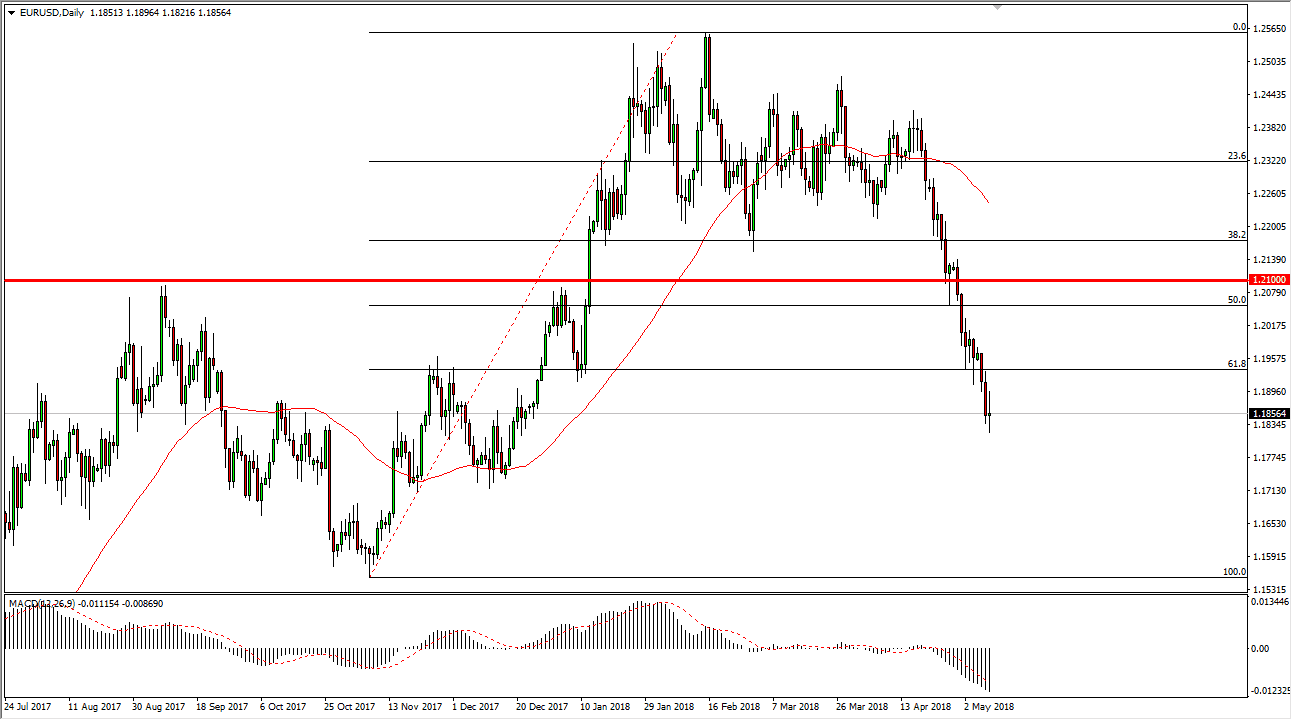

EUR/USD

The EUR/USD pair went back and forth on Wednesday, showing signs of volatility yet again. At one point during the day, I thought that perhaps we were going to see an attempt to go much higher, perhaps some type of “relief rally.” Because of this, I think that the market showing that we would roll over and fall again tells us just how negative this market is. I think that by the end of the summer, we will more than likely go looking towards the 1.15 level, an area that is massive in its psychological and structural support. Every time we rally, I’m looking for a selling opportunity on signs of exhaustion. Quite frankly, I’m a bit surprised how quickly came during the Wednesday session, and I do think that we need to bounce a bit to offer more value in the greenback. However, it’s not until we break above the 1.21 level that I would be convinced of bullish pressure.

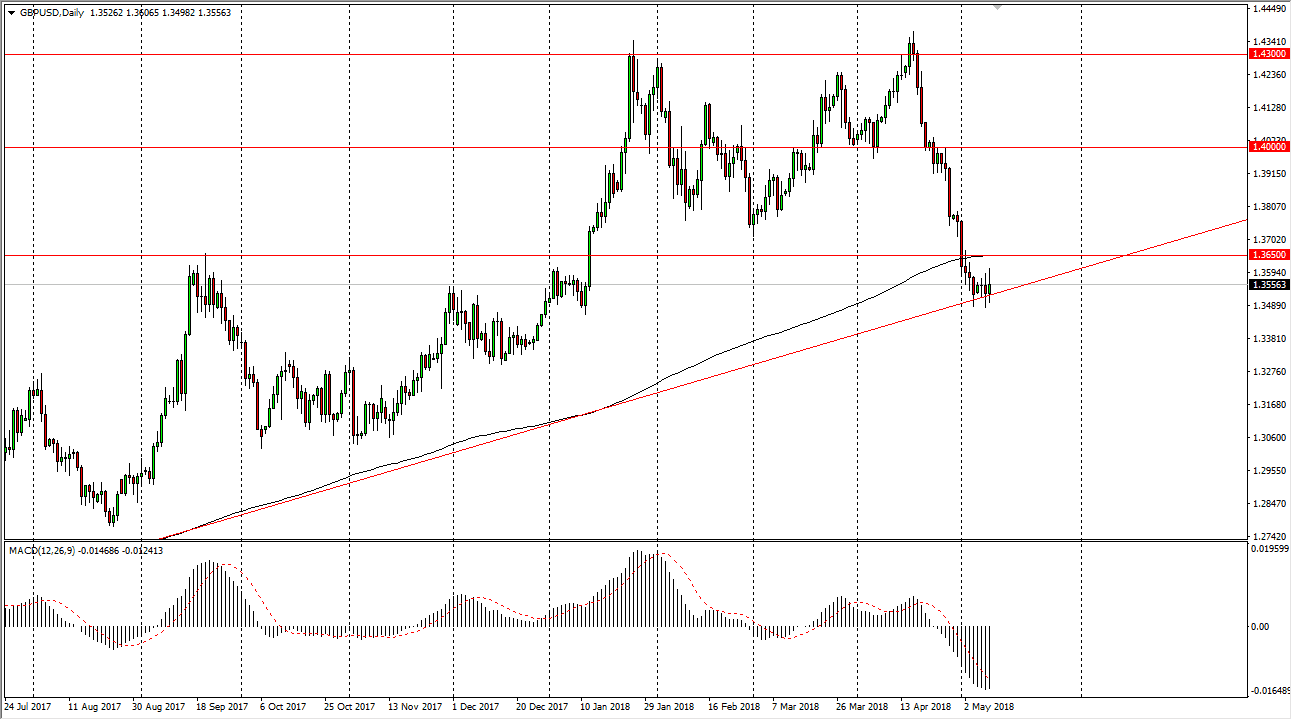

GBP/USD

The British pound has gone back and forth during the day on Wednesday, showing signs of strength at one point, but then turning around to form a shooting star. The shooting star sits on top of a massive uptrend line that is crucial, and I think that if we break down a fresh, new lows of sensibly the 1.3475 handle, then the British pound will more than likely unwind quite a bit. We would then go to the 1.33 handle, and then the 1.30 level. The 200-day simple moving average is just above at the 1.3650 level, so if we broke above that level it would be a bullish sign. However, it’s obvious that we are struggling to do so. I do believe that eventually we unwind quite a bit as the US dollar should see strength over the summer.