USD/CAD

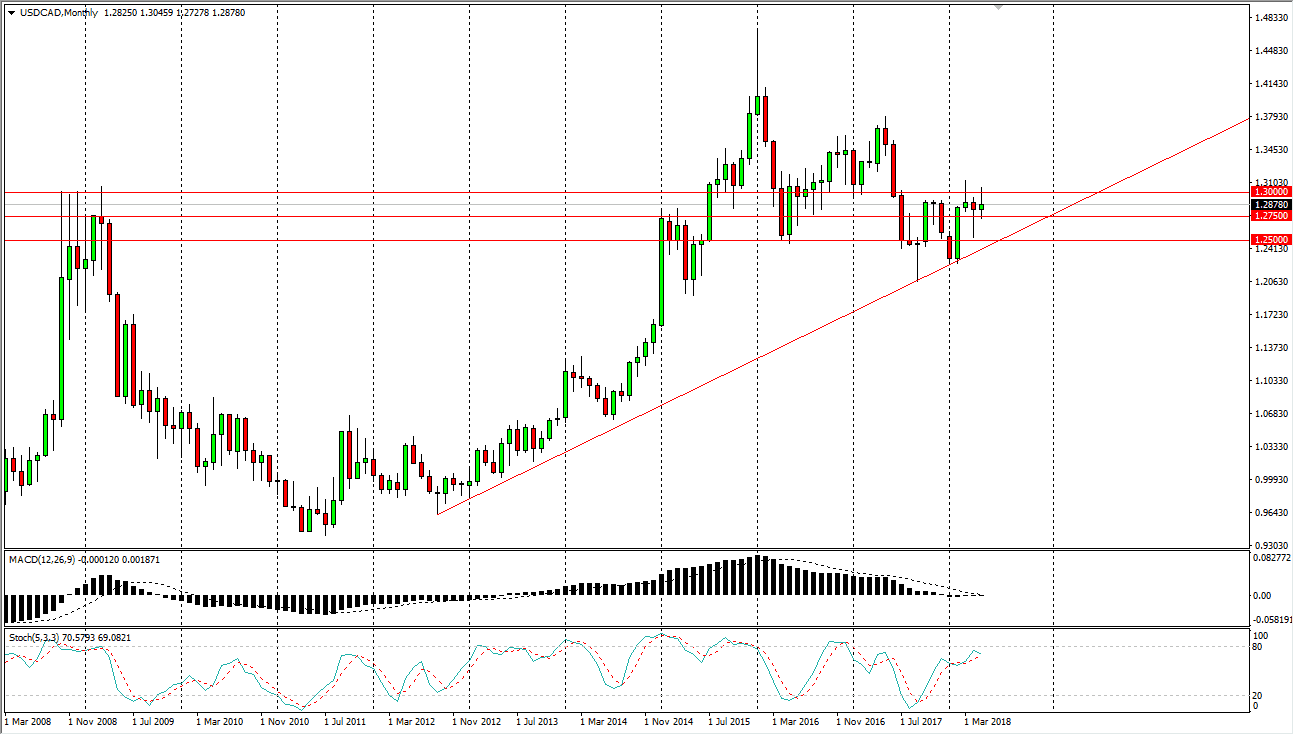

The US dollar had a slightly positive month against the Canadian dollar but has turned around rapidly on the 30th as the Bank of Canada has suggested that interest rate hikes are coming after all. That being said, the Federal Reserve is more than likely going to raise interest rates much quicker than candidate, so I think there is still the possibility of an upward proclivity. The fact that the May candle is a bit of a shooting star, the April candle is a hammer, and the market was a shooting star suggests to me that we are going to be range bound more than anything else. I think you can probably expect this market to spend most of the month going sideways, perhaps reaching towards the uptrend line over the next several months.

While difficult to deal with, the reality is that this market quite often does go sideways as the economies are heavily interconnected. That means that it makes sense that we will do very little, especially during summer which tends to be range bound in this market not only because of the high correlation between the two economies, but also becomes driving season in the United States which typically brings up demand for oil.

If we do break above the 1.31 handle, we will probably try to work towards 1.35 level, although I would be very surprised to see that level reached during the month. If we break down below the uptrend line, then obviously it’s very negative sign but I don’t think that’s going to happen. If it does, then I think 1.20 would have to be the initial target for the longer-term trader. Look for a lot of back and forth trading on the stochastic indicator based system during the month of June.