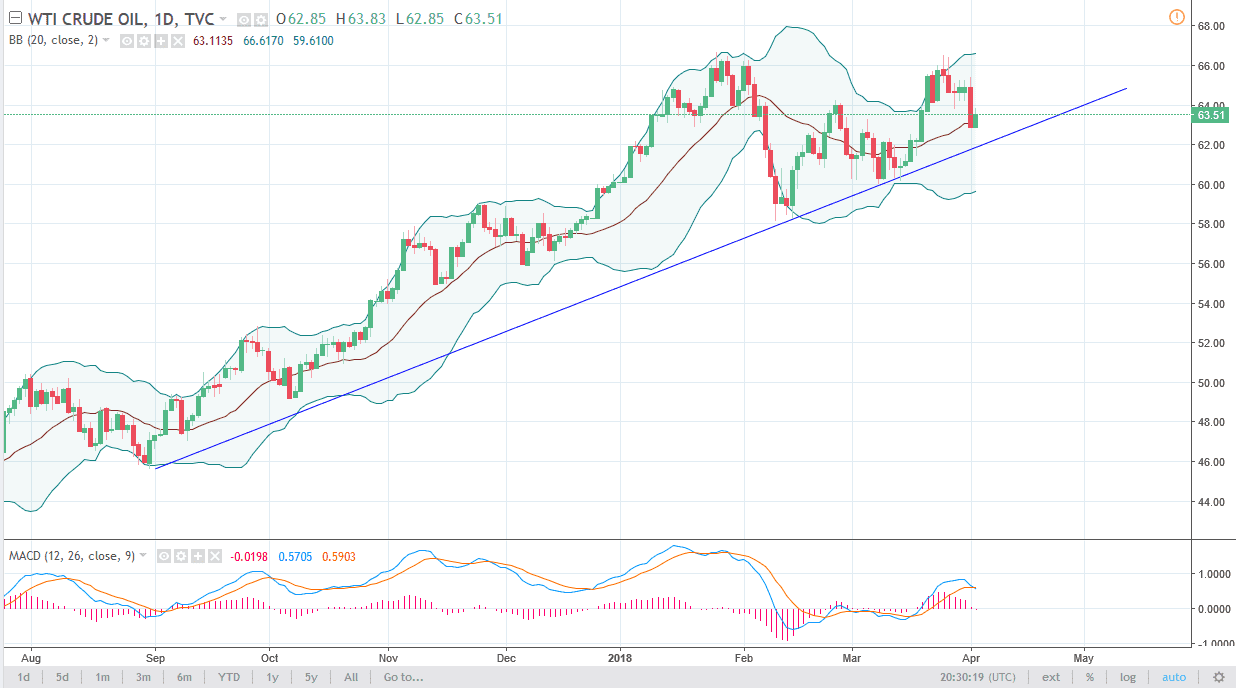

WTI Crude Oil

The WTI Crude Oil market bounced over 1% during the trading session on Tuesday, partly in reaction to the oversold condition that Monday left us in, but also as we went reaching towards the uptrend line. I believe the uptrend line will be very important, and I think that if we break down below the uptrend line, the market will probably go looking towards the $60 level initially. However, we could bounce from this uptrend line, and I think that if we can stay above it, the market should continue to reach towards the $66.50 level again. This is a market that I think continues to be very noisy, and therefore buying on the dips if we can stay above the uptrend line is the best way to go. We would be best served by trading small positions in the meantime. Otherwise, if we break down below that uptrend line think things could get rather ugly.

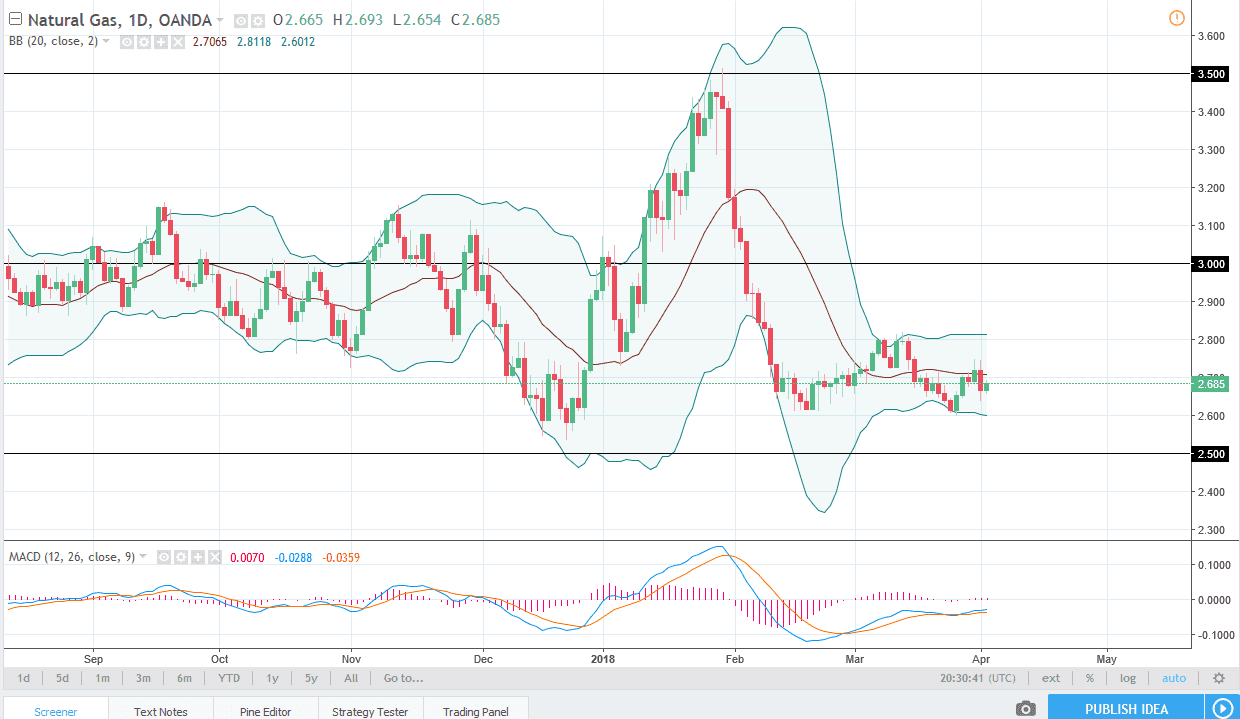

Natural Gas

Natural gas markets rallied a bit during the trading session on Tuesday, but there is still a major bearish attitude to this market, as the $2.80 level continues to be massive in its implications. I think that if we rally from here, it’s only a matter of time before the sellers return. If we can break above the $2.80 level, the next major barrier would be near the $3.00 level, where I expect to see more sellers come back into the marketplace. I believe that the $2.50 level underneath is a massive “floor” in the market and should keep this market somewhat afloat in the meantime, but if we did breakdown below there, things could get extraordinarily bearish with the quickness. I still suspect that rallies will be faded.