GBP/USD

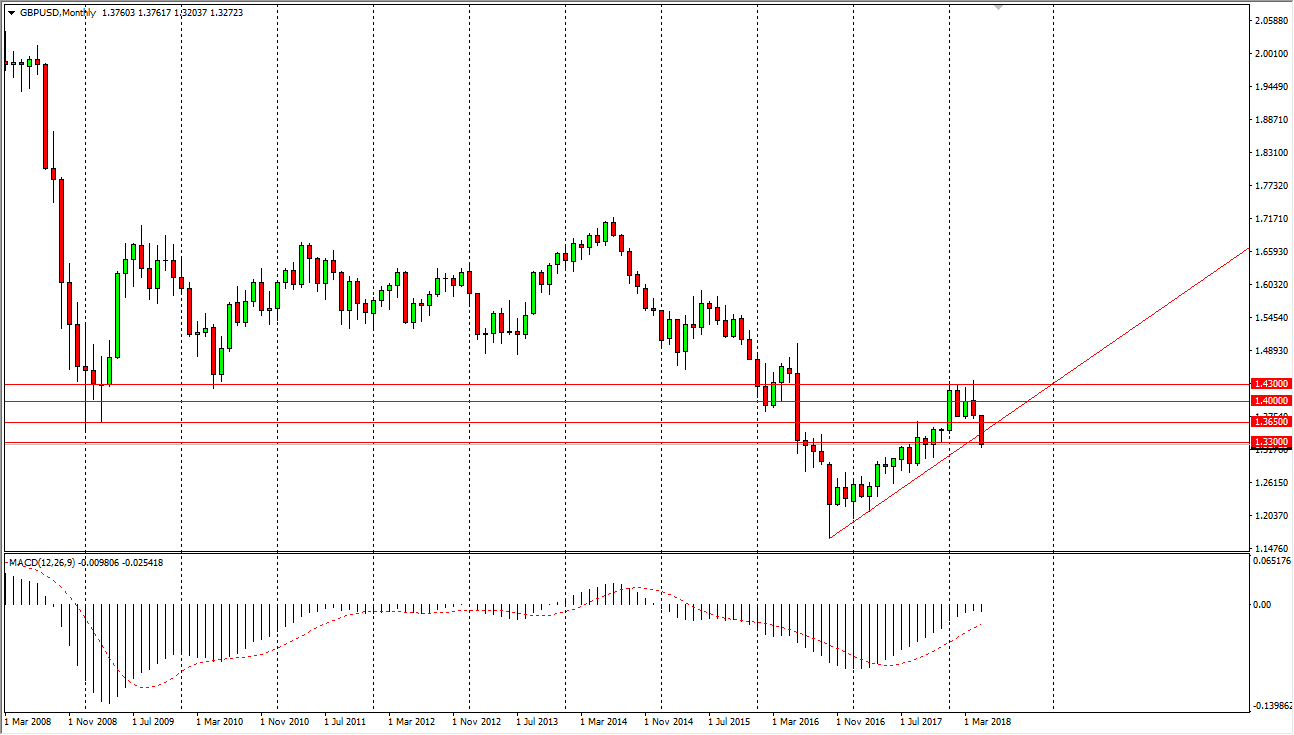

The British pound has broken down significantly during the month of May, breaking below a major uptrend line. This signifies that we may be looking for the next leg lower, and I think if we break down below the lows of the month, extensively just below the 1.33 handle, this market should continue to go lower, perhaps reaching towards 1.30 level next. The British pound continues to fall due to the significant bullish pressure in the greenback that we see due to the interest rates rallying in the United States. By breaking through this uptrend line, that’s a major sign of resistance being broken, and then should also look likely to be a continuation of what we have seen over the last several years. While the Bank of England looks likely to raise interest rates at least once over the next year, the Federal Reserve is all but set to do at least three, if not four.

Because of this, I think that rallies will be sold this month, and I also look at the previous uptrend line as massive resistance. So if we can stay above the 1.35 handle during the month of June, I think it’s only a matter of time before we fall even further and go looking towards the lows over the next several months, if not year. If we broke above the uptrend line on the chart, extensively the 1.3650 level, then I might be convinced to start buying and aiming towards 1.43 level again. That seems to be the least likely of scenarios though, because not only have we broken down below the uptrend line, we have closed at the very bottom of the range for the month which of course is always a very bearish site and normally leads to continuation.