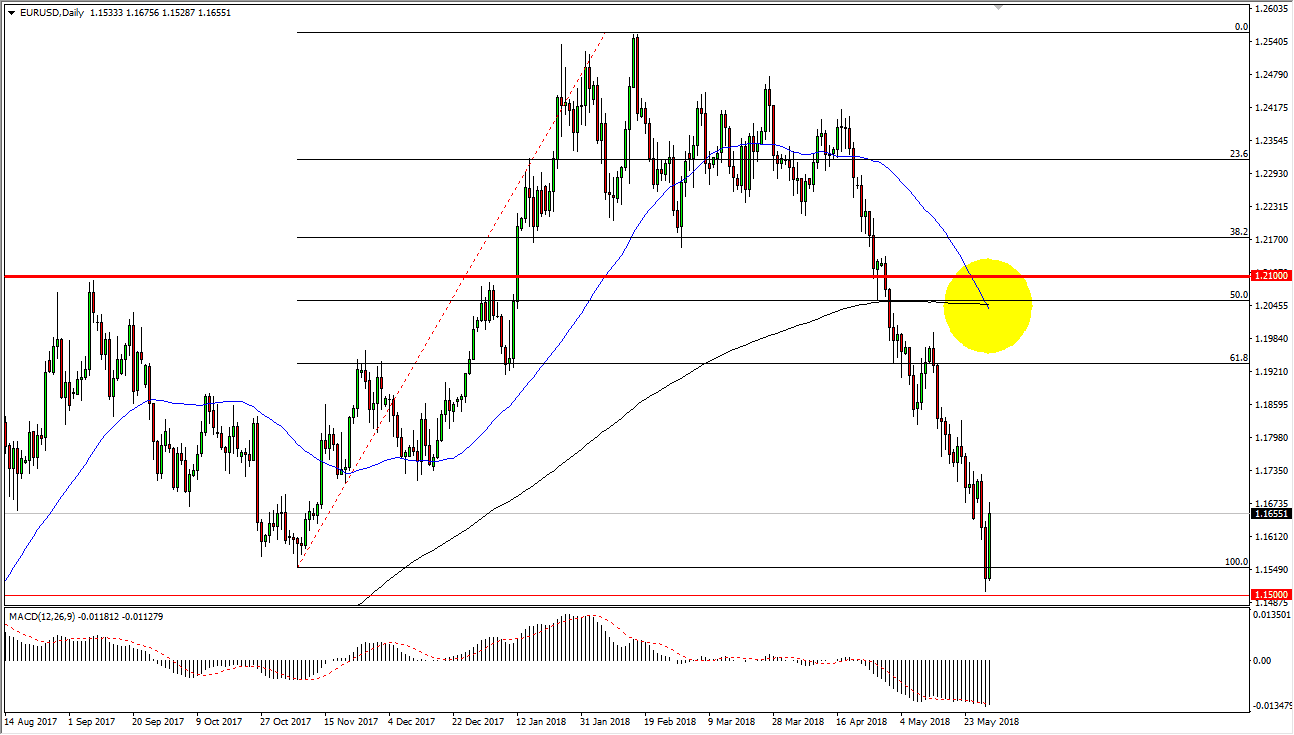

EUR/USD

The EUR/USD pair has rallied significantly during the trading session on Wednesday in perhaps reaction to the slight progress made in forming a government in Italy. The 1.15 level has offered enough support, as one would expect as it is a major level on longer-term charts. That’s an area that of course will cause a significant amount of interest in the market, and quite frankly was reached far too quickly. I think a bounce is necessary, and eventually we will see sellers come back into this market on signs of exhaustion. We could bounce quite a bit from here, but one thing I would point out is that we have formed the “death cross” on the chart, and that of course will attract a lot of attention as well. It’ll be very interesting, but I think if you are patient enough you can sell at higher levels instead of trying to fight the massive selloff overall.

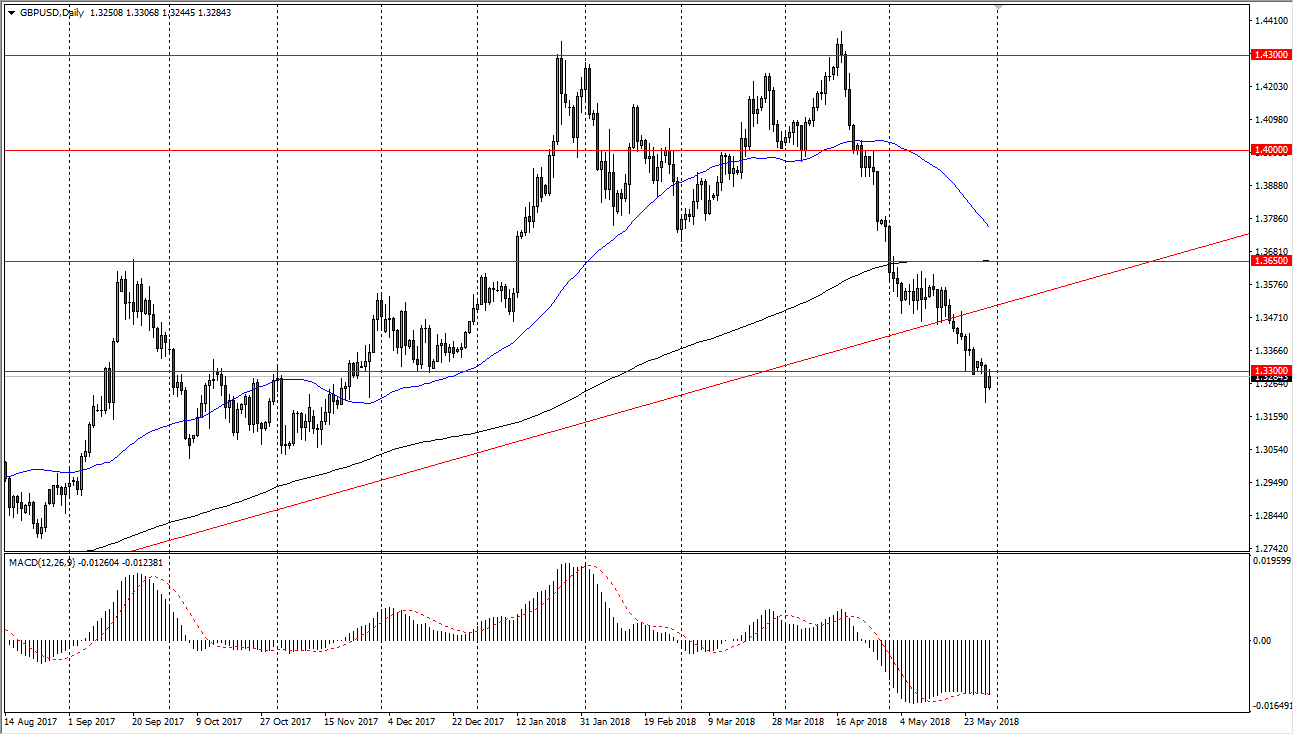

GBP/USD

The British pound rallied a bit during the trading session on Wednesday, breaking towards 1.33 level. That level has offered resistance though, and we are starting to drift a little bit lower late in the session. The market should continue to break down from here and go to the 1.30 level after that, which is a much more important level. The uptrend line above was massive support, and since we break down below there I think that it certainly shows a bearish proclivity in this pair. I think selling rallies will continue to be the best way, at least until we were to break above the 1.3650 level, an area that we are nowhere near right now. Ultimately, interest rates in the United States should continue to rise, and I think that should continue to put bearish pressure on this market.