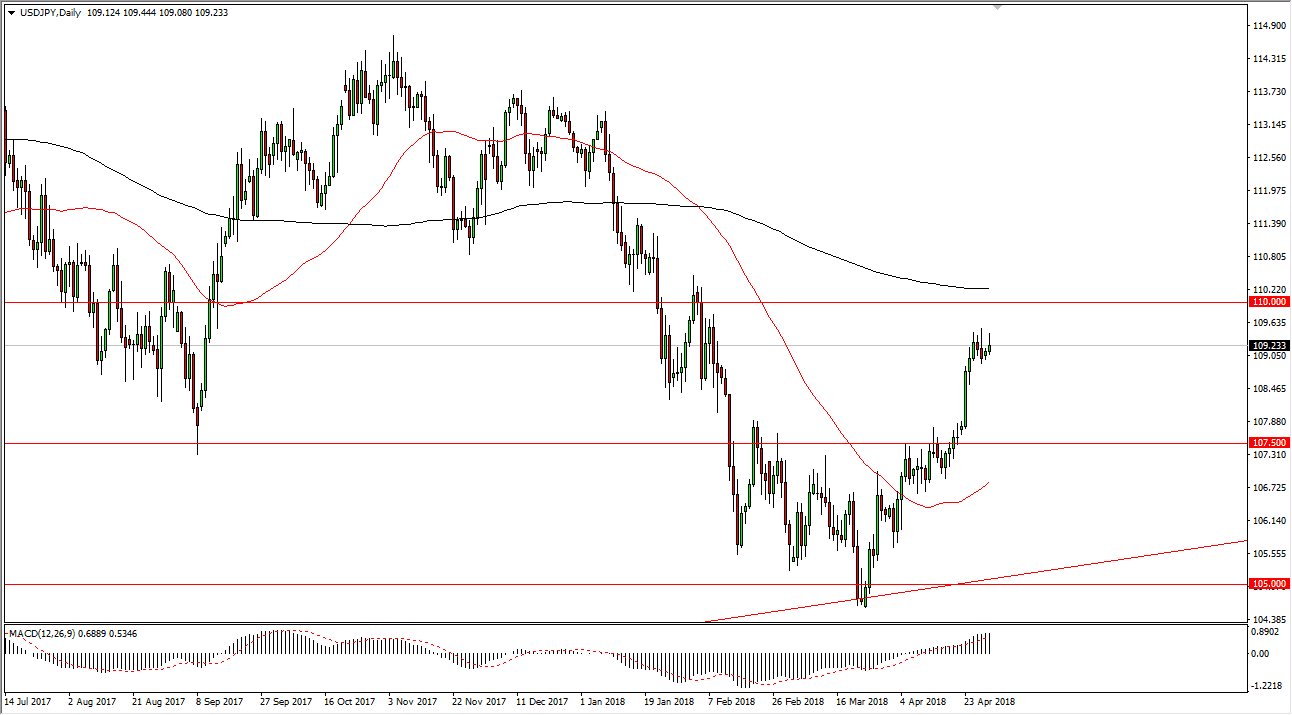

USD/JPY

The US dollar initially tried to rally on Monday but as you can see fell again to form a bit of a shooting star on the daily chart. I believe that the fact that we had formed a shooting star again, we are more than likely going to see this market pull back a bit. What I find interesting is that it looks that towards the end of the session, we are starting to see a little bit of a push back against the US dollar. Beyond that, this pair is a bit overextended, so a pullback makes a lot of sense. After all, the 110 level above is a major level from both a psychological and a structural standpoint, so it will probably take a couple of attempts to get above there. If we do, that would be a very strong signal to start buying again. In the meantime, I expect a short-term pullback, but I also expect the 107.50 level to offer a floor. Be patient, we should get a buying opportunity rather soon. In the meantime, I’m on the sidelines.

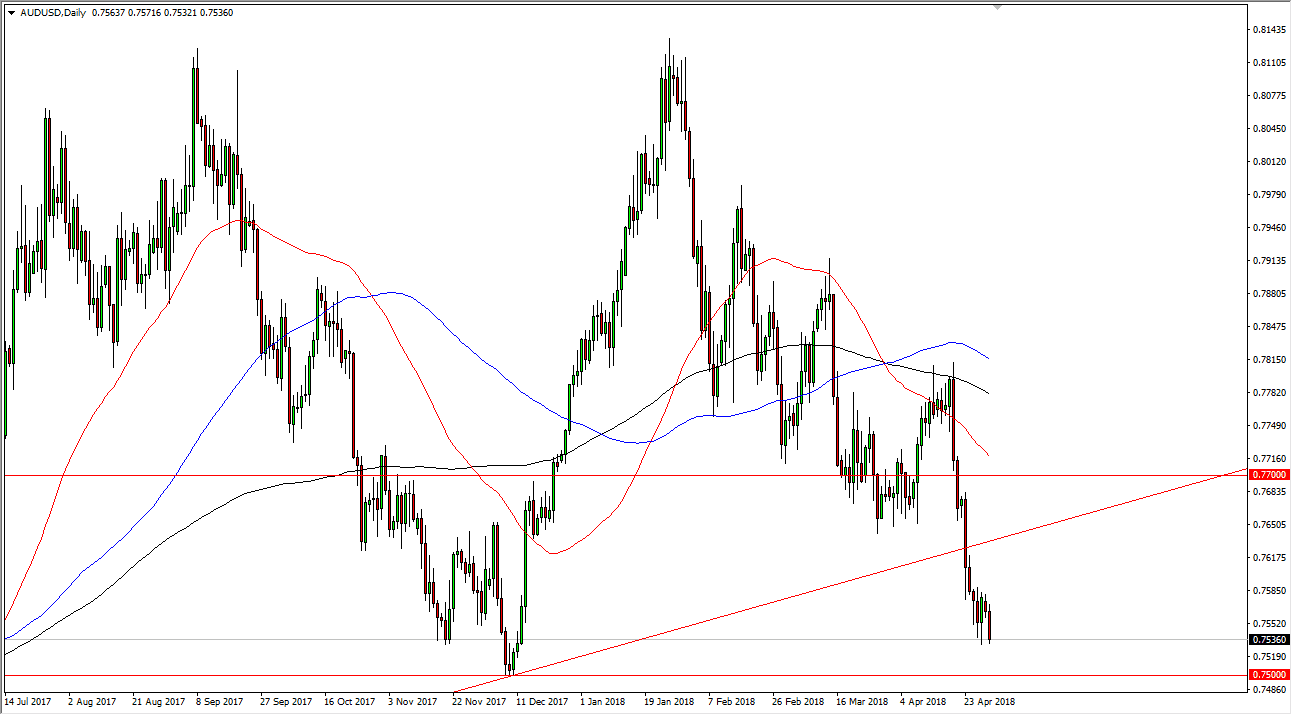

AUD/USD

The Australian dollar has had a very negative session on Monday again, testing the lows. The market certainly has a lot of support to be found at the 0.75 level underneath, which is not only large, round, psychologically significant number, but where we bounce from so drastically late 2017. If we can break down below there, this market could unwind rather quickly. In the meantime, rallies continue to be selling opportunities, at the very least until we break above the uptrend line that had been broken below recently. Pay attention to the US interest rate markets as they will have a major influence as to where the United States dollar goes.