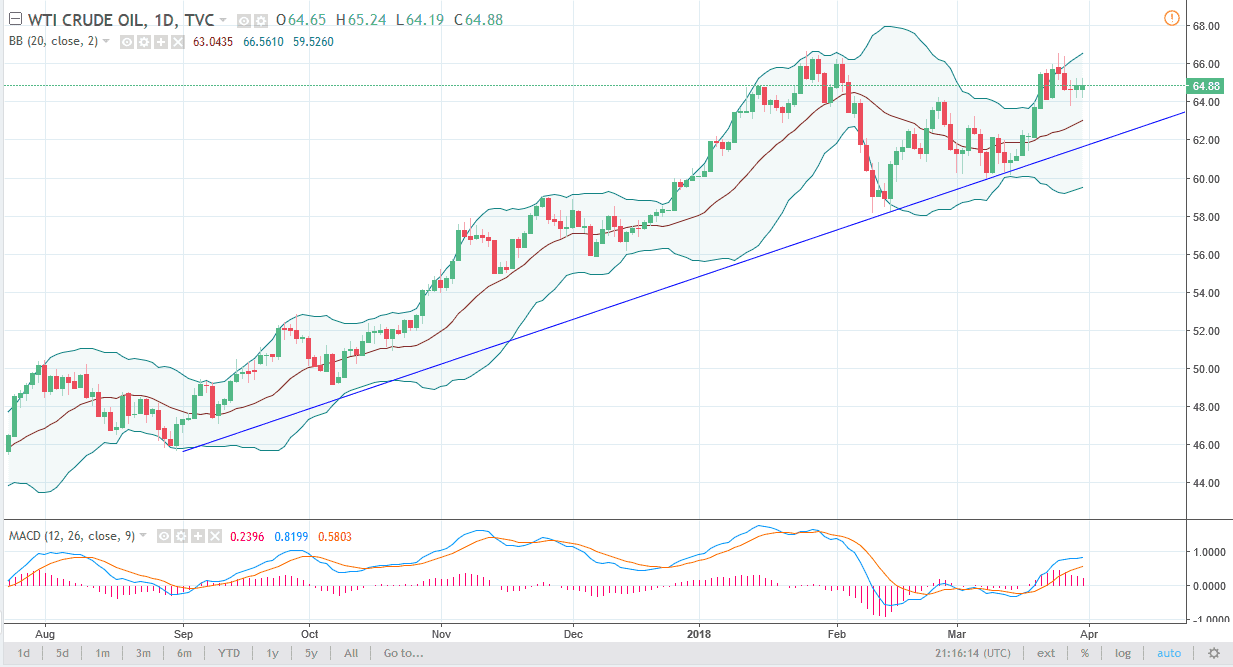

WTI Crude Oil

The WTI Crude Oil market went back and forth in electronic trading on Friday, as we continue to struggle a bit. The $64 level underneath should be supportive, and most certainly the uptrend line will be as well. I believe that the area underneath should end up being massively supportive, and I think that it’s only a matter of time before the buyers will return. However, if we broke down below the uptrend line, the market could unwind down to the $60 level, perhaps even lower than that such as the $58 level. Currently though, most of the hedge fund traders that I speak to have bullish positions on, and I think that in the short term we should continue to see bullish action. If we can break to a fresh, new high, that opens the door to the $70 handle.

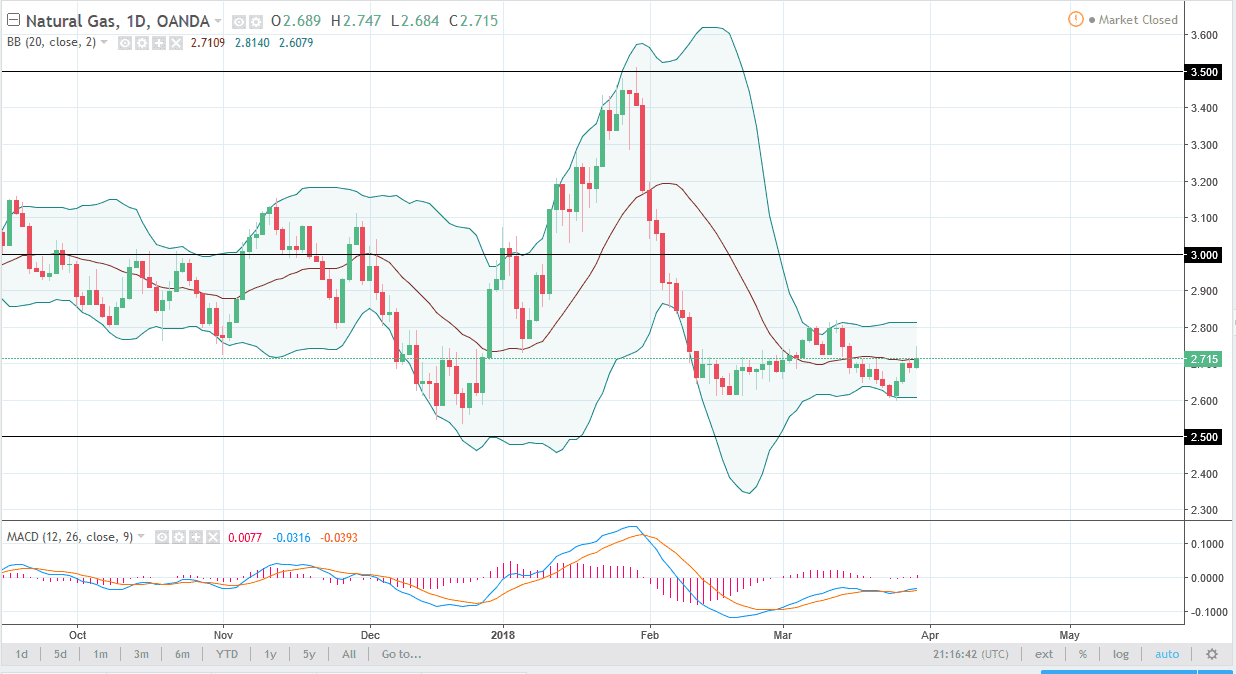

Natural Gas

Natural gas traders initially rallied during the session on Friday in the CFD markets, but we turned around to form a bit of a shooting star. Ultimately, I think that the $2.80 level continues to be resistance, and I think that every time we rally, there should be sellers jump into this market place, perhaps reaching the market down to the $2.60 level. A breakdown below there, could send this market down to the $2.50 level. Otherwise, if we can break above the $2.80 level, the market will probably go looking towards the $3.00 level, an area that will be even more resistive. Ultimately, I think that the natural gas markets will continue to be very noisy, but the oversupply issue is going to continue to be a major problem, and I think that something that can’t be overlooked.