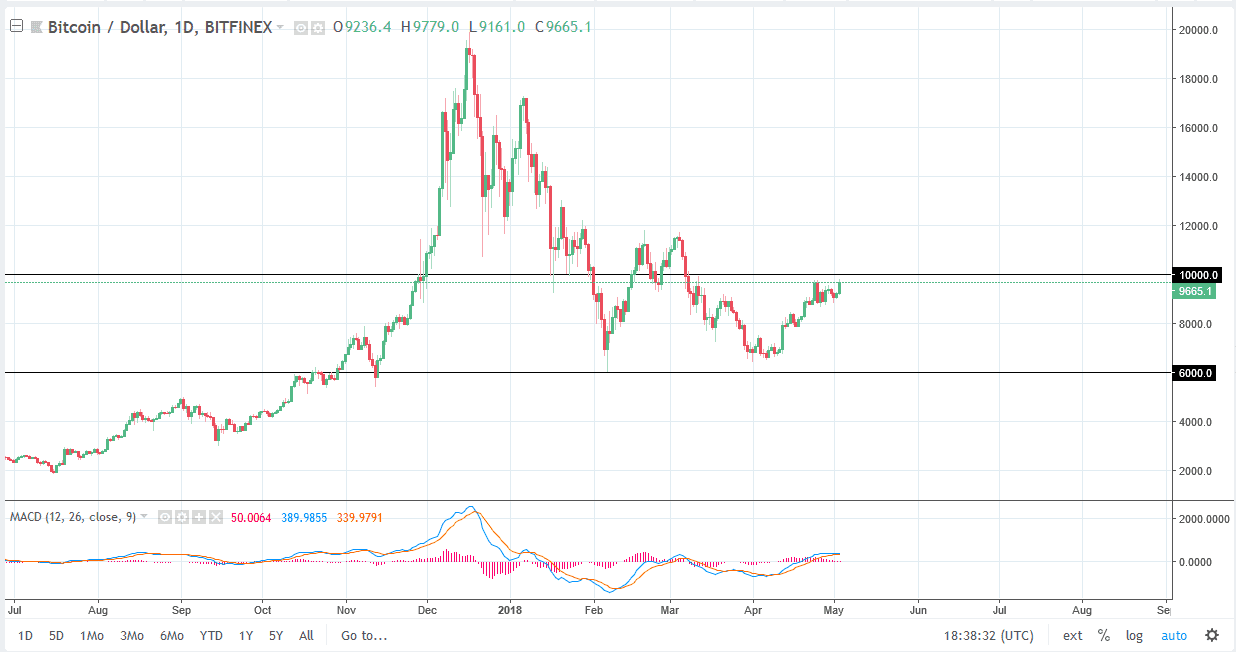

BTC/USD

Bitcoin was initially a little softer during the day on Thursday, but then found enough buyers to push this market higher. We are currently trying to break above the psychologically and structurally important to thousand dollars level, and if we can get above that level I think the next target will be $12,000. With today being the jobs number, you will have a massive influence on what happens with the US dollar, which of course will have an influence on what happens here. I think that the market will probably continue to see a lot of choppiness and volatility, but on a daily close above $10,000 I think the only thing you can do is buy. The $9000 level below continues to offer support, and if that gives way to selling pressure, we more than likely will go down to the $8000 level.

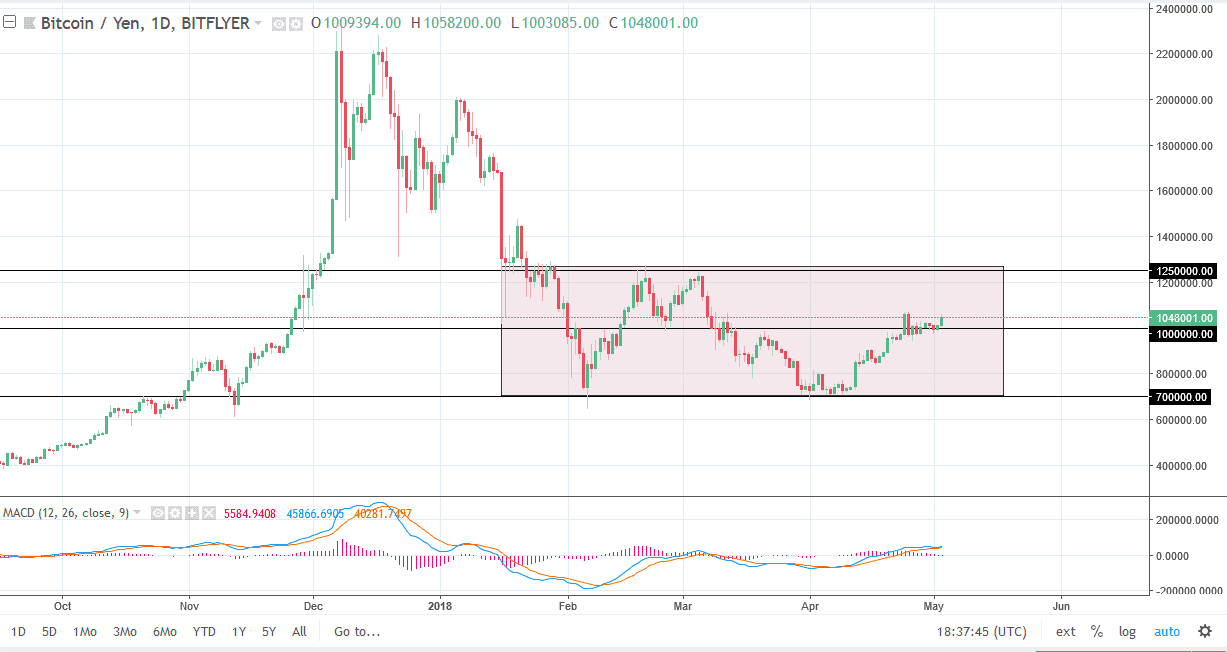

BTC/JPY

Bitcoin rallied during the trading session against the Japanese yen as well, breaking towards the ¥1,050,000 level. This is an area that shows a bit of resistance, but I think if we can break above the ¥1.1 million level, that will be a much more significant signal to go higher, and that we would probably reach towards the top of the consolidation area again which is to be found at the ¥1.25 million handle. Alternately, if we break down below the ¥900,000 level, then we will probably unwind towards the ¥700,000 level. Currently though, it looks as if crypto currencies are coming back in favor, at least for the short term so I think that there’s much more likelihood of a rally than the market falling. In general, this is a market that I think continues to be very schizophrenic and noisy, but it looks as if the buyers are going to control at least the next few sessions.