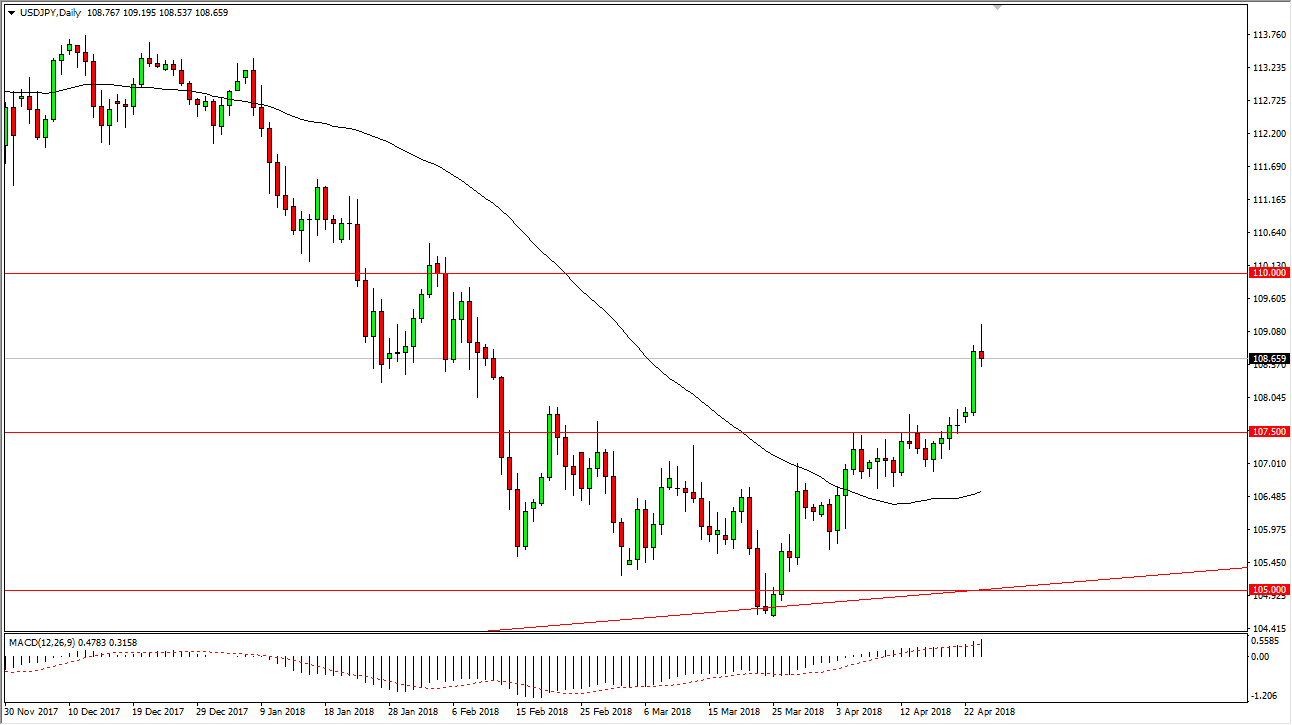

USD/JPY

The US dollar has rallied initially during the trading session on Tuesday, reaching above the 109 handle. However, we have turned around to form a bit of a shooting star as stock markets in America roll over. This was in reaction to higher interest rates in the treasury market, and I think this could have the markets cooling-off a bit. The shooting star of course is a sign of negativity, and I think that if we break down below the bottom of the shooting star, it’s not necessarily that we are going to break down, but perhaps we will turn around and try to pick up momentum underneath. The alternate scenario is that we break above the top of the shooting star which could send this market to the 110 handle. This is a bullish move, but I think we are more than likely going to see a bit of a dip in the short term.

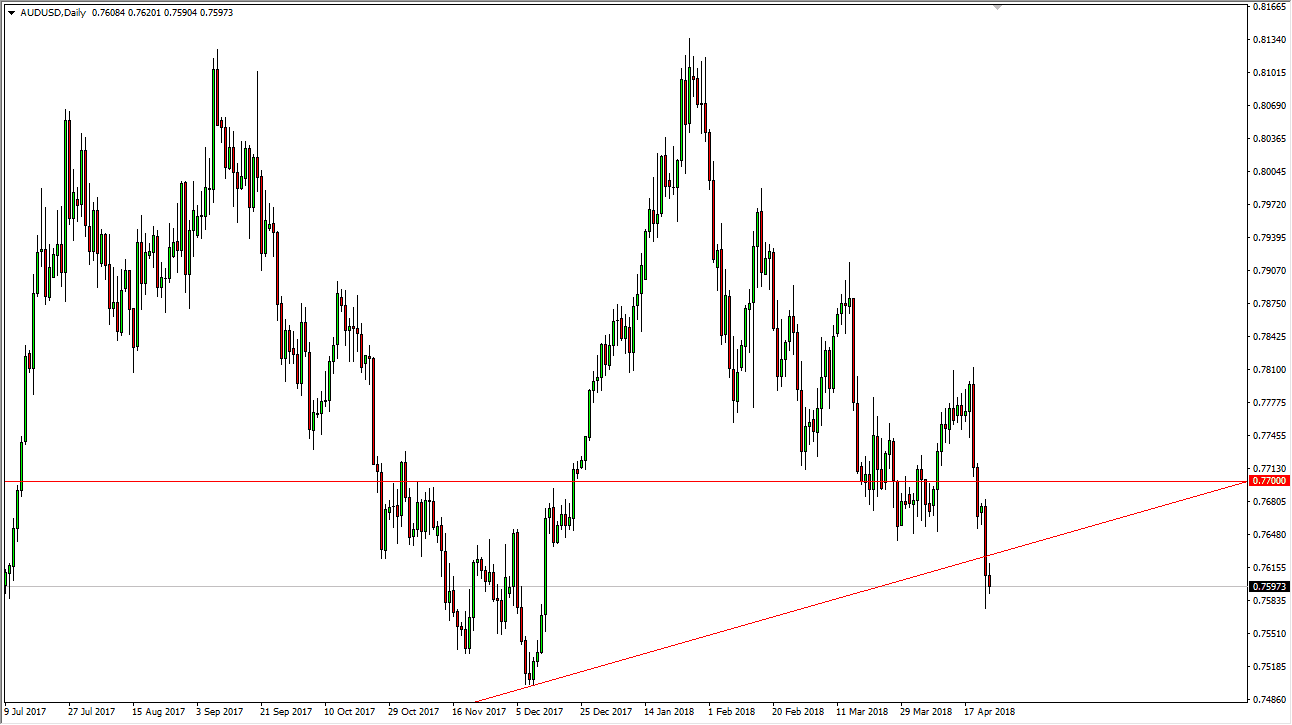

AUD/USD

The Australian dollar broke down below the uptrend line on Monday, but on Tuesday was a bit quiet. I think if we can break down below the bottom of the Monday candle, the sellers would come in and overwhelm the buyers. We should then go to the 0.75 level underneath there, which is a large, round, psychologically significant number. I think that we would not only reach towards that level but go much lower than that. The alternate scenario of course is that we break above the uptrend line again, perhaps showing signs of strength. However, I would be cautious about buying this market until we break above the 0.77 level as it is a large, round, psychologically significant barrier, and is also an area of previous consolidation and noise. At that point, the market could continue the longer-term uptrend.