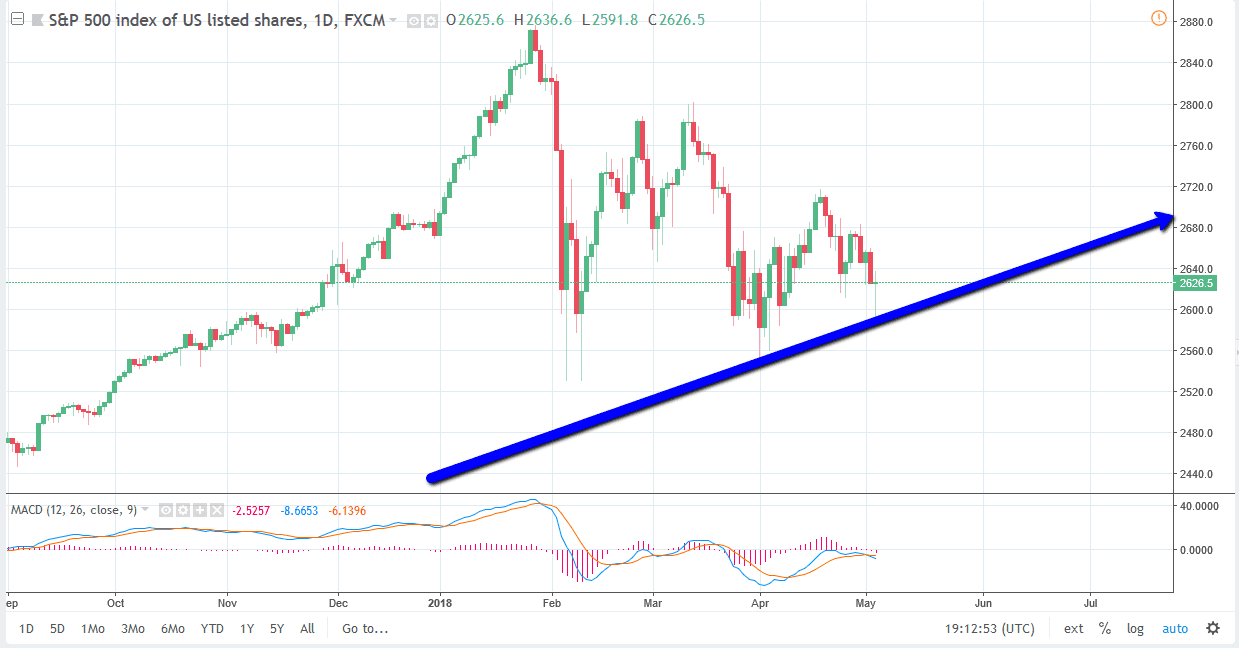

S&P 500

The S&P 500 fell rather significantly during the trading session on Thursday but found enough support at the 2600 level to turn around and form a hammer. We did breakdown below the 200-day exponential moving average on the underlying index, and that caused a bit of a panic for a very brief moment in time. By turn around and forming a hammer the way we have, that suggests that we could see a bounce from here. A break above the 2640 level sends this market looking to 2680, while a breakdown below the bottom of the hammer would be very negative, sending this market to 2560, perhaps even 2500. With today being Nonfarm Payroll, it’s very likely that we will continue to see volatility, once the announcement comes out at 8:30 AM Eastern Standard Time.

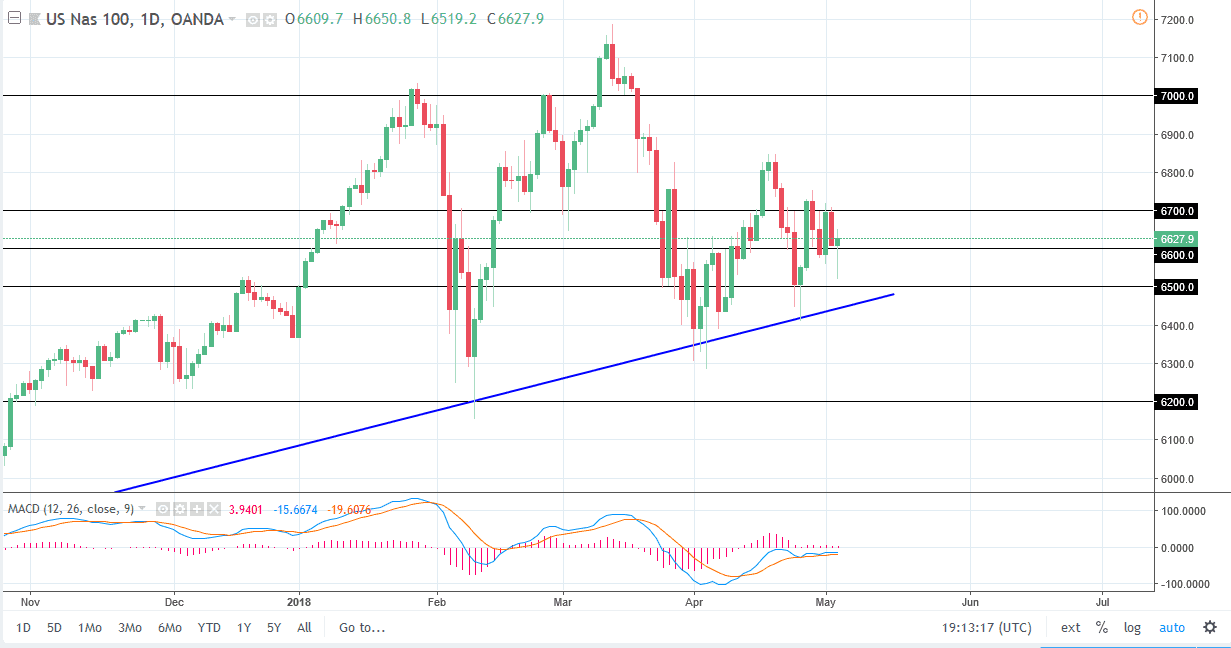

NASDAQ 100

The NASDAQ 100 pulled back during the session as well, reaching as low as 6500, before turning around to form a massive hammer. The hammer is a very bullish sign, and I think that the market will try to go to the 6700 as a result. If we can break above 6725, the market is likely to continue to go much higher. Otherwise, we will test the uptrend line just below the 6500 level, and a breakdown below that level would be very catastrophic. I think that if that were to happen, you would see similar moves in S&P 500, Russell 2000, and Dow Jones 30 indices. I think longer-term though, we are starting to see value hunters come back in and if the jobs number is spot on, people won’t be as concerned about rising interest rates and should continue to try to grind to the upside. However, the jobs number is very strong, we could see this market break down little bit.