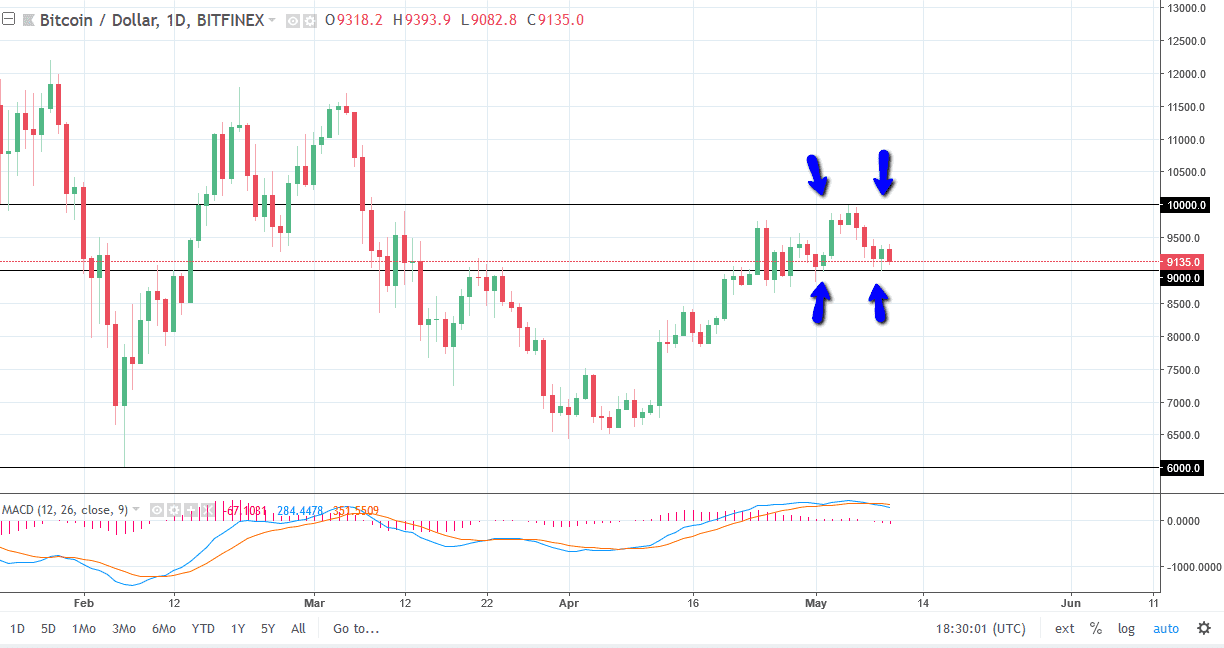

BTC/USD

Bitcoin markets initially tried to rally on Thursday, but then fell towards the $9100 level. I think that the $9000 level continues to offer support though, and that extends down to the $8800 level. I believe that the market will probably try to build up enough momentum to continue going higher, perhaps making yet another attempt on the $10,000 level. That’s an area that has caused a significant amount of resistance more than once, but I think that we will continue to see this as an opportunity to pick up value on short-term dips. If we break down below the $8800 level, the market could breakdown rather significantly, perhaps down to the $8000 level. $10,000 above is major resistance, so I think that the market will spring to life if we do break above there, perhaps sending the market to the $12,000 level rather quickly.

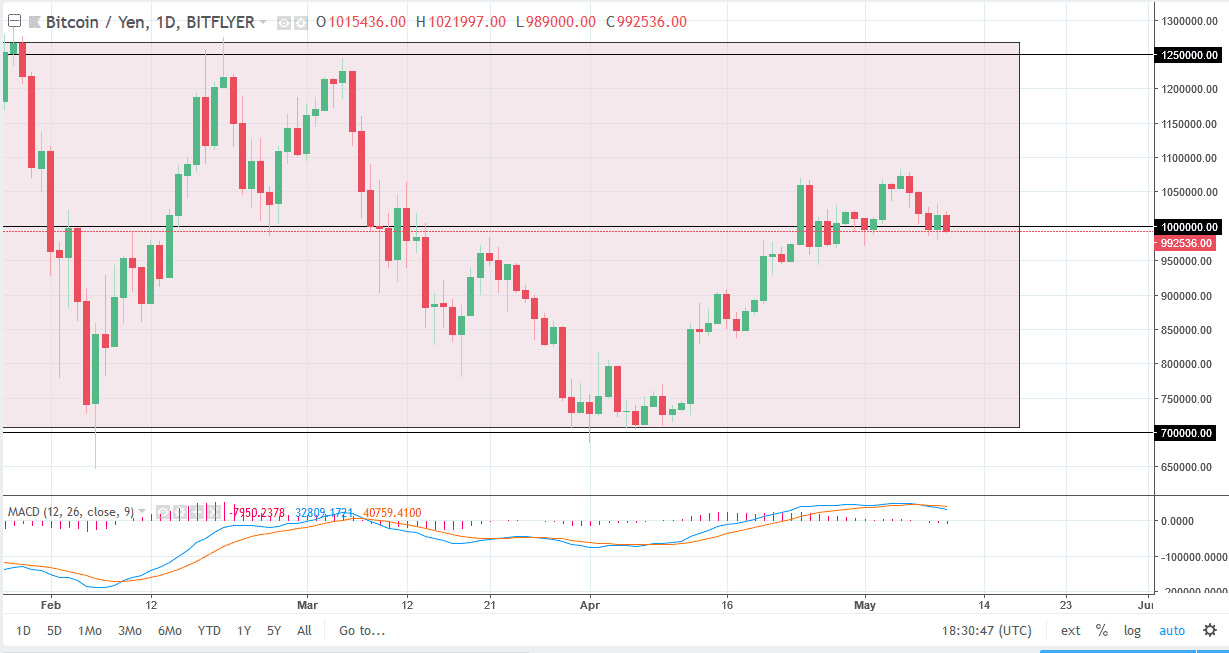

BTC/JPY

Bitcoin also fell against the Japanese yen, as we continue to dance around the ¥1 million level. This is an area that is attracted a lot of attention, and I think that there is plenty of support just below, especially near the ¥950,000 level. A breakdown below there, then we will test ¥900,000, ¥800,000, and then eventually ¥700,000. Alternately, if we can break above the ¥1.1 million level, the market should continue to go much higher, perhaps reaching towards the ¥1.25 million level above, as it is the top of the overall consolidation area. This market continues to bang around in both directions, so keep that in mind. I think we will continue to see a lot of volatility, as quite frankly there isn’t much in the way of clarity at this point. I believe that we are in the middle part of the range, so that of course causes a lot of choppiness as well. It’s not until we break out of this area that I think you can build a sizable position.