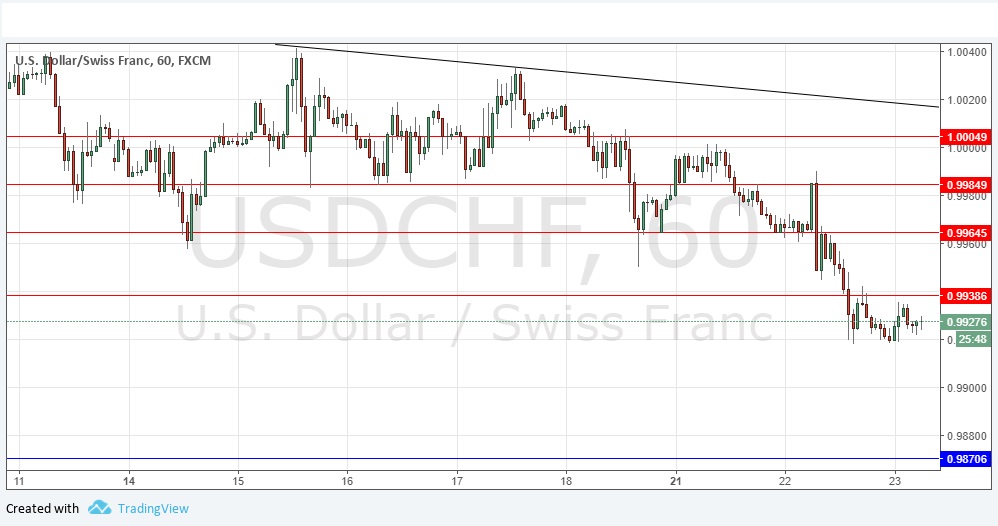

Yesterday’s signals produced a short trade from the bearish rejection of the resistance level identified at 0.9985, which would currently be in profit and moving in the right direction, at the time of writing.

Today’s USD/CHF Signals

Risk 0.75%.

Trades must be taken before 5pm London time today, during the next 24-hour period.

Short Trades

Short entry following a bearish price action reversal upon the next touch of either 0.9939 or 0.9965.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.9871.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/CHF Analysis

The outlook looks a little more bullish as the price has printed a couple of flimsy but real resistance levels close to the parity level and below. I took no directional bias yesterday. The price has been consolidating within a narrow range for some days, looking a little bearish after a long, strong bullish move which played out over two months. At the time of writing, the previous hour has seen a strong push up, which has not yet reached either of the resistance levels. A bearish turn at the resistance could provide a short trade entry. If taken, it would probably be advisable to be conservative with profit taking.

There is nothing due today concerning the CHF. Regarding the USD, there will be a release of Crude Oil Inventories at 3:30pm London time, followed by the FOMC Meeting Minutes at 7pm.