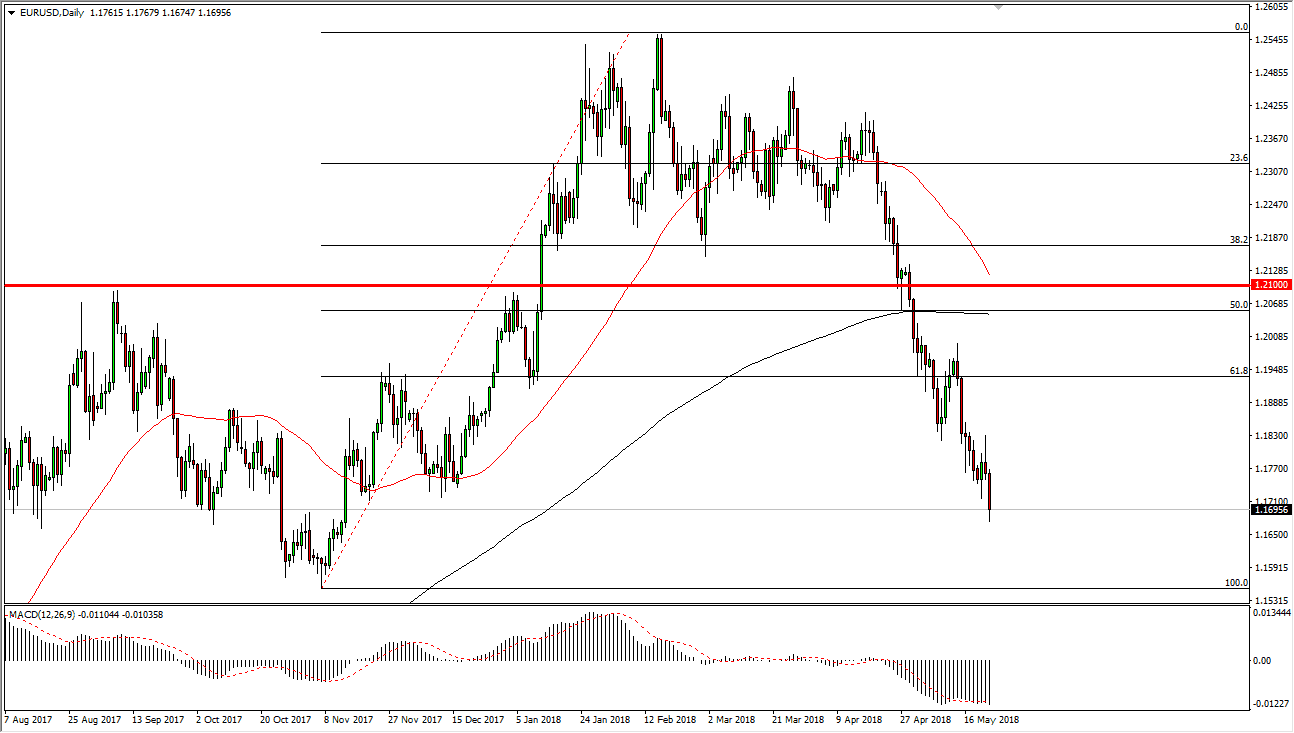

EUR/USD

The Euro fell significantly during trading again on Wednesday, as we have broken below the 1.17 handle. Quite frankly, this move has been much quicker than I anticipated, and it appears that the situation with the Italian bond markets are starting to scare a lot of investors. Add to that that the five-star movement has formed a bit of a coalition government in Italy, and we are starting to see the next potential European Union crisis form itself. Rallies at this point are to be sold obviously, and I think that we are going to go to the 1.1550 level in the short term, wiping out the entirety of the move from late last year. At this point, it’s very difficult to imagine buying this pair, unless of course we were to form some type of weekly candle showing strength. Higher interest rates in the United States will continue to push this pair lower as well.

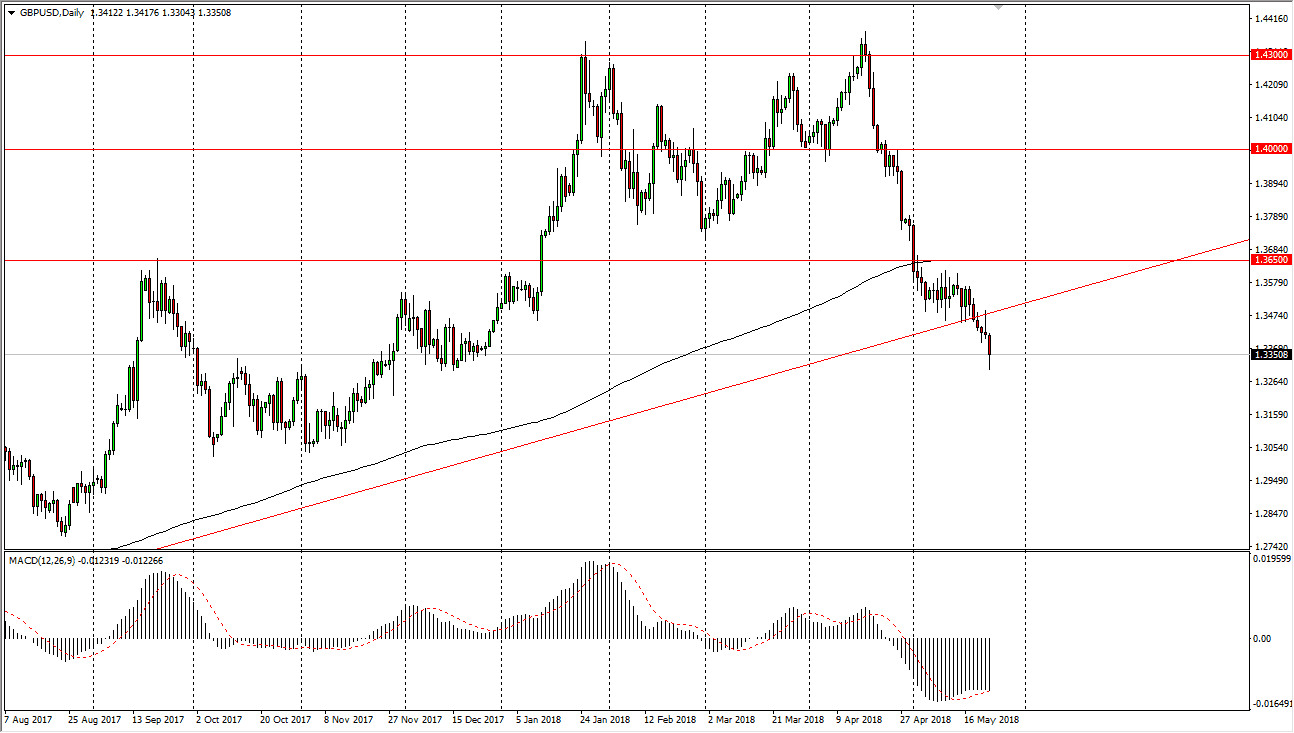

GBP/USD

The British pound fell to the 1.33 region during the session on Wednesday, the first area I suggested that could be supported. We have bounced slightly from there, but I think it will end up being a selling opportunity by the time it’s all said and done. I like selling exhaustion on short-term charts, and I think that the previous uptrend line is not only resistance, but it is even more so now that we have formed a shooting star touching it during the session on Tuesday. Look at this as an opportunity to pick up “value” in the greenback. The 200-day moving average is well above us and the cluster that sent us lower, so I think we are in fact going to go looking towards the 1.30 level over the next couple of weeks.