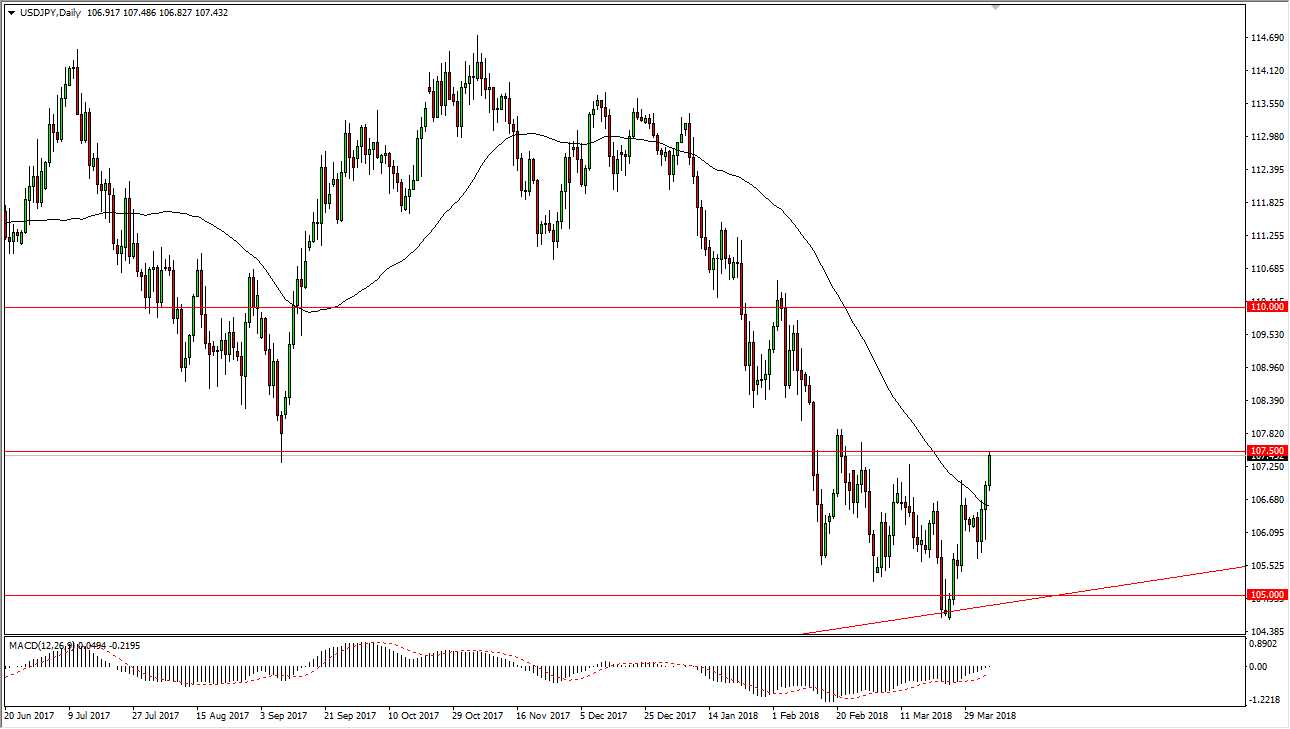

USD/JPY

The US dollar rallied significantly during the trading session on Thursday, reaching towards the 107.50 level, perhaps in response to the possibility that tensions are falling between the United States and China. As we have the jobs number today, this could be a very volatile session for this pair, but I think it has shown its underlying proclivity, to rally under the slightest provocation. When I look at the overall noise of the last couple of months, it looks to me like we are trying to form a bottoming pattern. I recognize the 105 level as support, as it is not only horizontal support, but there’s an uptrend line on the daily chart that is very important that coincides with that level. I’m looking for a pullback to take advantage of value, and I believe that if we were to break above the 108 handle, the market should continue to go higher, perhaps reaching towards the 110 level.

AUD/USD

The Australian dollar fell during trading on Thursday, as we continue to grind sideways overall. There is an uptrend line that is crucial in this pair just below, somewhere near the 0.76 level. I think that the market will eventually find buyers to push this market to the upside, perhaps after the jobs number. Alternately, if we break down below the uptrend line, that could unwind this market down to the 0.75 handle. In the meantime, I suspect that if we get any type of good news out of the jobs figure, or perhaps good news out of the United States or China when it comes to the trade negotiations, that could send this market much higher. In general, it looks as if we are closer to the bottom of the overall daily channel, so I think it’s only a matter of time before the buyers return.