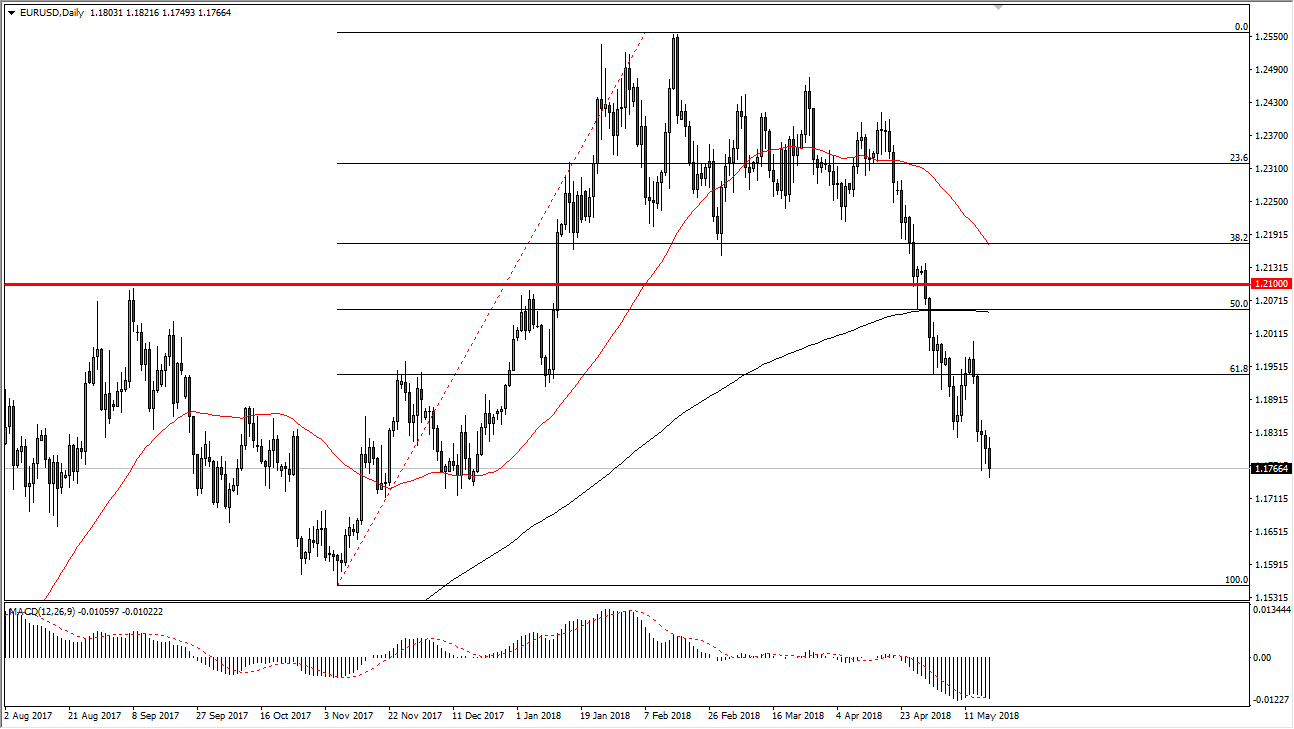

EUR/USD

The Euro fell during the trading session on Friday, as we reach towards the 1.1750 level underneath, an area that has been a bit supportive in the past, but ultimately I think that we are to go much lower. I think that rallies at this point are selling opportunities as it is clear that we are in the downtrend, and we should then break down to wipeout the entirety of the most recent high move. By doing so, I think the market will target the 1.1550 level, and then perhaps even the 1.15 handle. The US dollar continues to be the strongest currency that I follow overall, and I think that should continue to benefit the downside in this pair. Interest rate differential will continue to be a major factor as well, and I have no interest in buying, at least not until we break above the 1.21 handle, or we form some type of longer-term buying signal.

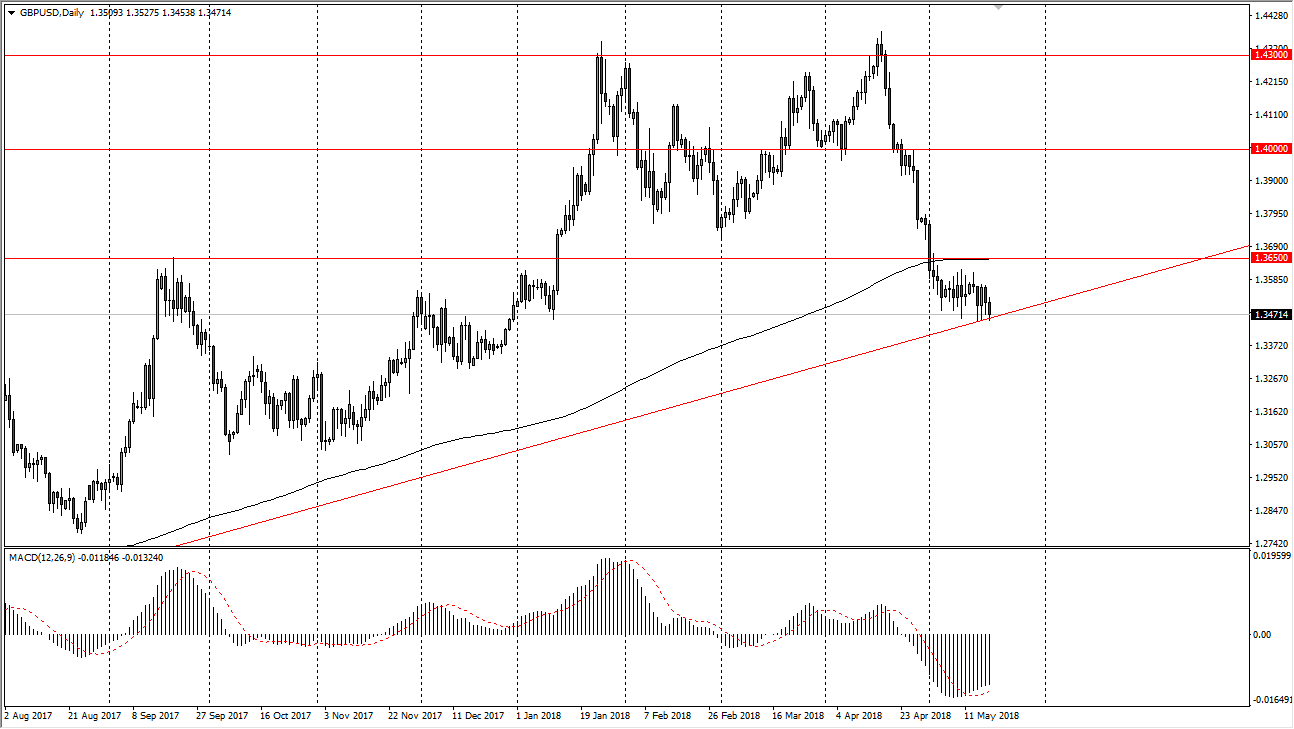

GBP/USD

The British pound fell during the session on Friday as well, testing a major uptrend line. If we can break down below the 1.3450 level, and I think we will rather soon, the market should unwind at that point. The 200-day exponential moving average is just above at the 1.3650 level, and it's not until we break above that area that I would consider buying this market, suggesting that we have found massive support on the uptrend line. I think that a break down is somewhat imminent though and will not hesitate the short once we get that move. The 1.33 level would be the first target, and then eventually the 1.30 level after that. This is a bit oversold though, so the grinds sideways over the last couple of weeks makes sense.