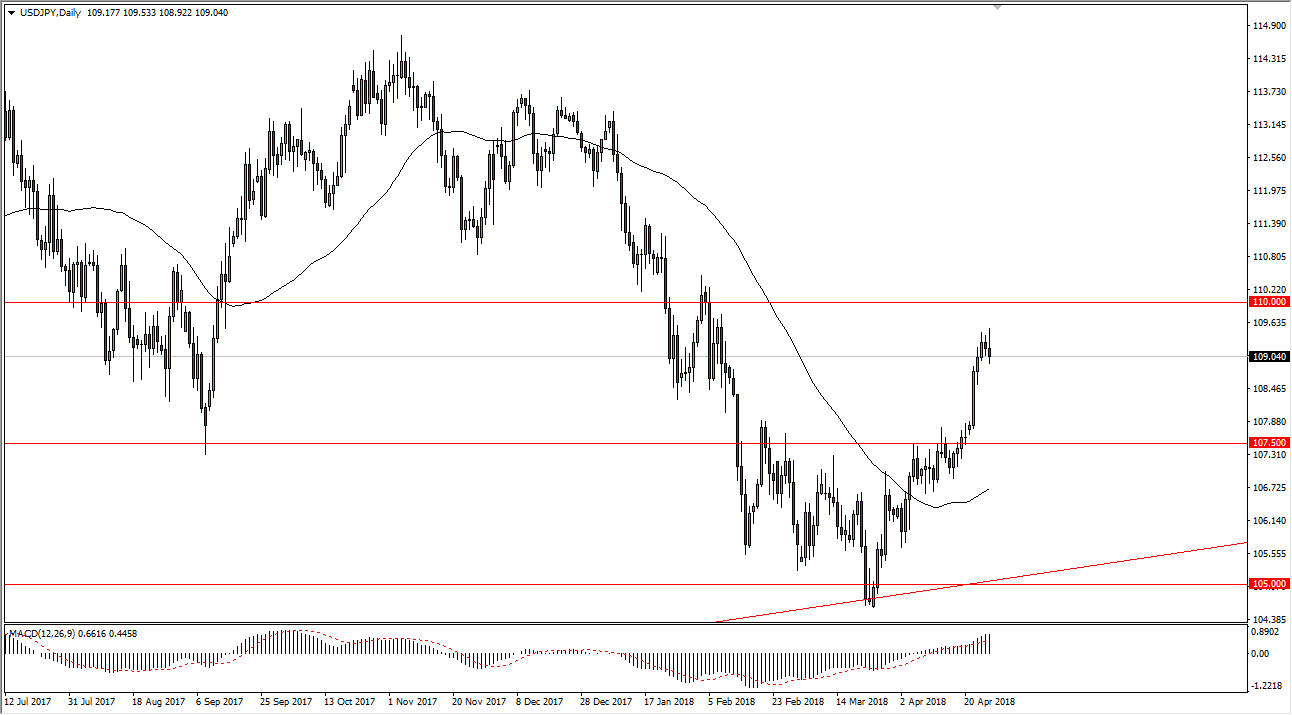

USD/JPY

The US dollar has rallied initially during the trading session on Friday but rolled over to form a bit of a shooting star. It looks as if the area above the 109 level should continue to be resistive, extending the resistance all the way to the 110 handle. I think that rolling over this market makes a lot of sense as we have been a bit overextended recently. I believe that the market will probably find buyers underneath though, especially near the 107.50 level. I think that it makes sense that we pull back as we are trying to build up a bit of a base to continue going higher. The uptrend line underneath and the 105 level have both offered support, so I think it’s likely that we will continue to go higher given enough time. However, we need to build up the momentum, and I think find value hunters underneath to go higher.

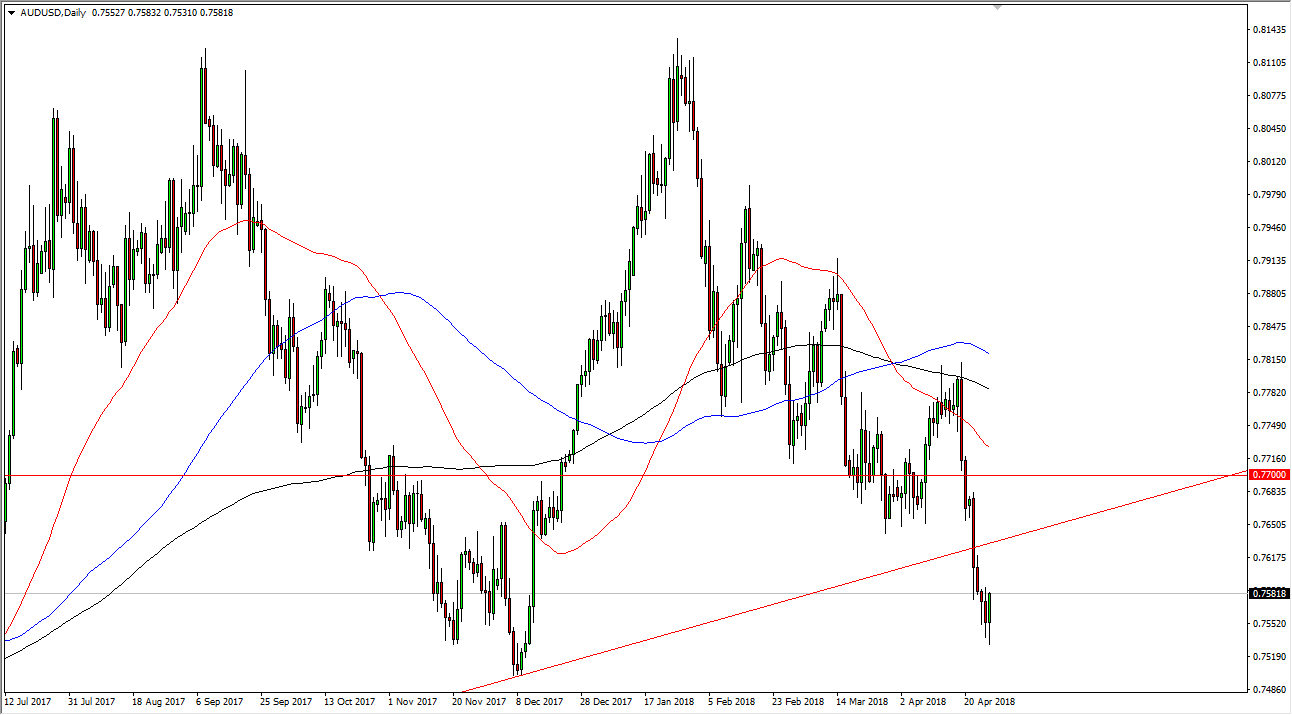

AUD/USD

The Australian dollar fell during the trading session on Friday but turned around to show signs of strength. However, we are below a major trend line that has recently been broken down, and market memory suggests that we could have sellers in that area. I anticipate that the short-term bounce is simply that, a short-term bounce. I think some type of exhaustive candle near the 0.7625 level would be and I selling opportunity. I would not have any interest in buying until we broke above the 0.77 level on a daily close, because I think there is far too much in the way of trouble above to keep this market guessing. The other scenario is that we turn around and break down below the 0.75 handle, that could also free the market to go much lower as a result.