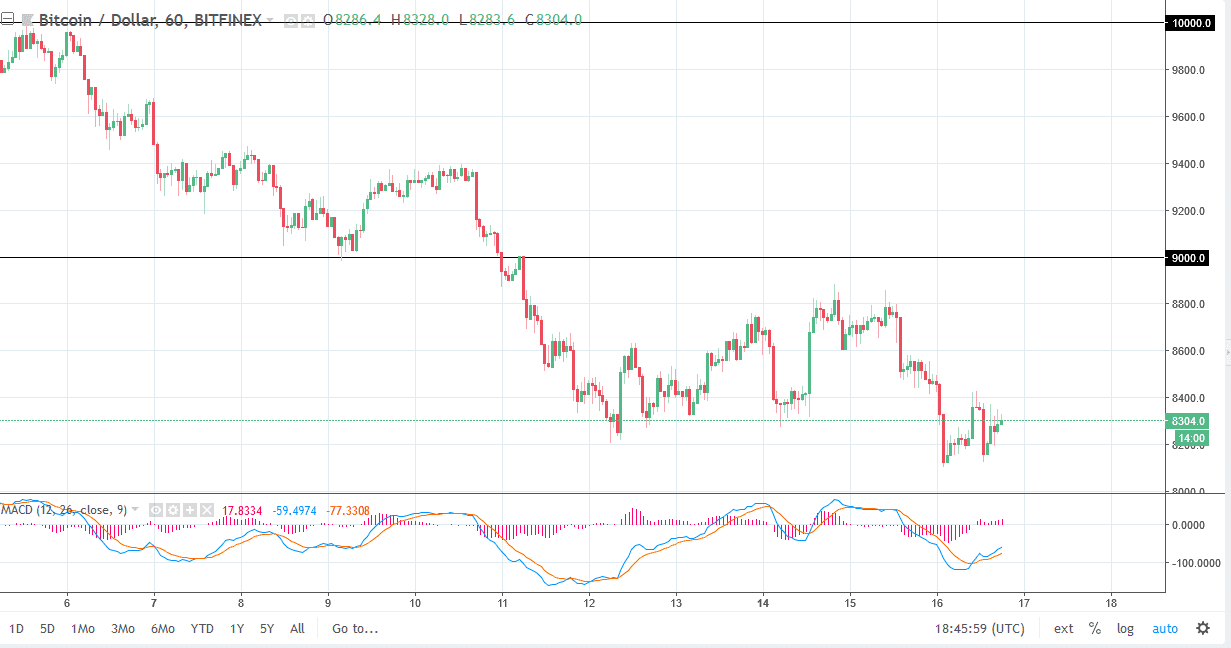

BTC/USD

The bitcoin markets were choppy during trading on Wednesday, breaking below the $8400 level, reaching down to the $8100 level after that, bouncing again towards $8400, and then breaking back down before bouncing at the end of the day. The market looks likely to continue to see a lot of noise, but with the recent move lower I think we are going to continue to see a bit of a grind to the downside. The $8000 level underneath is the longer-term support, and I think it’s the target in the short term. If we do rally from here, I feel it’s only a matter time before the sellers get back involved, as the $9000 level of course has been massive resistance. It’s not until we break above there that I think it shows any real strength. When you look at the chart, you can clearly see that we have been going from the upper left to the lower right.

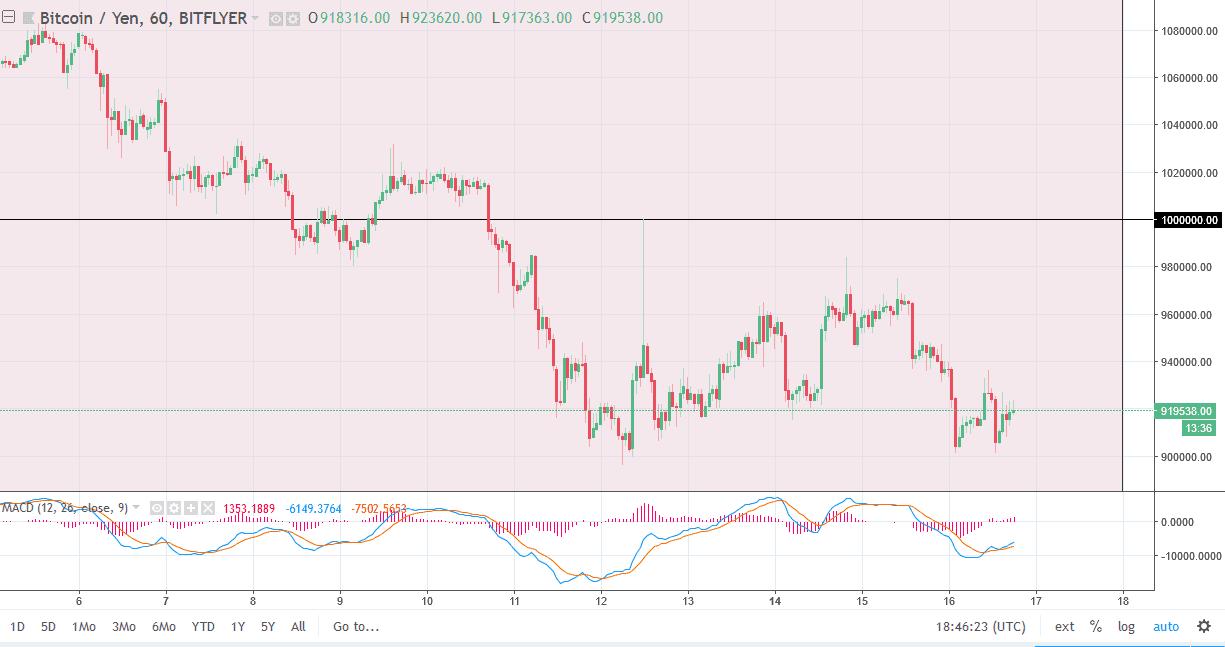

BTC/JPY

Bitcoin has fallen against the Japanese yen initially during the day on Wednesday as well, but has also turned around to rally, fall again, and then bounce again. It looks as if the ¥900,000 level is going to be support, and you can see that it has been more than once. I believe that if we break down below the ¥900,000 level, the market is likely to break down below the level to the ¥800,000 level. We rally from here, it’s very likely that the ¥940,000 level continues to be resistance in the short term, followed by the ¥960,000 level, and of course the ¥1 million level as it is a large come around, psychologically significant number. I don’t have any interest in trying to buy this market currently, because we have seen so much in the way of softness. However, if we can break above the ¥1 million level, that’s a very strong sign and we would probably go looking towards ¥1.1 million level.