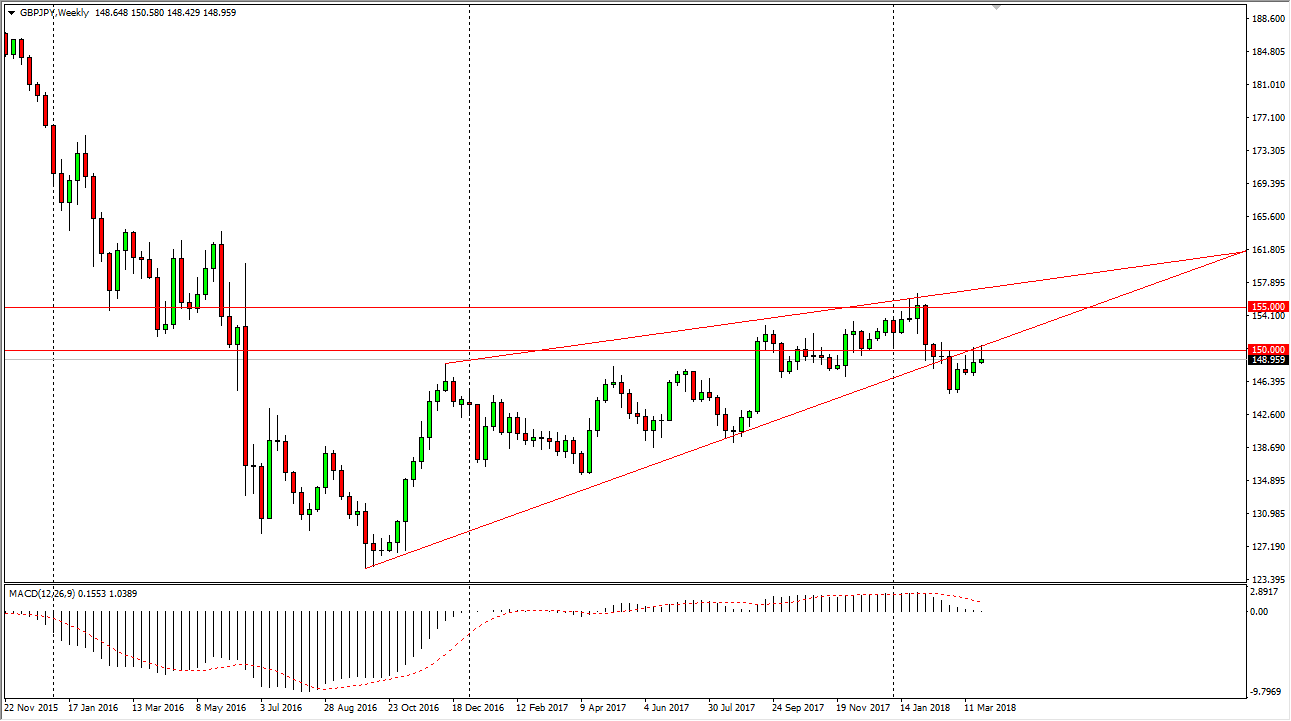

GBP/JPY

The British pound initially rallied during the week, reaching towards the 150 handle. This is an area that is significantly important based upon the large, round, aspect of the number, but also as you can see there is an uptrend line that coincides nicely with that area. We have broken below it and tested it several times on the way back down. By forming the shooting star for the week, and the preceding 2 weeks, I think it’s only a matter of time before we roll over. A breakdown below the bottom of the candle for the week could send this market down to the 145 handle. Alternately, if we break above the top of the shooting star for the week, that would be a very bullish sign and could send this market towards the 155 handle.

