EUR/USD

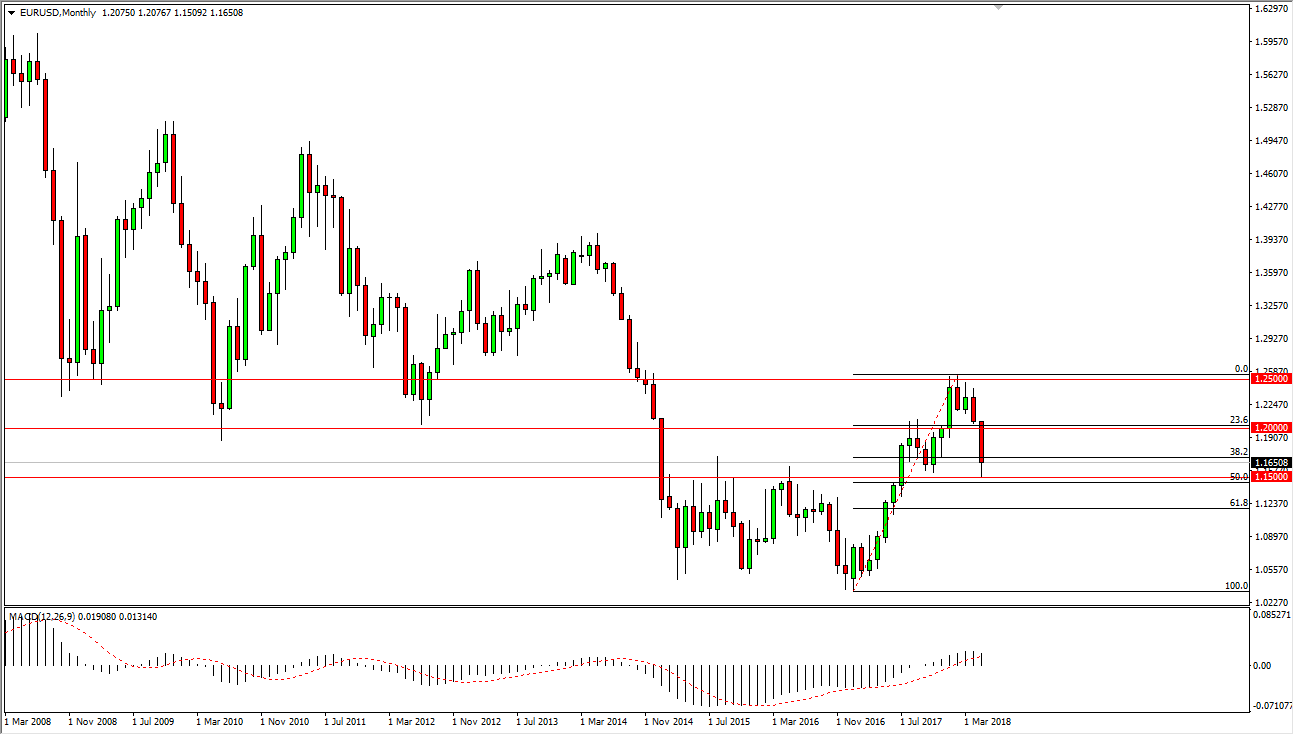

The EUR/USD pair has broken down significantly during the month, losing over 500 pips. That’s a very negative sign, and the 1.15 level underneath could be thought of as a major support level based upon the previous resistance. We have bounced a bit since then, but I think that the market will probably test that area again. If we can break down below the 1.15 level, I would be extraordinarily short of this market and I think that we could go to the 1.1250 level, possibly the 1.10 level after that. The fact that we have bounced a bit shows that there are a lot of buyers interested in going long of this market, and it’s very interesting that the markets have bounced basically from the 50% Fibonacci retracement level as well.

I think that the market could bounce from here and then go to the 1.25 level above over the longer-term. This month I think will be very noisy and very consolidated, as we are looking at the Italian situation with great interest. I think this month will be very difficult, but I also believe that we will see a longer-term move just ready to happen. On a supportive candle or some type of impulsive move I think I would be a buyer, but there’s a clear and obvious support level at the 1.15 level underneath. If we were to break down below there, then obviously things would change but I have to believe that this area will lease cause some type of support in the short term.

If we did break down below there, it’s not lost on me that the 1.1250 level is where the 61.8% Fibonacci retracement finds itself, so that obviously is an area that has historically attracted a lot of attention.