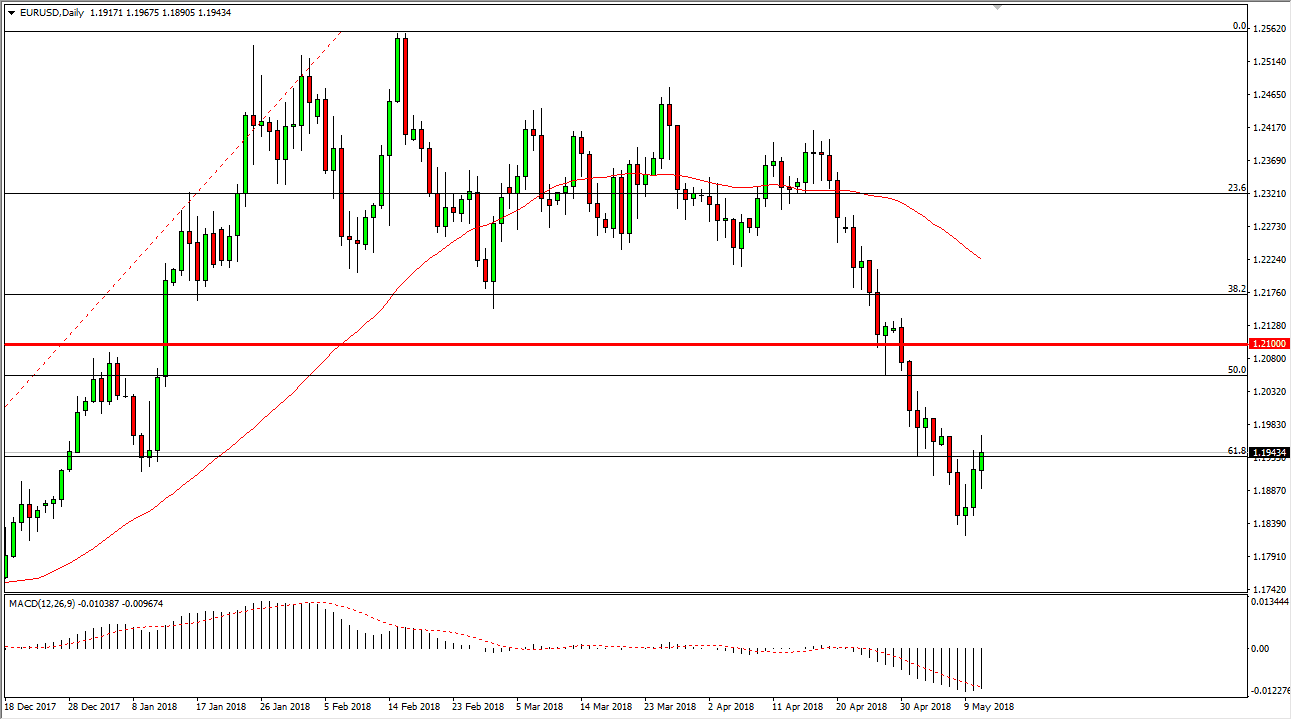

EUR/USD

The EUR/USD pair has rallied again during the day on Friday, as we continue the upward move from Wednesday. We ended up forming a weekly hammer, which of course is a very bullish sign, and I think at this point the market will probably reach towards the 1.21 handle. That’s an area that should be resistive, but when I look at the longer-term charts it’s a little bit more interesting as the market has been testing a massive bullish flag on the weekly chart. If we can break above the 1.21 handle, the market should continue to go to the 1.25 handle, and then possibly the 1.32 level. However, there are a lot of reasons to think that the US dollar could strengthen over the summer, but at the very least we are oversold, so a bounce makes sense.

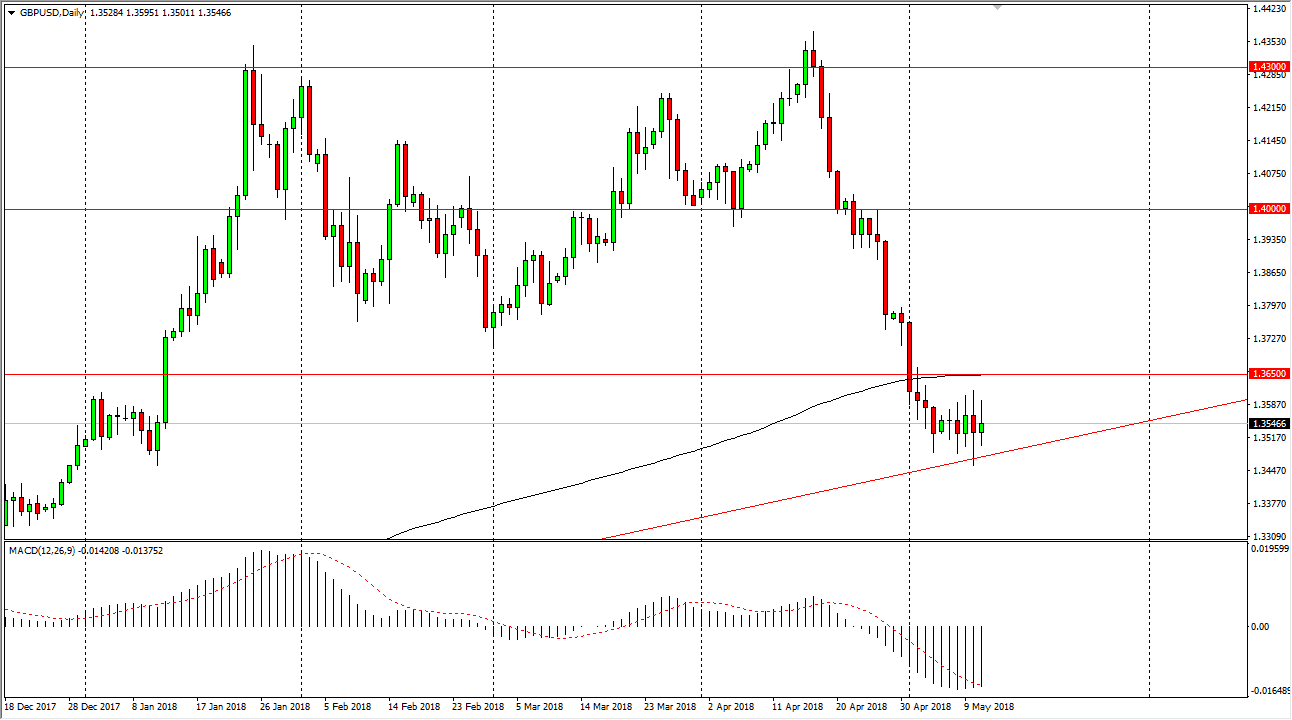

GBP/USD

The British pound has gone sideways during the session on Friday again, as we continue to bounce from the uptrend line. The uptrend line of course keeps this market afloat, but the 200-day simple moving average just above will offer resistance, just as the 1.3650 level will. If we can break above there, the market could then go to the 1.38 level. If we were to break down below the uptrend line, then the market probably drops down to the 1.33 handle, and then the 1.30 level after that. This is a market that is oversold, so a bounce wouldn’t be a huge surprise. When I look around the Forex world, it looks as if we could see some softness in the US dollar against several currencies, so it’s possible that this bounce makes quite a bit of sense. A breakdown below the 1.34 handle unwinds this market rather drastically, but then again it looks as if we are hanging tough in this area. We will eventually get a stronger candle, then we can start trading with more confidence.