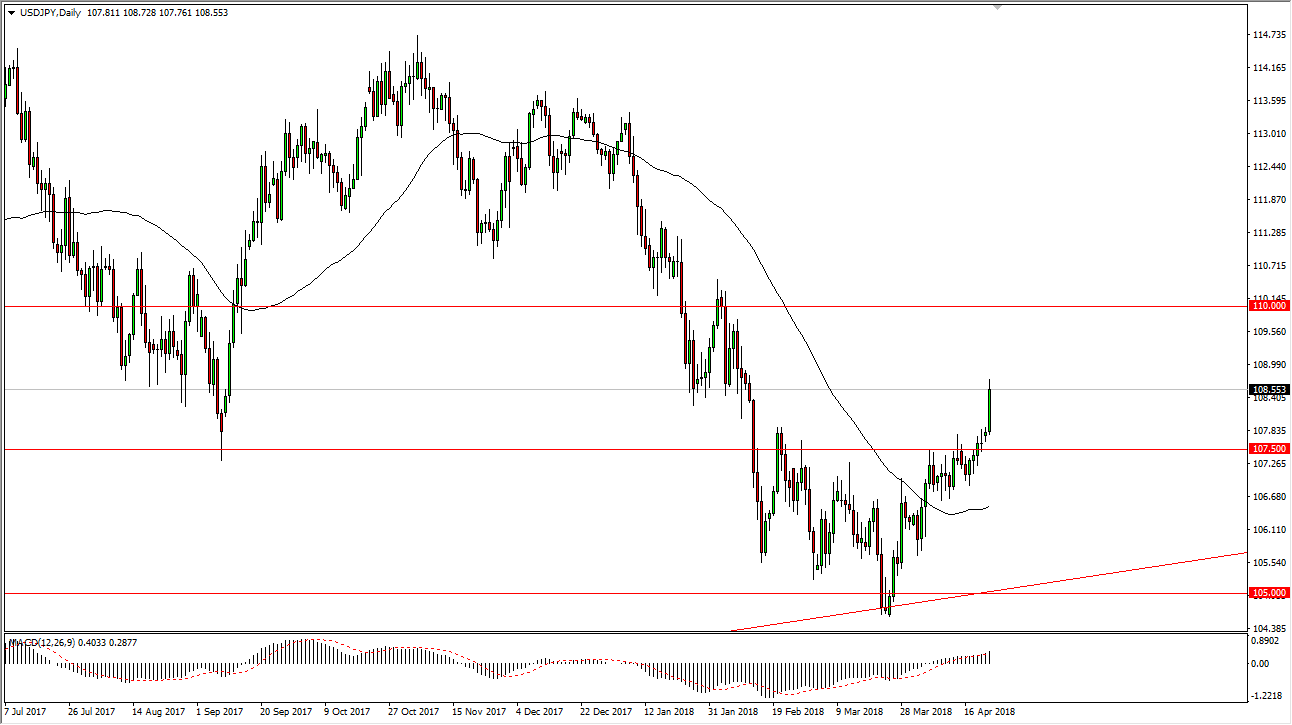

USD/JPY

The US dollar rallied significantly during the trading session on Monday, breaking above the 108.50 level. The market looks likely to find resistance between here and 110, but I suspect that the buying pressure could continue as interest rates in America are starting to rise in the bond markets. This of course will work in favor the US dollar, and if the stock markets can gain slightly, it could help push this market higher as well. The 110 level will be rather stringent resistance, but I think will be difficult to overcome. If we do, then I think the market will eventually go much higher. Currently, I look at the 107.50 level as the “floor” in the move higher that we have been paying attention to. The Japanese yen overall has been a bit soft during trading on Monday. If we were to break down below the 107.50 level, the market probably goes looking for the uptrend line below.

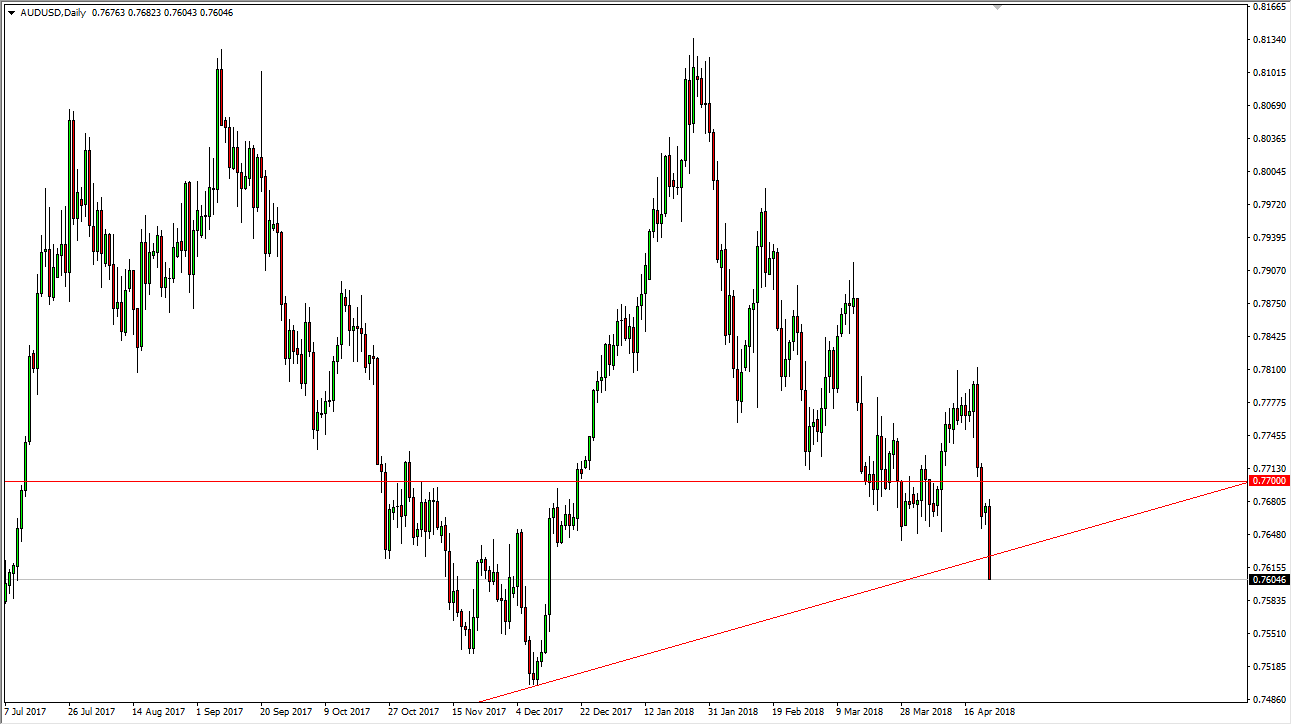

AUD/USD

The Australian dollar fell hard during the trading session on Tuesday, breaking through the massive uptrend line that goes back to the end of 2015. This is a major development, and I think that if the market break significantly below the 0.76 handle, the market could go much lower. Obviously, the initial target will probably be close to the 0.75 handle, and then possibly even lower than that. The market looks likely to continue to find bearish pressure now that we have broken through this area, and the fact that we are closing at the bottom of the daily candle is of course a very negative sign. The 0.75 level should in theory be psychologically important. If we can break above the 0.77 level on a bounce though, that could verify the uptrend line and make this turnout to be a “false break out.”