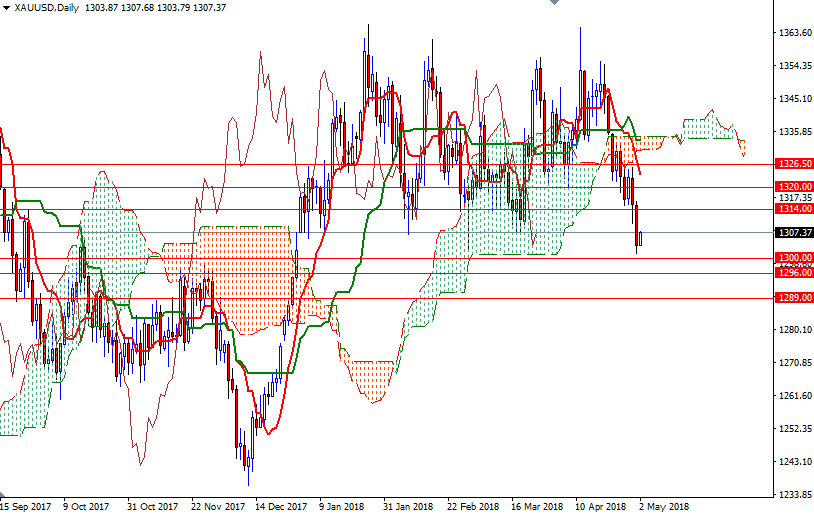

Gold prices dropped $11.09 an ounce on Tuesday, pushed down by a stronger dollar. XAU/USD traded as low as $1301.59 after the market failed to stay above the $1314 level. Markets are now waiting for the Federal Reserve’s monetary policy decision later in the day. Gold prices are slightly higher in early Asian trading on a mild rebound following recent selling pressure that took prices to the lowest level since December 29.

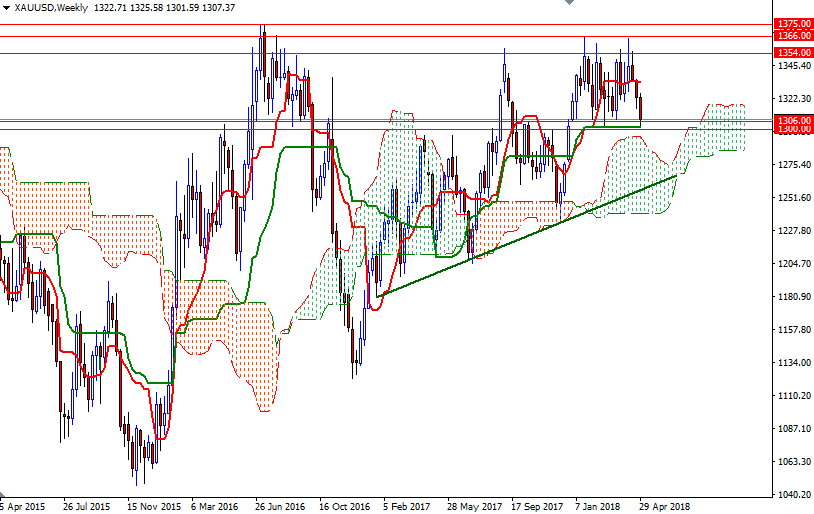

The bears still have the short-term technical advantage, with the market trading below the 4-hourly and the hourly Ichimoku clouds. However, the potential downside will be limited until the bears capture the strategic support in the 1300-1296 region. If prices get back above 1308, expect to see some more short-side profit taking. In that case, keep an eye on the 1312.50 level, which happens to be the top of the Ichimoku cloud on the M30 chart. Beyond there, the bears will be waiting in the 1315/4 area. The bulls have to convincingly lift prices above 1315 to gain momentum for 1322/0. A break through there suggests a push up to 1326.50-1325.60.

A breakdown below the 1300-1296 area could trigger a fresh round of selling and drag prices towards 1292-1289. Once below there, the market will be targeting 1285/2 next. If this support is broken, look for further downside with 1276/4 and 1270 as targets.