Gold prices settled at $1332.69 an ounce on Friday, rising 0.52% over the week, as anxiety and risk aversion in the world marketplace prompted investors to seek safer assets. XAU/USD initially moved towards the resistance in the $1347-$1345 area, but it was unable to pass through. Consequently, the market pulled back to tested the anticipated support in the $1321-$1320 zone. The yellow metal reversed its course as the dollar drifted lower after the March jobs report showed that the U.S. economy added only 103000 jobs. World stock market saw a choppy weak. U.S. stocks ended the lower over fears that a trade war between the world’s two largest economies could slow economic activity. On the Fed front, Chicago Fed President Charles Evans said “I am optimistic that we are going get to 2 percent...In that environment, a gradual increase in our interest rate range objectives is appropriate.” The prospect of higher-than-expected interest rates in 2018 may prove a headwind for gold prices, but the recent volatility in major equity markets around the globe will continue to support precious metals.

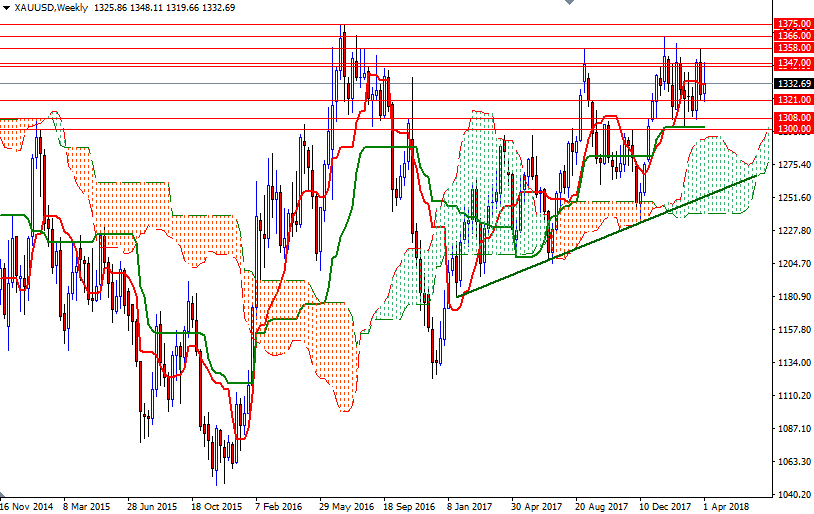

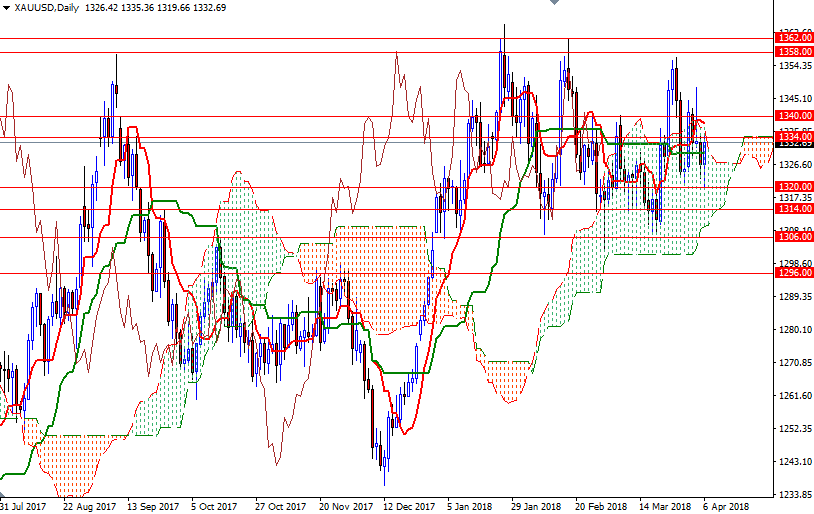

From a chart perspective, trading above the Ichimoku clouds on the weekly chart, along with the positively aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line), suggests that the bulls have the overall technical advantage. However, as you can see, these lines (Tenkan-sen and Kijun-sen) are flat on both the weekly and the daily charts. In addition to that, the market is still trapped within a three-month-old consolidation zone. With these in mind, we can probably expect the range bound nature will continue for now.

If XAU/USD gets back above 1342/0, we will probably see prices revisiting the 1347/5 region. A sustained break below 1347 could prolong the bullish momentum and open a path to 1358/6. On its way up, expect to see some resistance at 1352. The bulls have to produce a daily close above 1358 to gain momentum for 1362 and 1366. To the downside, the initial support stands in the aforementioned 1321/0 area. If this support gives way, XAU/USD will test 1316/4 next. A break down below there could foreshadow a move to 1308/6. The bears have to capture this strategic camp to challenge the next key support in 1300-1296.