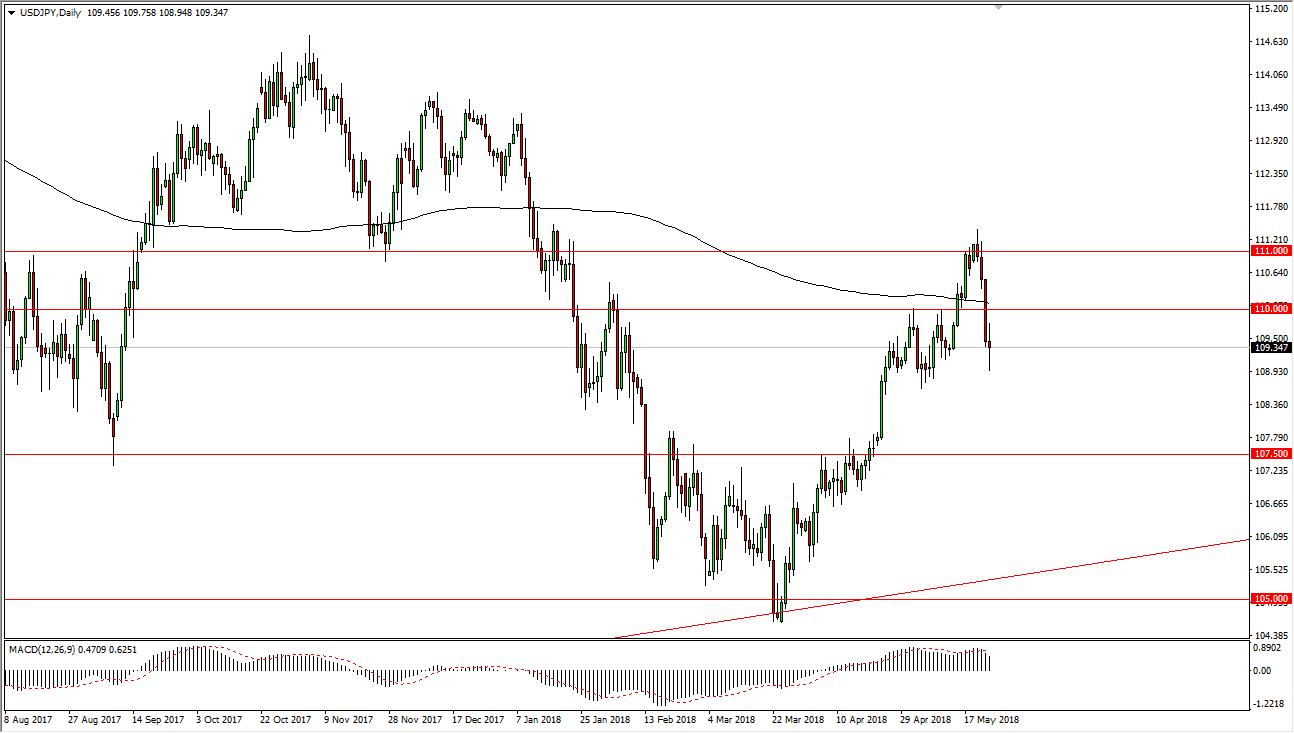

USD/JPY

The US dollar has gone back and forth during the trading session on Thursday, falling towards the ¥109 level, before finding some type of stability. If we can break above the ¥110 level above, and of course the important 200 day moving average, the market should continue to go much higher. Ultimately, this is a market that I think will find buyers, based upon the interest rates in America going higher, and I think that it’s only a matter of time before we find value hunters coming back into this market. I believe that short-term pullbacks will have the market looking at the 190 and level again, but if we break down below there we could find ourselves going as low as the ¥107.50 level before we find support. We are dancing around the 200-day simple moving average, which always attracts a lot of attention.

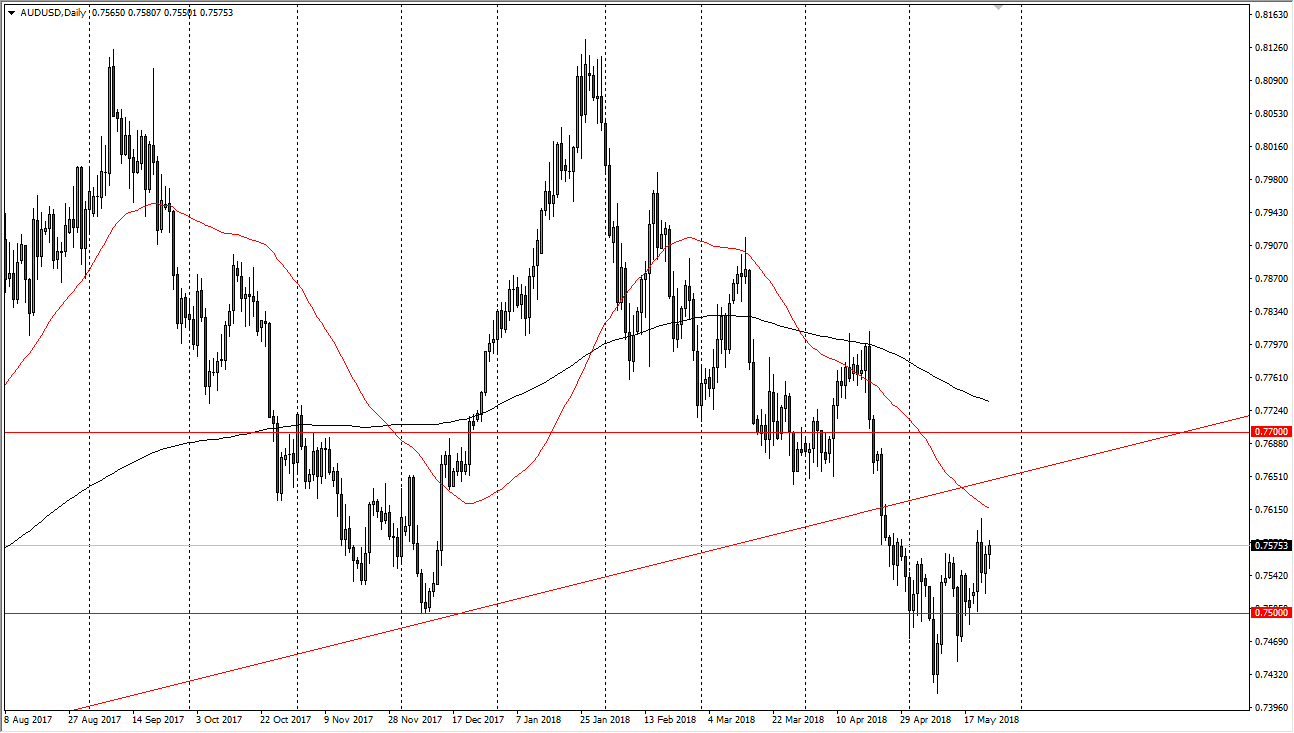

AUD/USD

The Australian dollar initially fell during the day on Thursday but turned around the show signs of support. I think that there is significant resistance above though, and when I look at the uptrend line just above, I think that will continue to put bearish pressure on this market, so I’m looking for signs of exhaustion. Ultimately, I think that as soon as we see signs of exhaustion, it’s a nice opportunity to start shorting again as the US dollar should continue to strengthen. It’s not until we break above the 0.77 level that I would be interested in trying to buy this market, and I believe that we will struggle mightily to get to that area. I have no interest in trying to fight what has been a significant bearish market over the last several months.