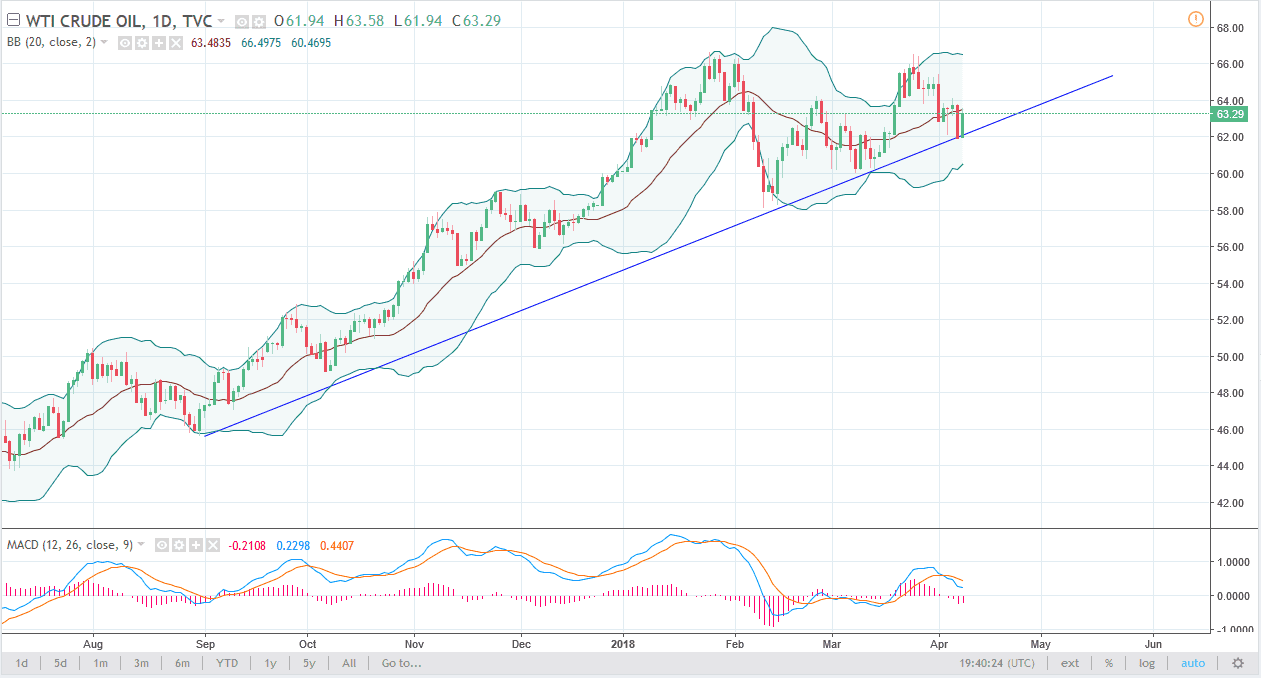

WTI Crude Oil

The WTI Crude Oil market rallied a bit during the trading session on Monday, as the uptrend line has held. The $64 level above is significant resistance, but if we can break above there I think that we would then go to the $66 level. I believe that the $62 level underneath is significant support, and a breakdown below that level should send the market down to the $60 level. Ultimately, I believe that the uptrend is going to continue to lift this market, so I like the idea of buying short-term dips, but I think that it will take a while to break out of the overall range. It looks as if we will continue to be noisy, but if we do break down, that would then make a “double top.” The choppiness in this market should continue, so keep your position size small.

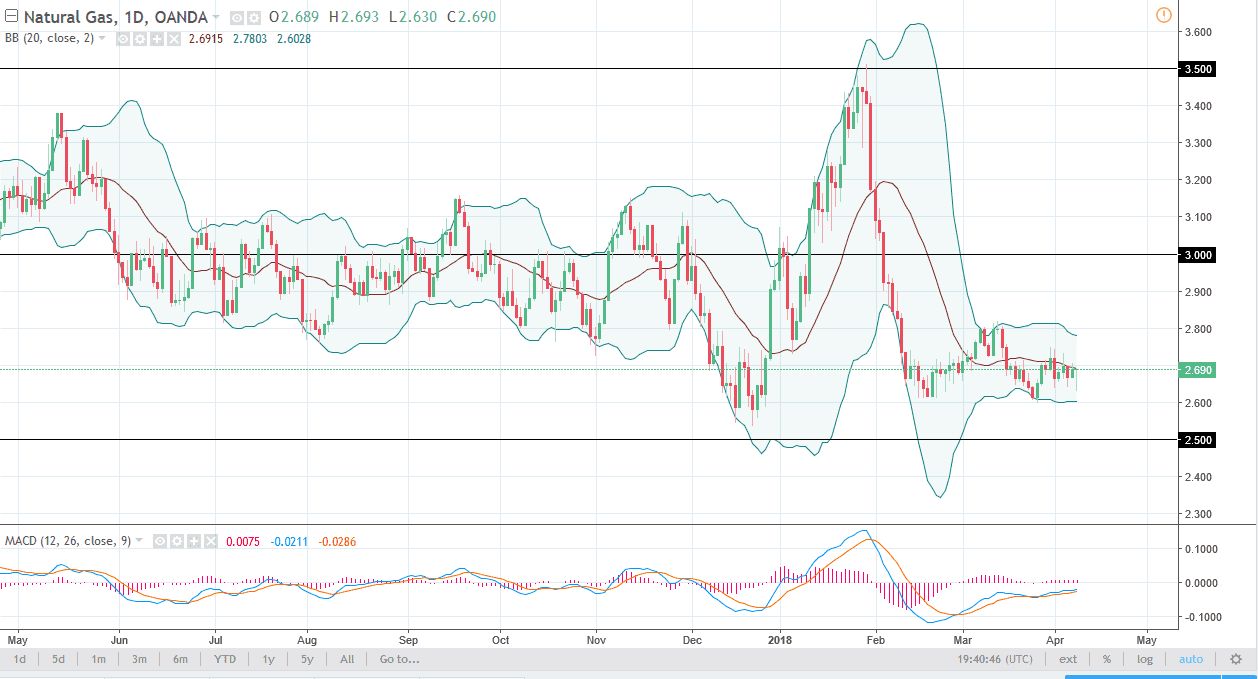

Natural Gas

The natural gas markets initially fell during the trading session on Monday but found enough support to form a nice-looking hammer. Because of this, I think that we will bounce but I think that the $2.80 level above will offer resistance, and I think it could offer a nice opportunity to start shorting this market. On signs of exhaustion I am more than willing to get involved to the downside, but I also recognize that we could even bounce as high as the $3.00 level. That area is even more resistive and could get sellers much more aggressive. I believe that the overall oversupply of the natural gas market will continue to weigh upon how this plays out. I have no interest in buying, although I do recognize that we could get a short-term bounce. I will ignore that and simply wait for an opportunity to take advantage of the fundamental situation.