Gold ended the week down $12.11 at $1322.91 an ounce, pressured by a strong dollar, high U.S. bond yields and easing geopolitical concerns. The U.S. dollar index hit a more-than-three-month high in the wake of better-than-anticipated U.S. data and following ECB chief Mario Draghi's speech. Friday’s summit meeting between the leaders of North and South Korea eased geopolitical concerns. While rising bond yields limit buying interest in the safe-haven gold, they also suggest rising inflationary pressures. Gold may perform better than paper assets if inflation becomes worrisome.

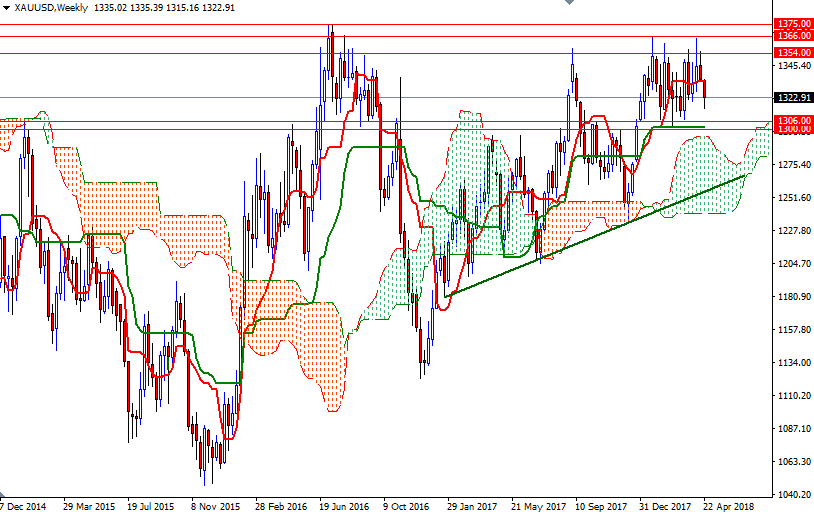

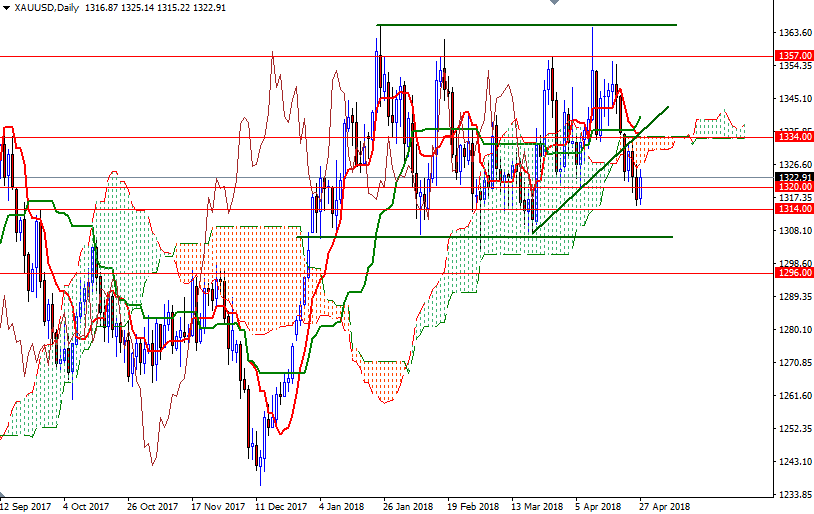

Technical selling was also behind gold’s second weekly loss. XAU/USD moved lower after the support around the strategic 1334 level was broken. The market is trading below the daily and the 4-hourly Ichimoku clouds; plus, we have negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line). Despite this bearish outlook, note that the weekly chart is still bullish. With these in mind, I think the support in the 1308/6 zone and the resistance in the 1336/4 zone will play crucial roles going forward.

If XAU/USD stays above 1320-1318.50, the bulls may have a chance to test 1329 and 1331. Beyond there, the aforementioned 1336/4 area stands out as an obvious resistance. The bulls have to produce a daily above 1336, the daily Tenkan-Sen, to march towards 1345/2. To the downside, keep an eye on the support at 1314. A break down below 1314 implies that the market will test the key support in 1308/6. Closing below 1306 on a daily basis paves the way for 1300-1296. If the capture this important camp, look for further downside with 1292-1289 and 1285/2 as targets.