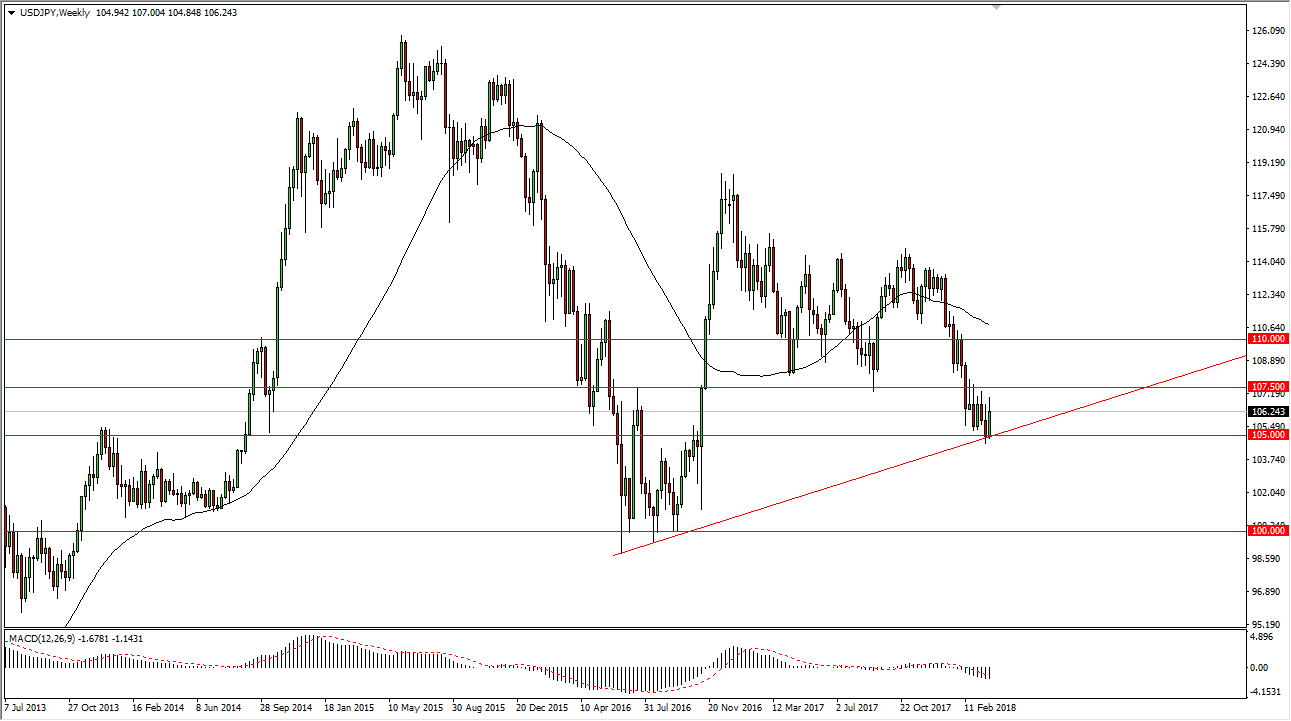

USD/JPY

The US dollar rallied against the Japanese yen during the week, bouncing from the 105 level. The 105 level also coincides nicely with an uptrend line, so it makes sense that we managed to rally a bit from here, but you can also see that there is a lot of resistance between here and the 107.50 level. If we can break above there, the market should then go to the 110 handle. The alternate scenario of course is that we break below the 105 level, which would send this market much lower, probably the 101 handle.

