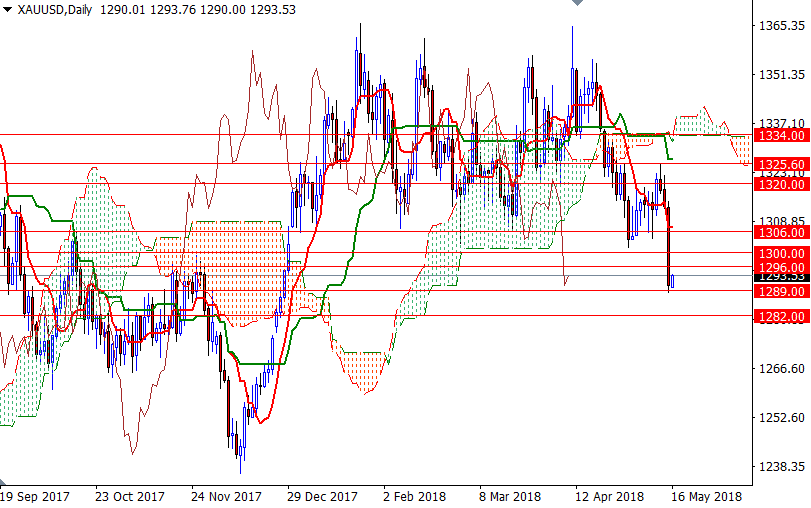

Gold prices ended Tuesday’s session down $22.63 an ounce, extending losses to a third straight session, as rising bond yields and a strong U.S. dollar abated investor appetite for the precious metal. The dollar index surged to a five-month high on the back of upbeat U.S. economic data. XAU/USD broke below the support in the $1313-$1310 area after the New York Federal Reserve Bank reported that manufacturing activity in the region climbed to 20.1 from 15.8 a month earlier. The U.S. retail sales report for April, was more or less in line with market expectations.

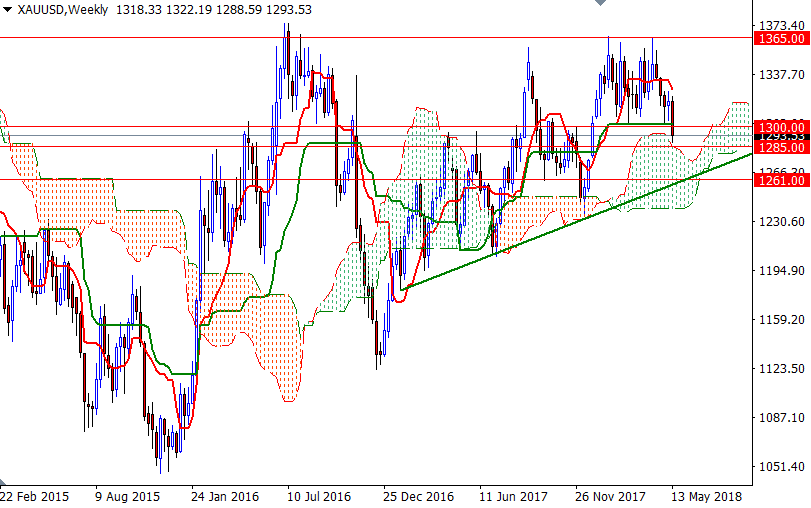

Technical selling was also behind gold’s 1.72% drop yesterday. XAU/USD came under strong pressure after prices fell through a key technical support in 1300-1296. Consequently, the market retreated to the 1292-1289 area as expected. Some normal short covering is featured in early Asian trading today, following recent selling pressure that drove the market to the lowest level since December 28. However, note that the market is trading below the daily and the 4-hourly clouds; plus, the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are negatively aligned on both charts. The Chikou-span (closing price plotted 26 periods behind, brown line), which is now below the daily cloud, also suggests more downside price pressure is coming.

To the upside, the initial resistance sits in 1300-1296, followed by 1303.50. If the bulls can push prices back above 1303.50, they will have a chance to revisit 1306. A break through there could foreshadow a move to 1313/1, where the bottom of the 4-hourly cloud resides. On the other hand, if the market can’t hold above 1292/89, then the 1285/2 zone will be the next stop. The bears will need to drag prices below 1282 to challenge the bulls waiting in the 1276/4 area. If this support is broken, look for further downside with 1270 and 1261 as targets.