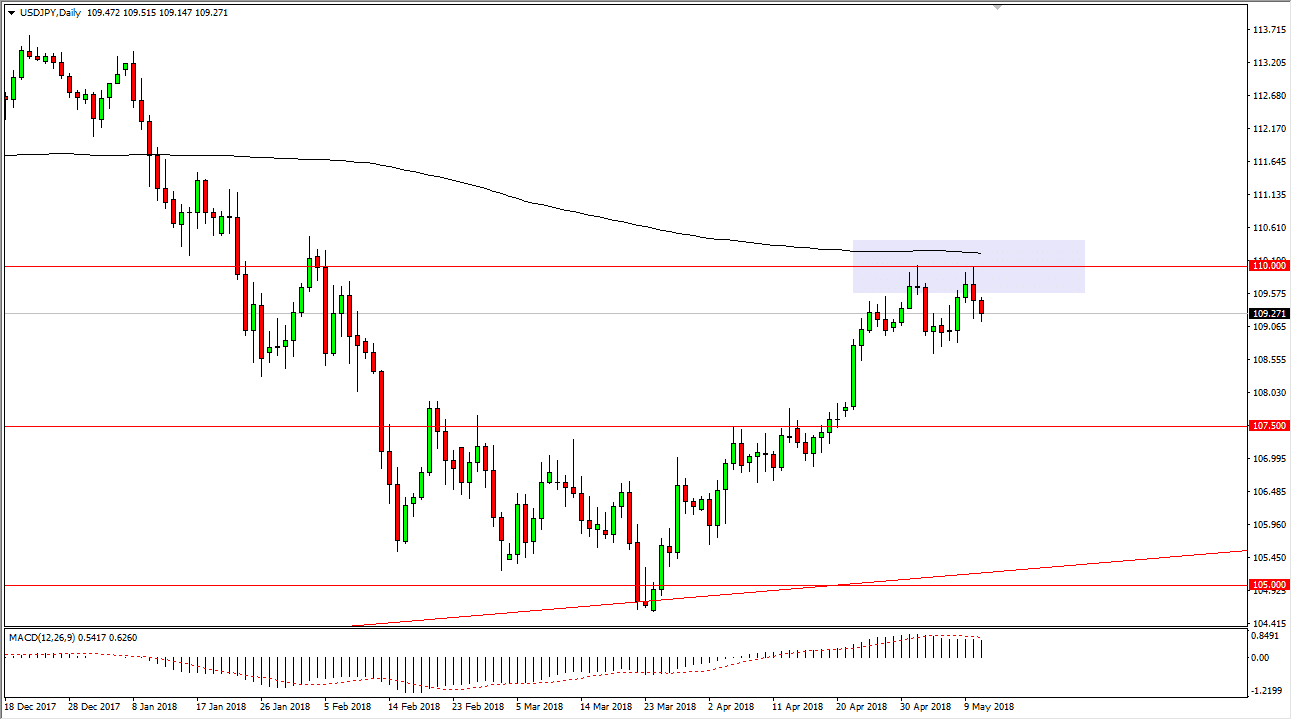

USD/JPY

The US dollar has fallen against the Japanese yen on Friday, reaching down towards the 109 level. The market looks likely to test that level again, but what I would point out is that the 200-day moving average is just above, and that should continue to provide a little bit of bearish pressure. The 200-day moving average is something that is followed by a lot of traders, but beyond that we have the ¥110 level which has offered resistance. Because of this, it’s not surprising that we would fail breakout. We have formed a couple of a shooting star is on the weekly chart, so that of course is very negative. I think that the market probably drops down to the ¥107.50 level underneath, where we see a massive amount of support. Otherwise, if we can clear the 200-day moving average then we will go to the ¥112.50 level.

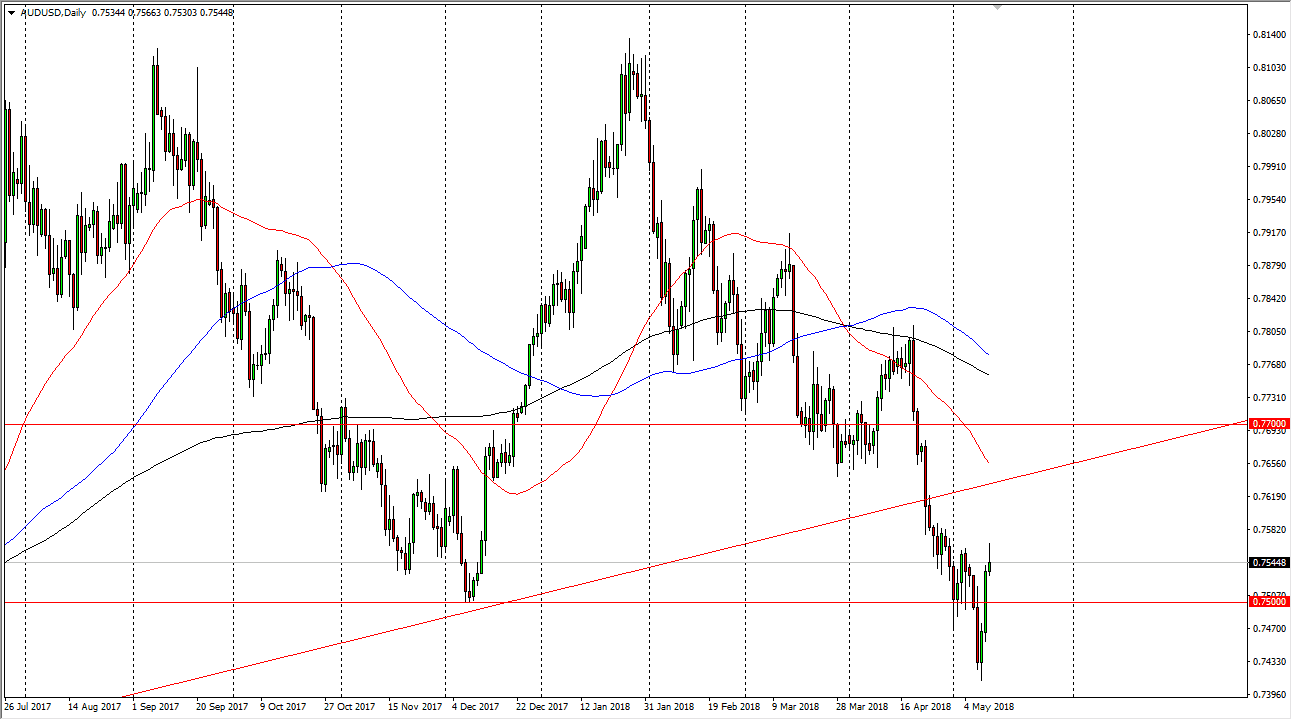

AUD/USD

The Australian dollar rallied again during the day on Friday but turned around to form a shooting star. That of course is a very negative sign and one of the most negative candlesticks that we can form. Because of this, I anticipate we could get a bit of a pullback, but what has me a bit confused is that we have formed a hammer. The hammer of course is a bullish sign, but we have recently broken through a major uptrend line. When I look around the Forex world, it looks as if the US dollar may fall in strength, so we may get a bit of a bounce but I’m not willing to buy this market until we break above the top of the shooting star for the Friday session. Otherwise, I anticipate that we will continue to grind around the 0.75 level overall. A breakdown to a fresh, new low would be an extraordinarily negative sign.