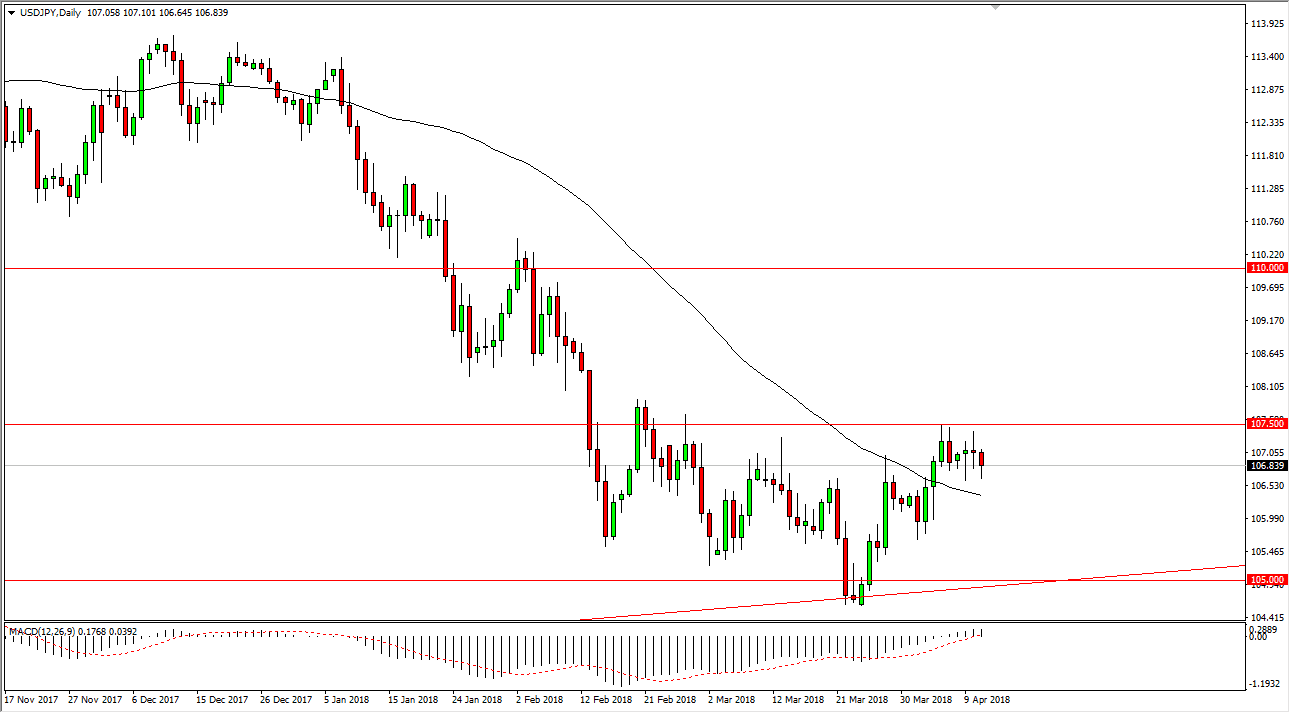

USD/JPY

The US dollar has rolled over during the trading session on Wednesday, reaching down to the 106.50 level. The 50-day EMA sits just below, and that should offer a bit of dynamic support. I also recognize that there is resistance above at the 107.50 level, that extends to the 108 level. I think that this market will continue to be very noisy due to the headlines coming out of both the United States and China involving possible trade tariffs, and as things cool off, that should help this market. Remember that the S&P 500 has an influence on the USD/JPY pair as well, so you should pay attention to how those markets are doing. The 105-level underneath is massive support, not only structurally but psychologically. Beyond that, we also have a nice uptrend line on the daily chart that crosses that area as well. Therefore, I think that any pullback at this point should offer a buying opportunity for those who are patient enough to wait for a supportive candle.

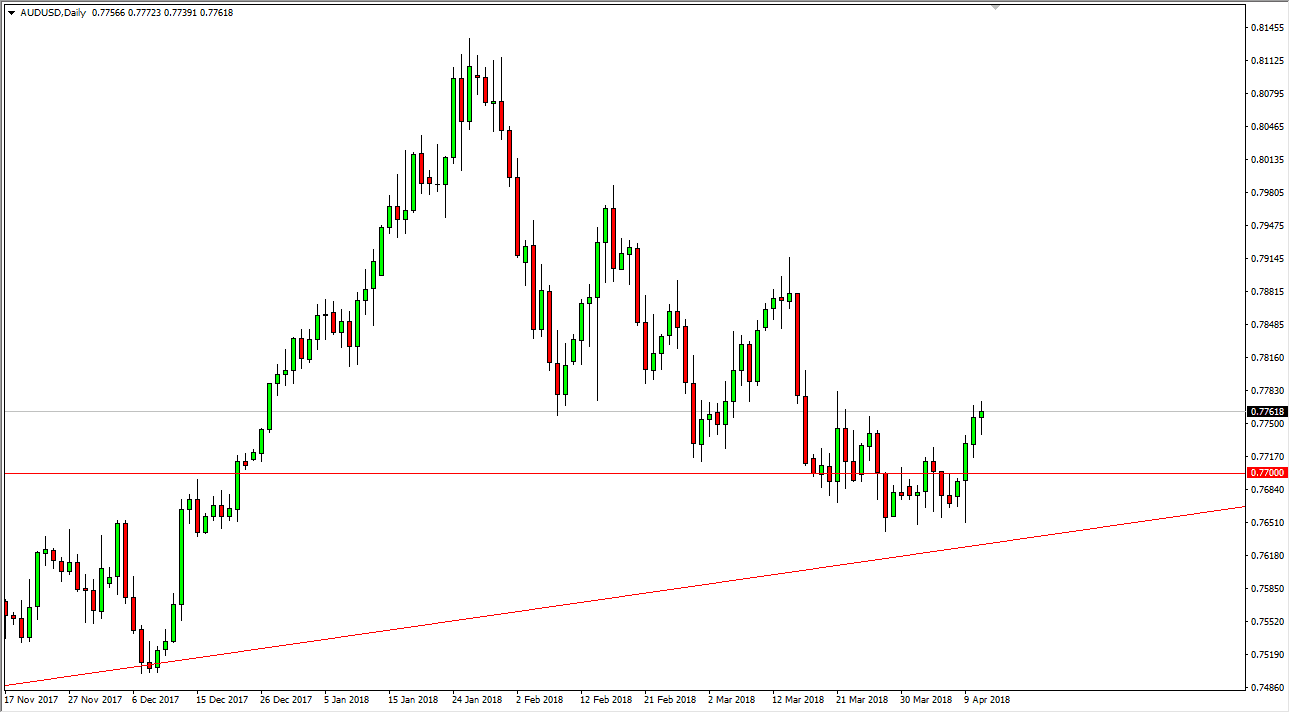

AUD/USD

The Australian dollar has gone back and forth during the trading session on Wednesday, showing the lot of volatility as markets are trying to figure out which direction they want to go, based upon the risk appetite coming from the talks between the United States and China. I believe that the potential trade war will continue to weigh upon the Australian dollar, but if we get a cooling of tensions, that should push the Aussie higher as the Australian dollar is highly leveraged to the Chinese economy overall. The uptrend line on the daily chart also helps, and I think keeps this market somewhat stable. If we were to break down below the uptrend line, then the market goes looking towards the 0.76 level.