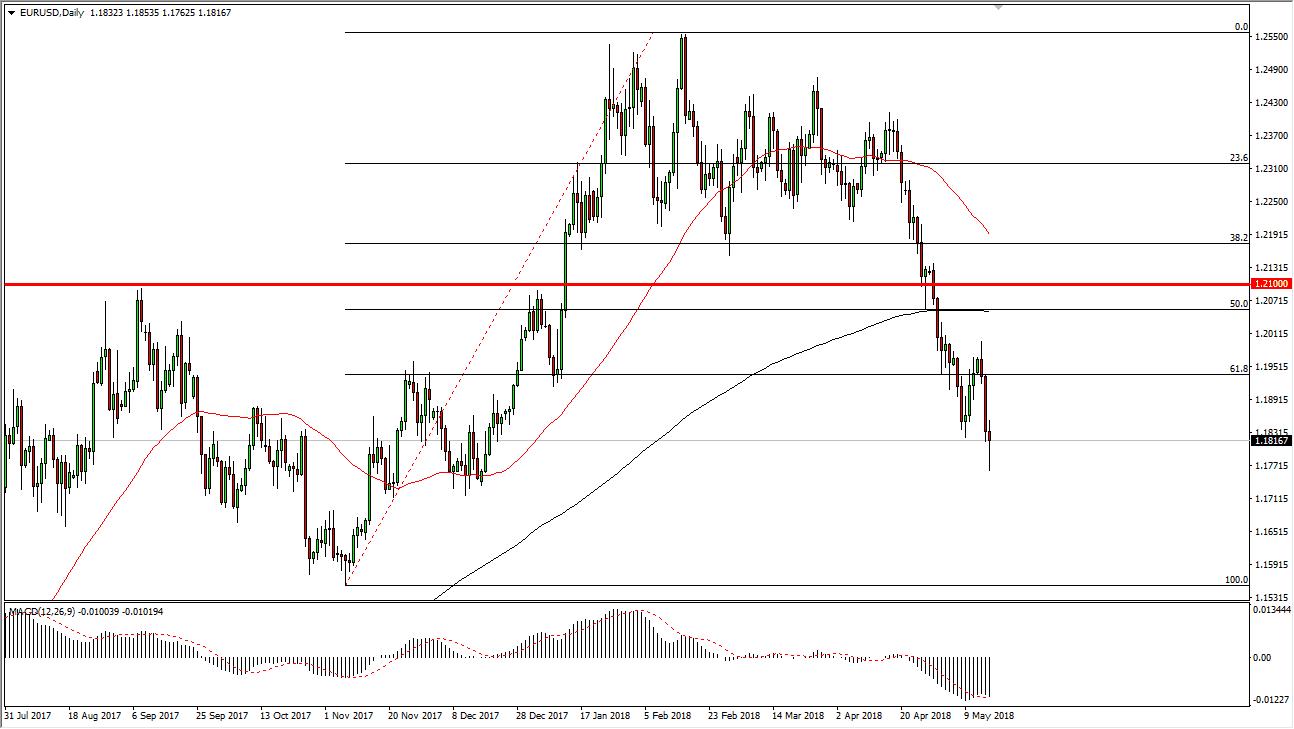

EUR/USD

The EUR/USD pair has fallen significantly during the day on Wednesday, reaching down towards the 1.1770 level before bouncing and forming a hammer. The hammer of course is a bullish sign, but I don’t think it’s necessarily a sign that you should be buying. I think this is simply a bounce waiting to happen, and that any rally from this point should be thought of as an opportunity to pick up the US dollar “on the cheap”. I think the 1.20 level above will offer resistance, so a couple of days’ worth of a rally would not be a huge surprise. The alternate scenario of course is to break down below the hammer for the session on Wednesday, that could send this market down to the 1.15 level rather quickly. That’s still my target over the summer though.

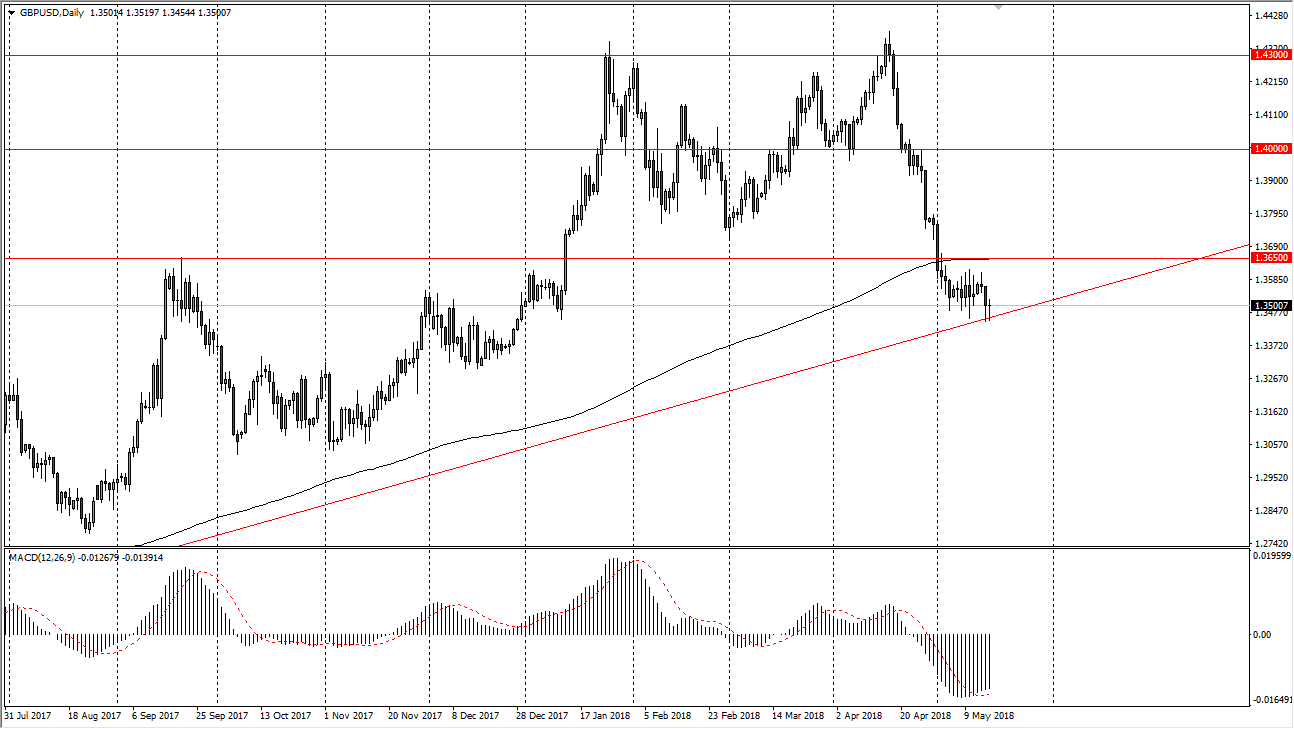

GBP/USD

The British pound has been very noisy during the trading session on Wednesday, testing the uptrend line underneath. That is an area that I think that is going to be very important for the longer-term move in this market, and I think that the breaking of the lows over the last couple of days could send this market much lower. We are currently just below the 200-day moving average, which of course is something that longer-term traders will tend to pay attention to. It’s not until we break above that level that I would consider buying, so at this point I think it’s a matter of whether we break down or not. If we do break down, I suspect that we will target the 1.33 handle, and then eventually the 1.30 level after that. US dollar strength could be a story for the rest of the summer, and certainly this market is suggesting that others agree.