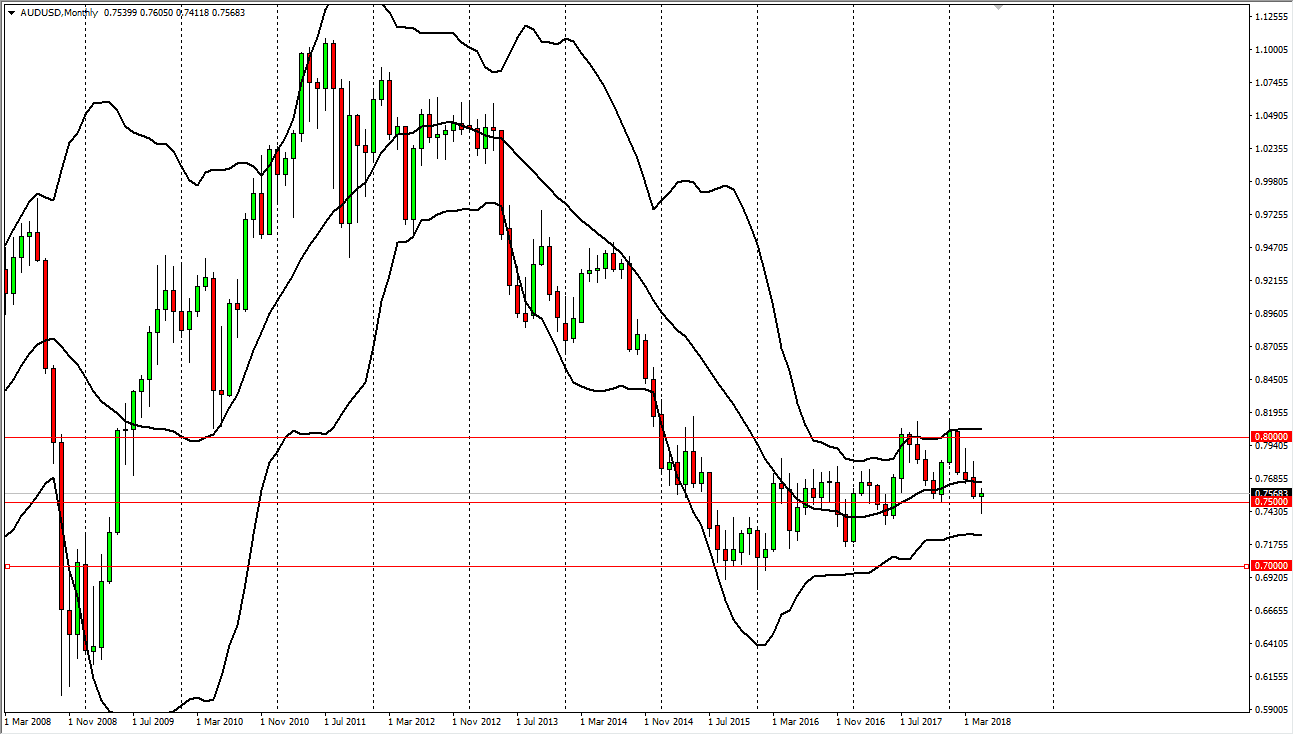

The Australian dollar has been very noisy over the last several months, but as you can see we ended up forming a hammer right above the 0.75 level for the month of May. This is a very bullish sign, and I think that it shows that we are not quite ready to break down. However, if we were to break down below the bottom of the hammer for the month, that’s obviously a very negative sign. I think that break down below there could open the door to the 0.70 level underneath, but I think what we are more likely to see is a rally towards the 0.77 level where we have a shooting star from the month of March. Because of this, I’m looking for choppiness and sideways action in general this month, which of course will be led by not only interest rates in the United States but also the geopolitical concerns and the reaction to the headlines in the Gold markets.

Remember, the Gold markets have a positive correlation with this market, so if they rally it’s likely that the Aussie will see strength. I think that if we break above the 0.77 level, we will more than likely go looking towards the 0.80 level eventually. That being said, I think that it’s probably best to simply sit and place back-and-forth type traits a range bound system, perhaps using the four hour charts between the 0.75 handle and the 0.77 handle until something dramatically changes.

Pay attention to the situation in Italy, because we could get a move in the Gold markets if there is more fear coming out of the European Union, which of course is always possible. The sinner moving average in the Bollinger Band indicator is trying to turn to the upside, so I think that we are in the midst of the market trying to change the longer-term trend. That’s never a quick process.