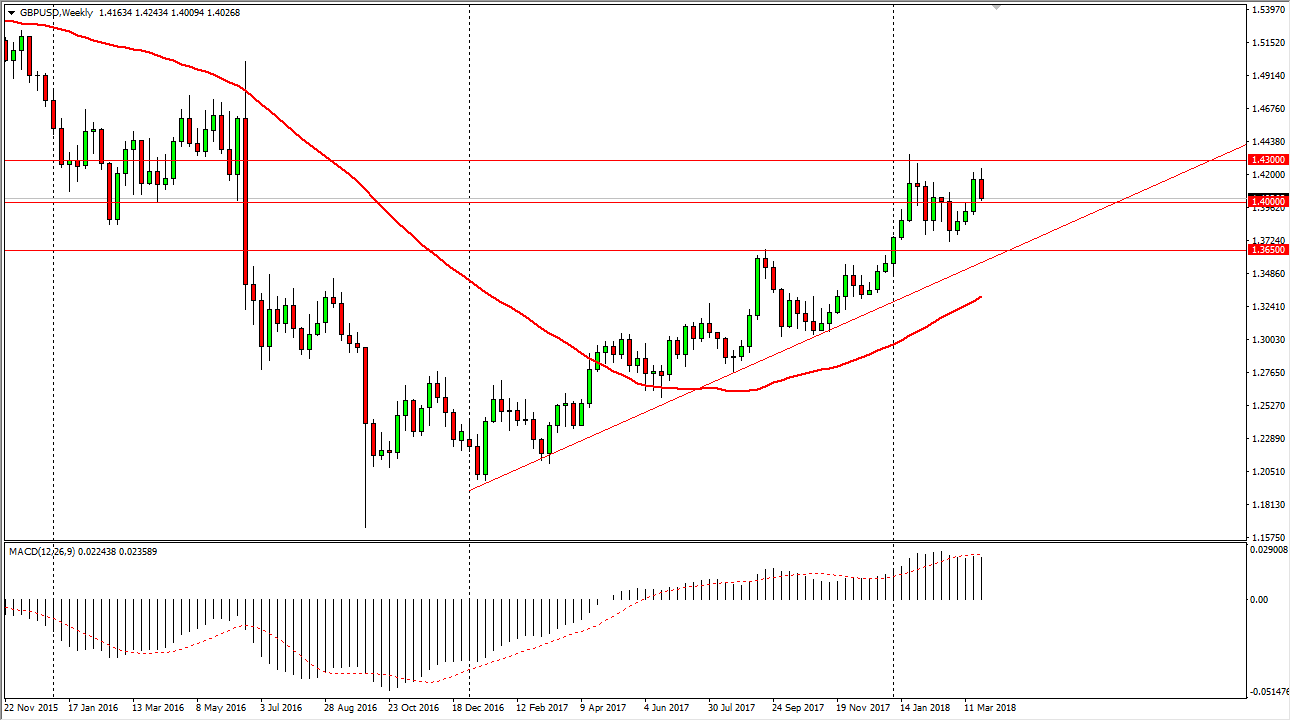

GBP/USD

The British pound rallied a bit during the week but rolled over as we got a bit too close to the 1.43 handle. By doing so, we reached down towards the 1.40 level. I think that level should offer short-term support, but if we break down below there we will go looking for support closer to the 1.38 level. I believe that the market should continue to go sideways in general, so I would expect more about over the next several sessions.

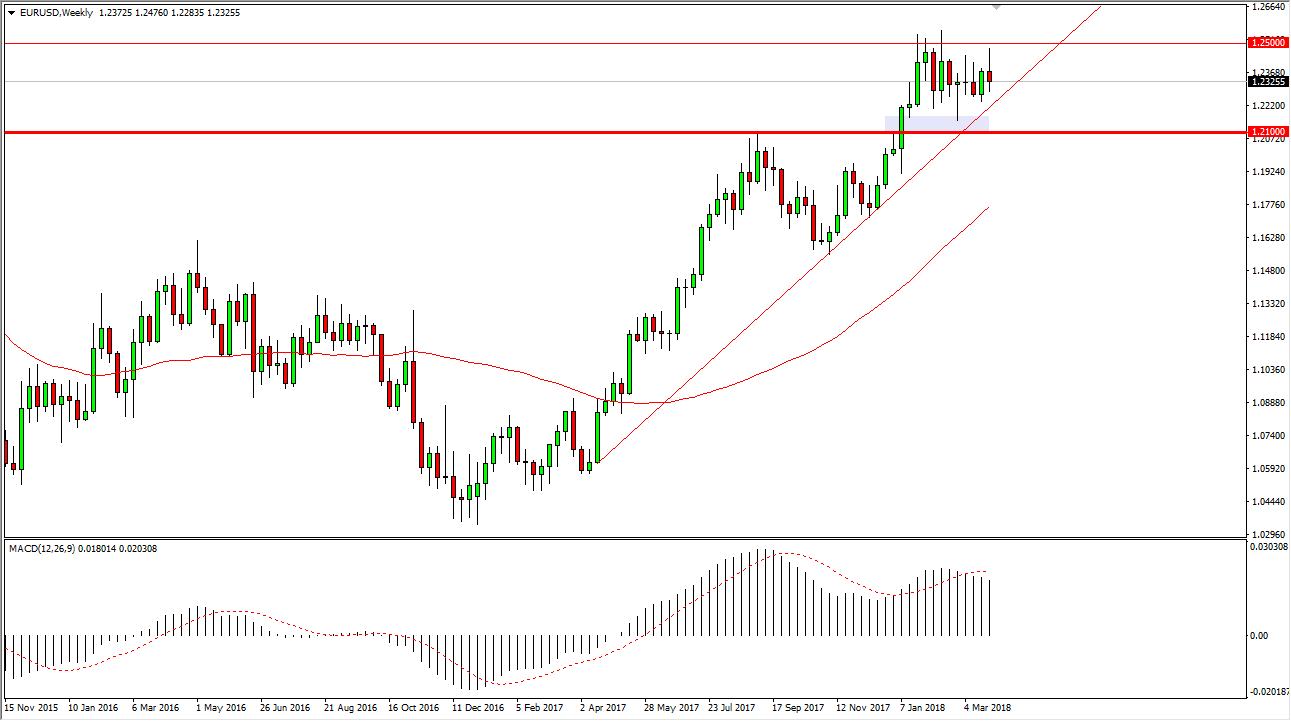

EUR/USD

The EUR/USD pair initially rallied during the week but found enough resistance near the 1.25 level to turn things around and form a bit of a shooting star. That is a negative sign, but we also have several supportive levels underneath that could come into play, so I think we probably have short-term bearishness, followed by a bit of a bounce. However, if we were to break down below the uptrend line, that could change things rapidly.