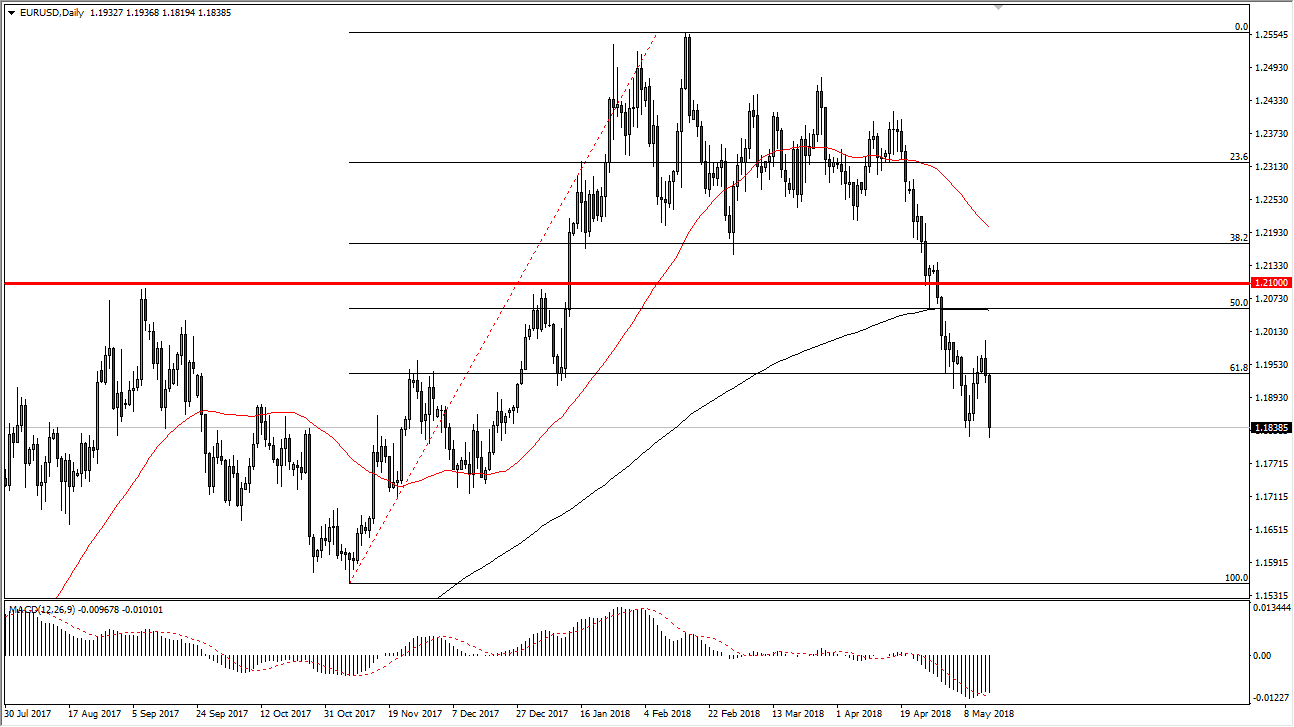

EUR/USD

The Euro broke down significantly against the US dollar during the day on Tuesday, as the 10-year yield reached above the vital 3.06% level. Ultimately, this is a market that reflects the interest rate differential between the economies, and I believe that the 1.18 level being broken to the downside opens the door to the 1.17 level, and then eventually the 1.15 level after that. That would be a complete reach raise of the entire uptrend, and I think that’s where we’re going. Summer strength in the greenback should continue to be the story, and Tuesday did nothing but confirm this as the previous week had formed a hammer, typically a sign of a rebound. Now that we have touched the bottom of the hammer, it’s probably only a matter of time before we break down.

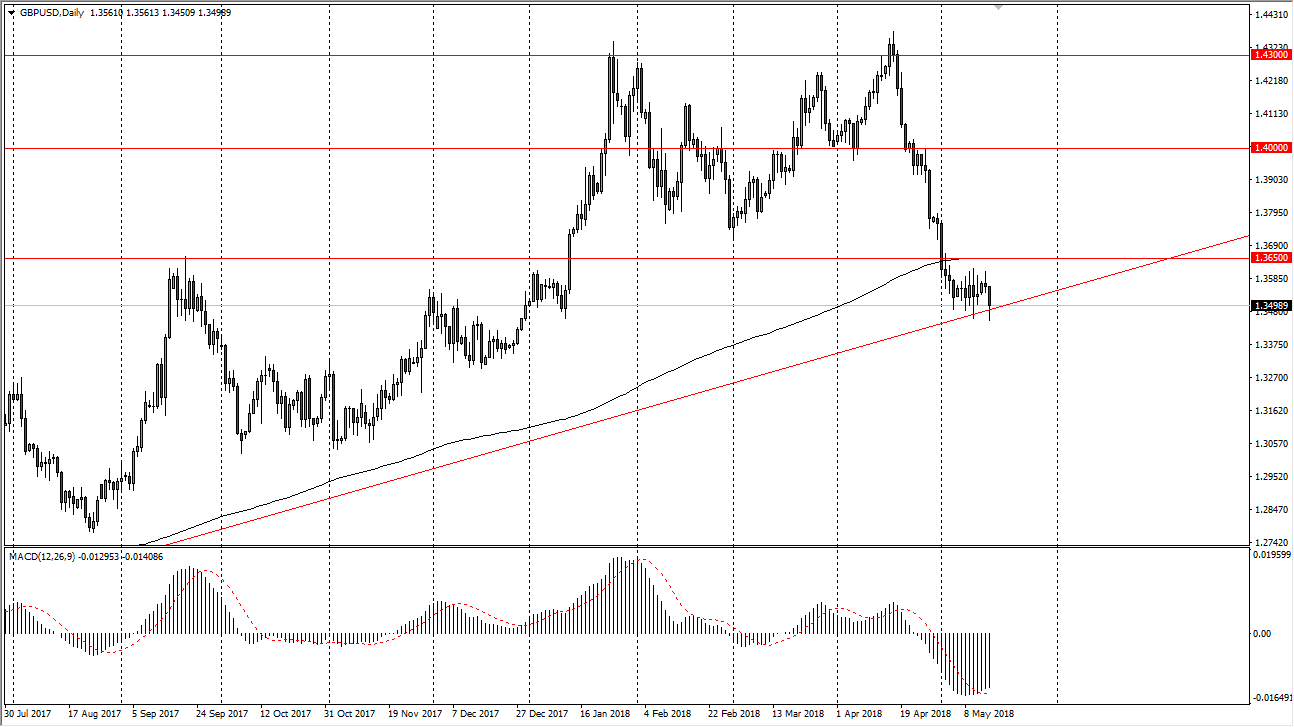

GBP/USD

The British pound has broken down during the day on Tuesday, testing the uptrend line. If we break down from here, it’s likely that we will continue to go lower, perhaps down to the 1.33 handle, and then the 1.30 level. The 200-day exponential moving average is just above, and now that we have consolidated between it and the uptrend line, I think we are building up a significant amount of momentum. A breakdown below the lows of the session on Tuesday could unleash a lot of selling pressure. Rallies at this point will continue to see a lot of resistance near the 1.36 handle, extending to the 200-day simple moving average above. Ultimately, if we did break out, the market could go to the 1.40 level, but I don’t think we have the momentum to do so quite yet. For what it’s worth, the Euro falling typically is a sign that the Pound will move right along with it.