EUR/USD

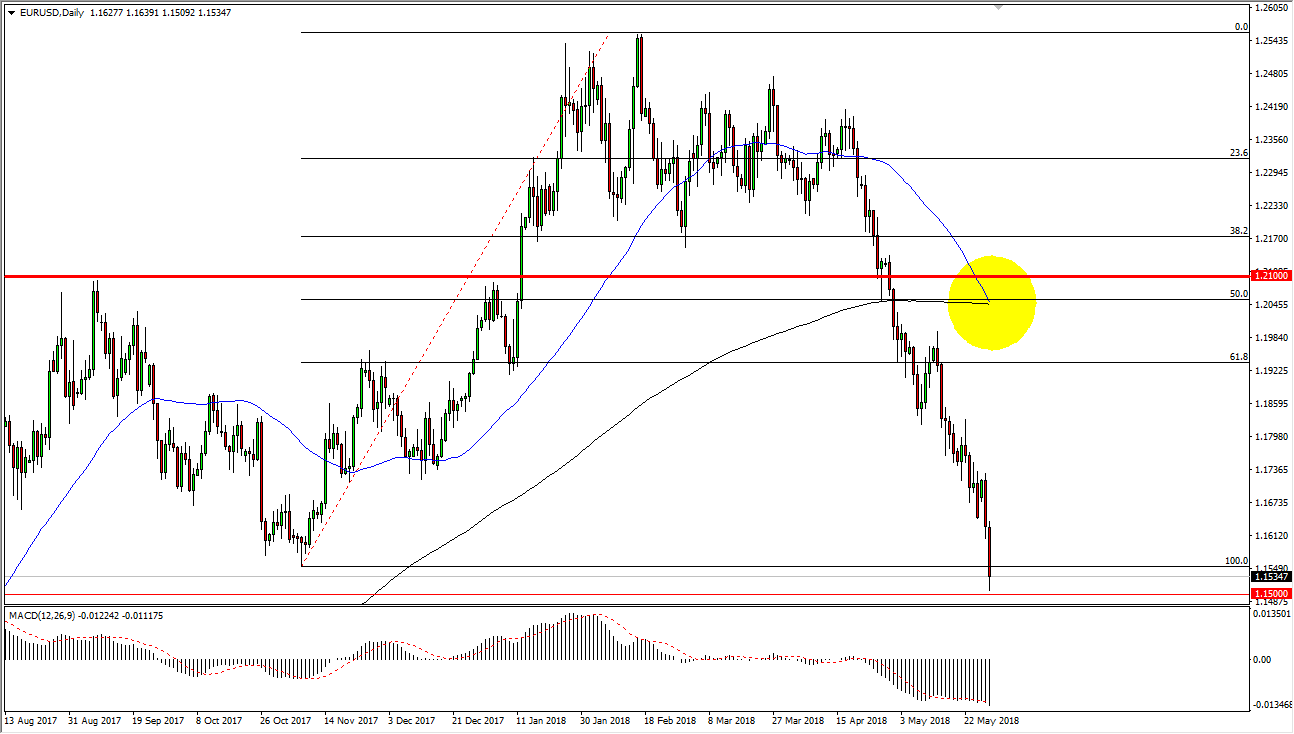

The EUR/USD pair fell rather significantly during the day on Tuesday again, reaching towards the 1.15 level below. That’s an area that is significant, and we have now wiped out the entirety of the bullish move that started in October 2017. Concerns with the Italian political scene and of course the bond markets continue to weigh upon the Euro, and although we did bounce a little bit during the day, it looks very likely that we will make another attempt at the 1.15 level. To say the least, we are oversold, and as you can see on the chart I have a yellow ellipse drawn. That is where the 50 day and 200-day simple moving averages are getting ready to cross, known as the “death cross.” This is a very negative sign, so I think if we break down below the 1.15 handle, this market could unwind rather rapidly due to algorithmic trading. In the short term, I would anticipate some type of bounce though, as we are so oversold. I am not willing to buy this market.

GBP/USD

The British pound broke below the 1.33 level underneath during the day, reaching down towards the 1.32 handle during the day before bouncing about 50 pips as I record this. The uptrend line continues to offer resistance from what I can see, and I believe that once we break down below that uptrend line, we have certainly entered a bearish phase of this market. I like selling rallies as they show signs of exhaustion, and I do believe that this market will eventually fall towards the 1.30 level underneath. The uptrend line I think coincides nicely with the 1.35 handle, which I would expect to see offering significant resistance from a psychological and structural standpoint.